Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Russia has restricted access to several crypto-media, 2026/01/28 14:09:39

Media analysts at Outset PR reported that the websites of several major international publications about cryptocurrencies have stopped opening for clients of Russian home Internet providers.

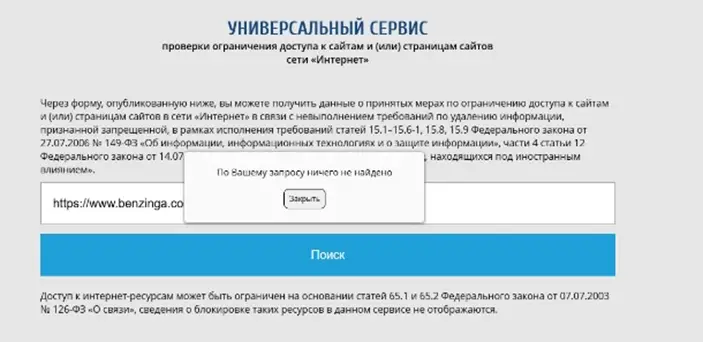

Outset PR says the restrictions affected Cointelegraph, Benzinga, CoinGeek, Criptonoticias, CoinEdition, The Coin Republic, AMBCrypto and Nada News. These sites do not load when connected to home networks and Wi-Fi, but remain accessible through other communication channels such as the mobile Internet.

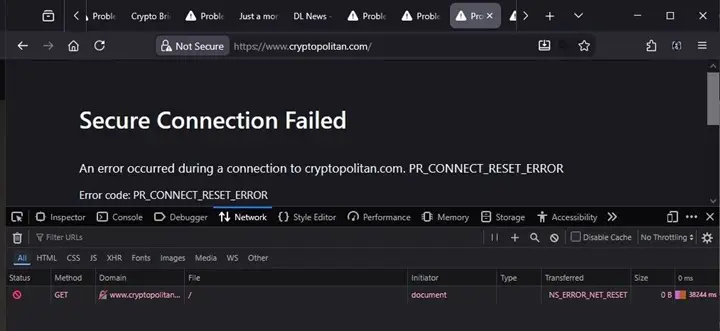

The cause of the problems, media analysts believe, was targeted interference at the network level, and not technical problems with the publications’ servers. Blocking uses Deep Packet Inspection (DPI) technology, which allows you to analyze traffic and selectively restrict access.

Outset PR says that access to resources is limited unevenly: on some networks, sites are completely inaccessible, on others – partially, which may indicate the distributed nature of the implementation of Roskomnadzor’s orders. At the same time, the domains of the blocked publications have not yet been included in the public register of banned sites of the Russian regulatory agency.

In 2018, Cointelegraph and Coinspot publications were blocked in Russia at the request of the tax service and the Volgograd court, respectively. The prosecutor’s office appealed to the court after stumbling upon an article about online casinos.

Recently, the Chairman of the Russian State Duma Committee on the Financial Market, Anatoly Aksakov, made it clear that cryptocurrencies are not capable of becoming a means of payment in the country and will forever remain only an investment tool under strict control.