Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

The cryptocurrency market declines, heightening investor concerns: what lies ahead?, 2026/02/06 19:58:32

Мнение On Friday, February 6, Bitcoin fell to its lowest point since the return of U.S. President Donald Trump to the White House. Political factors continue to shape the sentiments of crypto investors, but the situation is influenced by more than just that. The level of uncertainty is so high that investors are opting to sell their digital assets.

Bitcoin

From January 30 to February 6, 2026, Bitcoin lost 17.23% of its value. BTC dropped below $70,000 for the first time since November 2024. At its weekly low, the largest cryptocurrency by market capitalization traded below $60,000.

Source: tradingview.com

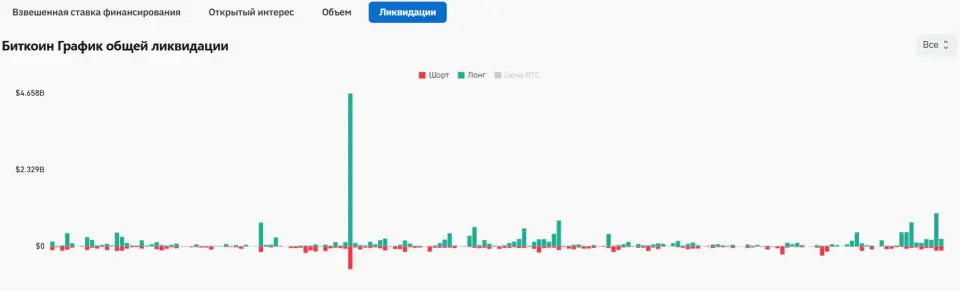

One of the factors behind the Bitcoin sell-off is the widespread liquidation of long positions. Over the past week, more than $2.6 billion in margin long trades were forcibly closed. In contrast, the liquidation of short positions was five times lower, totaling $521.8 million. The worst day for buyers was Thursday, February 5, when long positions were liquidated for over $1 billion.

Source: coinglass.com

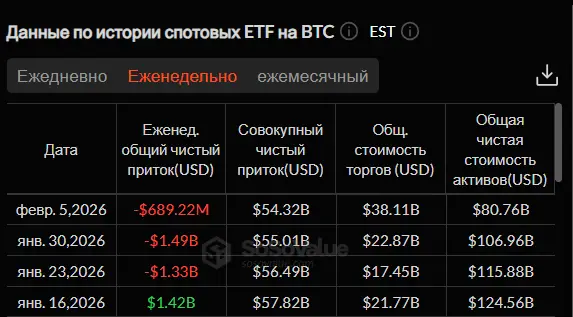

Bitcoin is also lacking support from exchange-traded funds. For the third consecutive week, there has been an outflow of funds from spot BTC ETFs. This time, the outflow reached $689.22 million, which is slightly less than the previous two weeks when outflows exceeded $1.3 billion each time. The largest withdrawal, amounting to $346.76 million, came from the BlackRock iShares Bitcoin Trust (IBIT).

Source: sosovalue.com

The political factor cannot be overlooked. In the U.S. on Monday, February 2, a meeting between crypto market participants and bankers regarding the CLARITY bill was unsuccessful. The bill has not progressed, indicating that the conflict between banks and stablecoin platforms persists.

Additionally, the U.S. issued a new advisory for its citizens to leave Iran — the second such warning this year. The timing is significant, as this new alert came just before U.S.-Iran negotiations regarding the Islamic Republic’s nuclear program, scheduled for February 6 in Oman. This news has only heightened the anxiety among crypto investors.

From a technical analysis perspective, Bitcoin remains in a downward trend. The price of BTC is significantly below its 50-week moving average (marked in blue), suggesting a prolonged correction may be underway. The RSI has entered the oversold zone (below 30), which could be interpreted as a positive signal for buyers. However, it is important to remember that in a declining market, this oscillator can remain at low levels for an extended period. Currently, Bitcoin has a considerable chance of dropping to a support level around $50,000, while the resistance level stands at $74,000.

