Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Stablecoins brought their issuers $8.3 billion, 2026/01/25 13:57:57

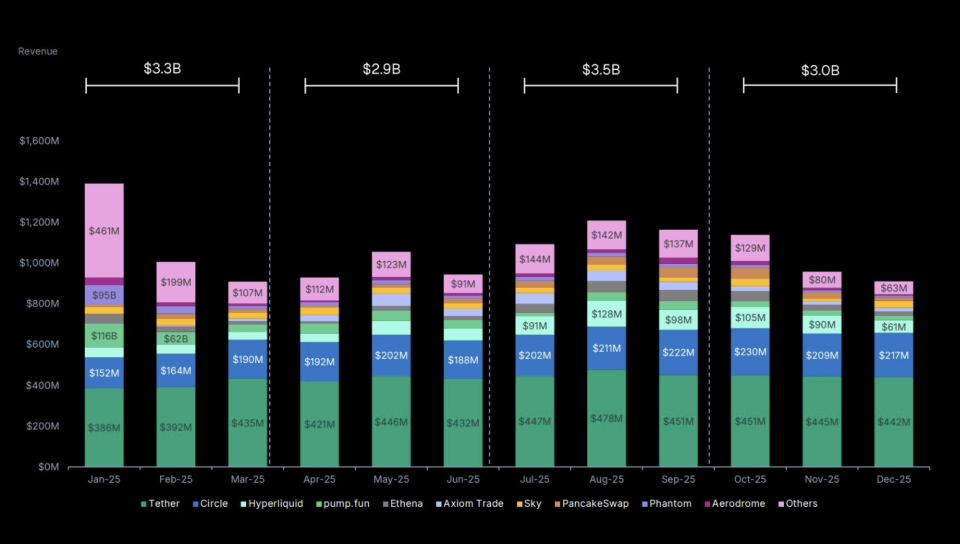

Stablecoin issuers earned $8.3 billion over the past year. The market leader was Tether, which issues USDT tokens pegged to the American dollar, analysts at CoinGecko Research calculated.

Tether accounted for 41.9% of total revenue among 168 crypto companies receiving income from the issuance and circulation of cryptocurrencies. In 2025, Tether earned about $5.2 billion. The company Circle, which issues the stablecoin USDC, was content with revenue of $2.37 billion.

Stablecoin issuers took the top four positions in the top ten most profitable crypto protocols: four companies provided 65.7%, or $8.3 billion, of the total market revenue for 2025. In total, cryptocurrency issuers received a total income of $12.7 billion.

The second place in terms of revenue among projects earning from the issuance and turnover of crypto assets was taken by the Tron network with $3.5 billion. This revenue was earned through stablecoins, CoinGecko Research clarified. Analysts explained the high popularity of the Tron network by the fact that it has the most comfortable commissions for USDT.

Revenue from trading protocols was highly dependent on crypto market conditions. The company Phantom last January, amid the hype around memcoins based on Solana, received revenue of $95.2 million. By December, when interest in memcoins faded, Phantom’s monthly revenue dropped more than tenfold, to $8.6 million.

The volume of the stablecoin market reached $35 trillion last year, according to experts from the consulting company McKinsey. Approximately 99% of transactions are the movement of funds between crypto exchange wallets and operations related to crypto trading, and not payments.