Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

The cryptocurrency sell-off persists: what lies ahead for the crypto market?, 2026/02/13 17:20:33

Investor anxiety remains elevated. The sell-off of major digital assets has persisted for the fourth consecutive week, despite favorable labor market and inflation statistics from the United States.

Bitcoin

From February 6 to 13, 2026, Bitcoin declined by 6.11%. The largest cryptocurrency by market capitalization failed to maintain its position above the significant psychological level of $70,000. For most of the week, five out of seven trading sessions were negative for BTC.

Source: tradingview.com

The latest batch of statistics from the U.S. was again not particularly encouraging for Bitcoin. The number of jobs increased by 130,000 in January, nearly doubling the consensus forecast. The unemployment rate fell from 4.4% in December to 4.3%. Inflation also slowed, dropping from 2.7% to 2.4%. What could be negative about this? For the world’s largest economy, the news appears positive. However, a strong labor market and declining inflation reduce the likelihood of a decrease in the key interest rate, which affects loans. Additionally, based on the statistical data, yields on ten-year Treasuries have risen, which is also unfavorable for Bitcoin, as some investors may prefer the guaranteed passive income from bonds over the risky investment in digital assets.

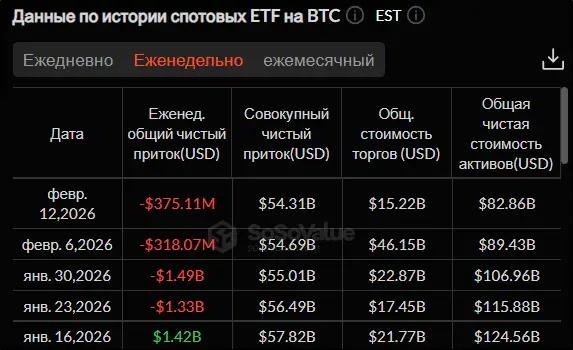

Spot Bitcoin ETFs continue to experience capital outflows. The streak of weeks during which investors withdraw funds from these exchange-traded funds has reached four. Over the past week, investors withdrew $375.11 million. The largest outflow of $225.29 million occurred from the iShares Bitcoin Trust (IBIT) managed by BlackRock. The Grayscale Bitcoin Mini Trust (BTC) performed better, recording an inflow of $103.09 million.

Source: sosovalue.com

Another factor contributing to Bitcoin’s decline is the reduced demand from large companies that were accumulating the largest cryptocurrency. In January, nearly all of the purchased BTC, 93%, was attributed to one company—Strategy. Their reserves increased by 40,150 coins, while other companies collectively acquired only 3,080 BTC. Additionally, some organizations have started to divest their Bitcoin holdings. Singapore’s Bitdeer Technologies reduced its balance from 2,017 BTC in December to 1,530 in January.

From a technical analysis perspective, Bitcoin’s trend remains bearish, as indicated by the price being below the 50-day moving average (marked in blue). A positive signal for BTC buyers could be the RSI moving into the oversold zone. However, caution is advised, as this oscillator can remain low for an extended period in a declining market. Before concluding a trend reversal, Bitcoin must establish itself above the resistance level around $72,200. The support level is at $59,930.

Source: tradingview.com

The fear and greed index has not changed compared to last week, remaining at 9. This still indicates that extreme fear prevails among crypto investors.

Ethereum

From February 6 to 13, Ethereum dropped by 6.04%. After a brief rise above $2,100, the second-largest cryptocurrency fell back below $2,000. Although most trading sessions were positive, the gains were so minimal that two days of declines exceeding 3.5% on Tuesday and Wednesday, February 10 and 11, determined the overall negative trend for the week.

Source: tradingview.com

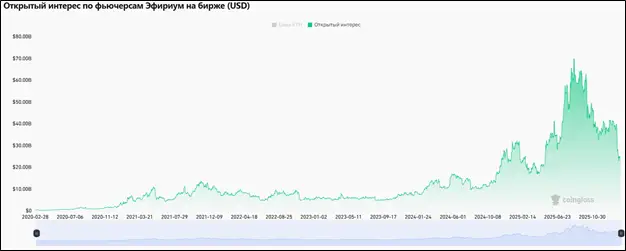

Investors have lost confidence not only in Ethereum itself but also in derivatives based on this asset. The open interest in ETH futures has fallen to $23.28 billion, the lowest level since May 2025. This interest is more than three times lower than the historical peak of $70.13 billion reached on August 23, 2025.

Source: coinglass.com

The outflow of funds from spot Ethereum ETFs, similar to Bitcoin products, has reached a four-week duration. Over the last week, investors withdrew $171.41 million, with the majority, $103.42 million, coming from BlackRock’s iShares Ethereum Trust (ETHA). The largest inflow of $35.39 million was recorded by Grayscale Ethereum Mini Trust (ETH).

Source: sosovalue.com

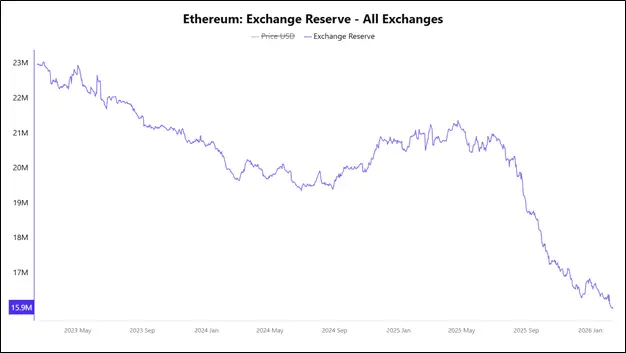

Despite the ongoing decline in Ethereum’s price, investors have a reason for cautious optimism due to the continued reduction in ETH supply on exchanges. As of February 13, the supply fell below 16 million coins. Such a low amount of Ethereum on exchanges has not been seen since 2016. The withdrawal of ETH from trading platforms is not a sudden spike but rather a steady trend observed for the eighth consecutive month.

