Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Strategy acquired $75.3 million worth of Bitcoin., 2026/02/02 18:00:42

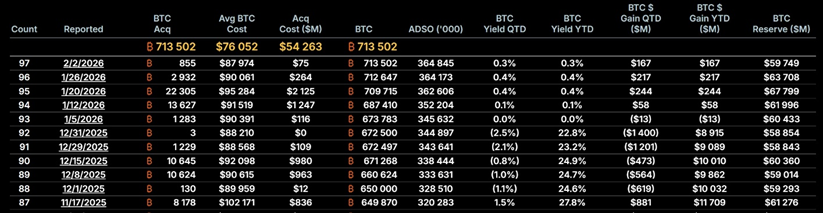

The largest publicly traded corporate holder of Bitcoin, Strategy, acquired 855 BTC from January 26 to February 1. The average purchase price was $87,974 per coin.

The company announced that this latest acquisition of Bitcoin was financed through the sale of common shares of MSTR, which are traded on the Nasdaq stock exchange. Currently, Strategy holds 713,502 BTC. The firm has invested over $54.26 billion to build this reserve at an average purchase price of $76,052 per BTC.

Founded in 1989 by Michael Saylor and Sanju Bansal, Strategy initially focused on business analytics and began building a Bitcoin reserve in August 2020 by purchasing its first 21,454 BTC for $250 million.

Several other large companies are adopting a similar strategy, though it carries inherent risks. American video game retailer GameStop transferred its entire reserve of 4,710 BTC to the Coinbase Prime platform for the purpose of selling the coins. Japanese management firm Metaplanet, which holds 35,102 BTC, reported a loss exceeding $680 million due to the decline in the price of the leading cryptocurrency.

Previously, Michael Saylor stated on the program What Bitcoin Did that “the true progress of Bitcoin” is not reflected in daily charts but in the crypto investments of major companies and the willingness of banks to utilize the asset.