Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Peter Thiel’s fund has divested its shares in a major holder of Ethereum., 2026/02/18 12:52:41

The venture fund of billionaire and investor Peter Thiel, Founders Fund, has completely divested its stake in ETHZilla, one of the largest corporate holders of Ethereum. Back in August, Thiel’s share was 7.5%.

The exit of Founders Fund from the company coincided with a shift in ETHZilla’s strategy: the firm moved away from profiting on Ethereum holdings and began focusing on the tokenization of real-world assets. The company cited the high volatility of Ethereum as the reason for this decision.

In January, ETHZilla launched the Eurus Aero Token I, which allows investors to own a portion of the revenue generated from the leasing of two CFM56 aircraft engines. The total value of these two engines is approximately $12.2 million. The price of one token is set at $100, with a minimum purchase requirement of 10 tokens. The company promises investors a return of 11% over the entire lease period.

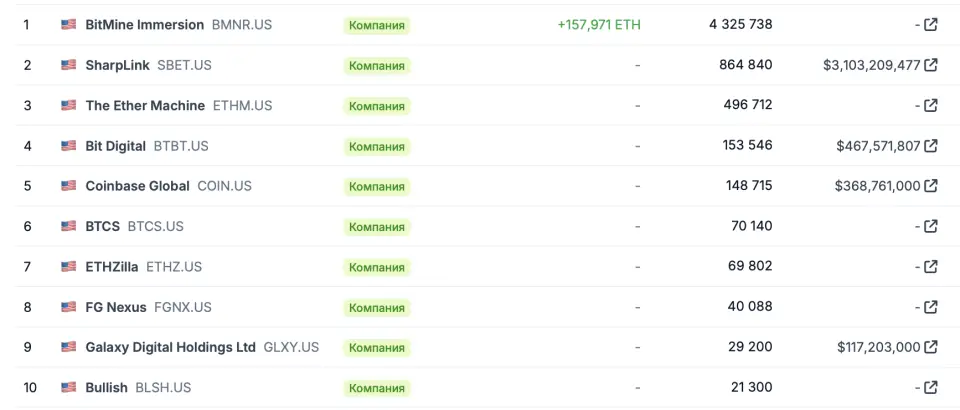

At its peak, ETHZilla’s crypto portfolio included over 100,000 ETH. However, due to liquidity issues and an inability to settle debts with creditors, the company sold $40 million worth of cryptocurrency in October. Subsequently, in December, it sold an additional $74.5 million to repay convertible bond obligations. Currently, the company holds 60,802 ETH, ranking seventh among public corporate holders of Ethereum. Prior to the cryptocurrency sell-off, ETHZilla was in sixth place, just behind the American cryptocurrency exchange Coinbase.

Shares of ETHZ are trading approximately 97% below their summer highs.

The fund of former PayPal CEO Peter Thiel invested in Bitcoin back in 2014 and recorded a profit of $1.8 billion in 2022, prior to the price decline. In 2024, Thiel stated that he does not foresee any conditions for significant growth in cryptocurrencies.