Source: cryptoquant.com

From a technical analysis standpoint, Ethereum’s trend remains bearish, as indicated by the price being below the 50-day moving average (marked in blue). The rising ADX indicator suggests that the prevailing trend continues to strengthen. The support and resistance levels on the daily chart are $1,741.8 and $2,149.9, respectively.

Source: tradingview.com

XRP

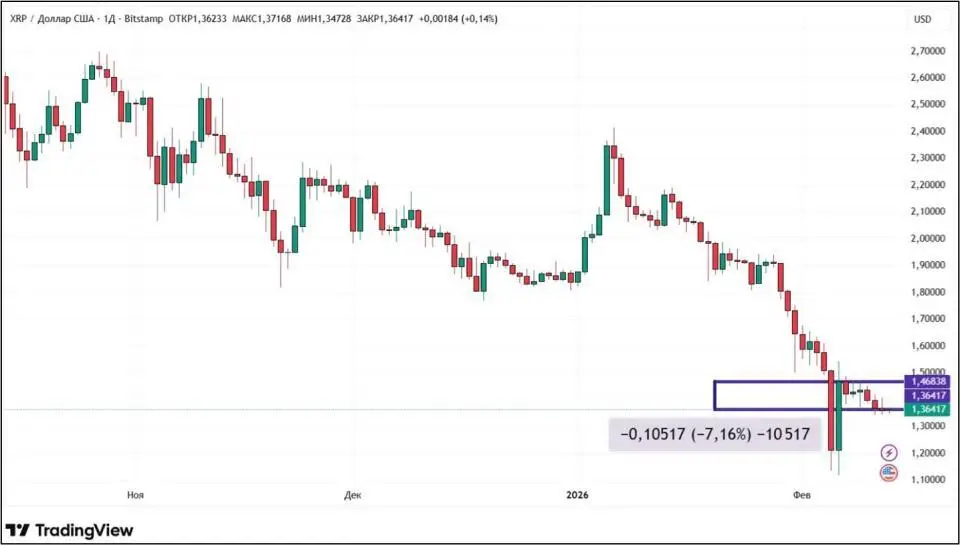

The cryptocurrency from Ripple experienced a decline of over 7% from February 6 to 13. Sellers’ attempt to maintain a position above $1.5 was unsuccessful. Throughout the week, trading occurred within the range of $1.34-$1.49 without significant price movements. The largest intraday change was a drop of 3.16% on Saturday, February 7.

Source: tradingview.com

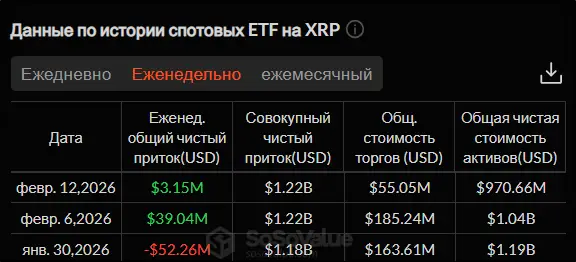

The primary catalyst for XRP’s decline is the overall downturn in the cryptocurrency market. However, there is a positive news backdrop specifically for this cryptocurrency. Spot XRP ETFs have recorded inflows for the second consecutive week, with this week’s inflow amounting to $3.15 million. The best performance was shown by Franklin Templeton’s Franklin XRP ETF (XRPZ) with $3.89 million. In contrast, the Grayscale XRP Trust ETF (GXRP) experienced an outflow of $8.91 million.

Source: sosovalue.com

In the asset tokenization market, XRP has climbed to sixth place, with a market share of 0.98%. Over the past month, XRP has shown the highest growth in tokenization, achieving an impressive 268%. This has allowed it to surpass one of its direct competitors, Solana. The increase in metrics is largely attributed to new partnerships formed by Ripple, including an agreement with investment firm Aviva Investors confirmed last week.

The U.S. Commodity Futures Trading Commission (CFTC) announced the establishment of a new Advisory Innovation Committee (IAC). This committee will include CEOs from cryptocurrency companies and traditional financial organizations. Ripple’s CEO, Brad Garlinghouse, is one of the participants in the IAC, which may aid in advocating for XRP’s interests.

From a technical analysis perspective, XRP’s trend is bearish, as indicated by the price being below the 50-day moving average (marked in blue). The stochastic indicator has exited the oversold zone, suggesting a potential slowdown in the pace of decline. However, it remains below the 50 mark, indicating that sellers are still in control. The support and resistance levels on the daily chart are $1.12 and $1.77, respectively.

Source: tradingview.com

Conclusion

Major cryptocurrencies are experiencing declines once again. Economic statistics from the U.S. and overall political uncertainty are weighing on crypto investors. However, some technical analysis indicators suggest that, if not a reversal, at least a slowdown in the correction may be on the horizon.

This material and the information contained herein do not constitute individual or any other investment advice. The views of the editorial team may not align with those of analytical portals and experts.