Source: tradingview.com

The fear and greed index has decreased by seven points compared to last week. Its current value is 9, indicating extreme fear among crypto investors.

Ethereum

Ethereum has decreased by nearly 25% from January 30 to February 6. Five out of seven trading sessions ended negatively for ETH. The price of Ethereum has fallen to $2,000, a level not seen since May 8, 2025.

Source: tradingview.com

An interesting pattern was noted by an analyst from the CryptoQuant platform under the pseudonym CryptoOnchain. He highlighted the metric of the total number of Ethereum transfers per day, which peaked at 1.66 million on January 16. Meanwhile, the simple 14-day moving average for this metric reached its maximum of 1.17 million later, on January 29. Although these figures may initially suggest an increase in network activity, CryptoOnchain draws a different conclusion. A sharp rise in the total number of Ethereum transfers was also observed in January 2018 and May 2021, both times followed by a significant drop in ETH’s value.

CryptoOnchain concludes that a sharp increase in Ethereum transfers indicates two things: long-term investors are moving funds to exchanges to secure profits, and there is a peak in price volatility. The CryptoQuant analyst believes that a prolonged decline in February 2026 is also quite possible, and investors should exercise caution in their decision-making.

Similar to the spot BTC ETFs, analogous products for Ethereum have also experienced outflows for the third consecutive week. Notably, this time the outflow was the smallest during this period, totaling $149.07 million. Investors withdrew the most funds from the BlackRock iShares Ethereum Trust (ETHA), with outflows amounting to $106.72 million — over 70% of the total for the week.

Source: sosovalue.com

Among other news related to ETH, it is worth noting the launch on February 4 of the stablecoin FIDD by Fidelity on the Ethereum blockchain. This move by Fidelity is expected to intensify competition in the stablecoin market. Kraken has already become the first major centralized exchange (CEX) to list FIDD.

From a technical analysis standpoint, the trend for Ethereum is downward. This is supported by the price being below the 50-day moving average (marked in blue). The trend is further reinforced by an increase in the ADX indicator. The $2,112 mark, which had long been a support level, has now become resistance. The new support level is $1,750, from which the price began to rise in May 2025.

Source: tradingview.com

Solana

From January 30 to February 6, Solana’s price dropped by 27.91%. The price of SOL fell below $85 for the first time in two years. The minimum price for Solana during the week was $66.76. The decline in value was accompanied by increased volatility and trading volume.

Source: tradingview.com

In addition to the overall downturn in the crypto market, Solana has also been negatively impacted by new actions from Chinese authorities. The People’s Bank of China, along with seven ministries, issued a circular declaring all activities related to virtual assets illegal. This includes the operation of crypto exchanges, trading, intermediary participation, and the issuance of tokens and related financial products. Notably, tokenized real-world assets (RWA) have also been banned, which is particularly detrimental to Solana as it loses a significant market, being one of the top three networks for tokenized goods.

Spot ETFs for SOL showed modest but positive dynamics. The inflow of funds for the week was $2.94 million. The best performer was the Fidelity Solana Fund ETF (FSOL), which saw an inflow of $5.19 million. The worst performance was from the Grayscale product, Grayscale Solana Trust (GSOL), which experienced an outflow of $5.22 million.

Source: sosovalue.com

The decline in SOL’s value has not hindered the Solana Foundation, the non-profit organization behind Solana, from entering into an agreement with South Korean investment firm DB Securities. Together, they will develop a digital capital market based on tokenized securities through joint projects in both the South Korean local market and globally.

From a technical analysis perspective, the trend for Solana is downward. This is indicated by the price being below the 50-day moving average (marked in blue) and the negative value of the Momentum indicator. The nearest support and resistance levels on the daily chart are $95.35 and $66.76, respectively.

Source: tradingview.com

Conclusion

The crypto market experienced a significant correction this week. Bitcoin and major altcoins have dropped to multi-month lows. Outflows from spot ETFs, investor anxiety, and an increase in liquidations of traders’ positions have triggered widespread sell-offs.

This material and the information contained herein do not constitute individual or any other investment advice. The views of the editorial team may not align with those of analytical portals and experts.