Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

The fate of Bitcoin bulls depends on two factors – Glassnode, 2026/01/15 13:06:53

Bitcoin bulls’ pressure on the asset’s price is weakening, and now their fate depends on two factors: an influx of capital into exchange-traded funds (ETFs) and increased demand in the spot market, analysts at the on-chain platform Glassnode said.

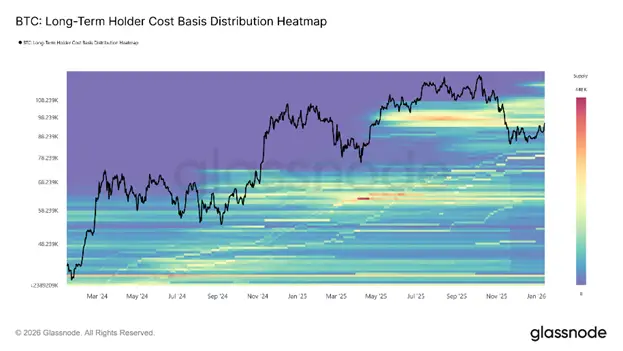

There is an ambiguous situation in the Bitcoin market, which is characterized by a stabilization of the distribution of coins by long-term holders and an outflow of funds from exchange-traded funds (ETFs), Glassnode explained.

“The move into the $96,000 area was driven more by mechanical positioning dynamics than by broad organic demand. Much depends on whether spot demand and current trading volume can be maintained. Or the rally risks fading after the bullish pressure caused by forced short covering is exhausted,” the analysts said.

Rebounds since November 2025 have repeatedly stopped at the lower limit of the $93,000-$110,000 range. Each attempt at growth was faced with new selling pressure, which prevented the recovery of the first cryptocurrency, experts noted.

It is important for Bitcoin to overcome the $98,300 mark and gain a foothold there. Sustained trading above this threshold would indicate that new demand is absorbing excess supply, allowing buyers to remain profitable, experts say.

Glassnode previously reported that over the past six months, large public companies have replenished their reserves by 260,000 BTC, up to 1.11 million BTC. This is three times the volume of Bitcoin mining during this period (82,000 BTC).