Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

The hacker behind Infini purchased $13 million worth of Ethereum during the market downturn., 2026/02/09 14:59:23

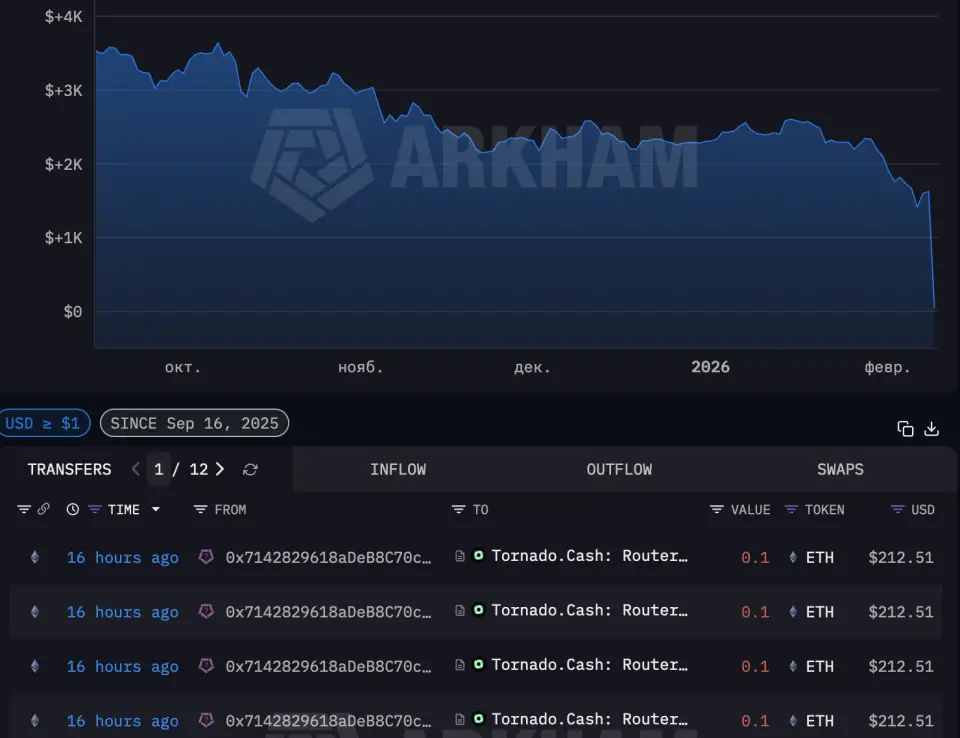

An address linked to the hacking incident involving the neobank Infini, which resulted in a loss of $50 million, acquired Ether worth $13.3 million a year after the event, coinciding with a market decline. This information was uncovered by analysts from the Arkham platform.

The hacker’s address purchased Ether when the asset’s price dropped to $2109. Subsequently, the funds were transferred to the Tornado Cash mixing protocol, which conceals transaction trails. These transactions mark the first recorded activity from the wallet since August 2025, when Ether was sold for $7.4 million at a price of approximately $4202, close to the annual peak of the cryptocurrency.

The attack on Infini occurred a year ago. The stolen USDC stablecoins were immediately exchanged for DAI, which are stablecoins without freezing capabilities. Recent transactions indicate that the perpetrator remains at large and continues to utilize the stolen funds for trading activities in the market.

The neobank speculated that the breach was due to a vulnerability exploited by a developer named Chen Shanxuan, who retained administrative rights after handing over the project to colleagues. A month following the attack, the platform filed a lawsuit in the Hong Kong courts against the developer and several unidentified individuals suspected of involvement in the breach; however, no further information regarding the legal proceedings has emerged since then.

The hacker’s activity coincided with a significant decline in the cryptocurrency market in early February: on the night of January 31 to February 1, the tenth-largest liquidation of positions in cryptocurrency history occurred, resulting in the destruction of $2.56 billion in borrowed funds. The price of Ether temporarily fell to $1811, marking a nine-month low. Since the peak in October, the cryptocurrency market has lost nearly half of its capitalization.