Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Pension funds incurred losses from investments in Strategy stocks., 2026/02/05 14:46:10

American pension funds that invested in Strategy, the largest publicly traded corporate holder of bitcoins, have experienced losses of up to 60% ($337 million) due to a decline in the company’s stock prices.

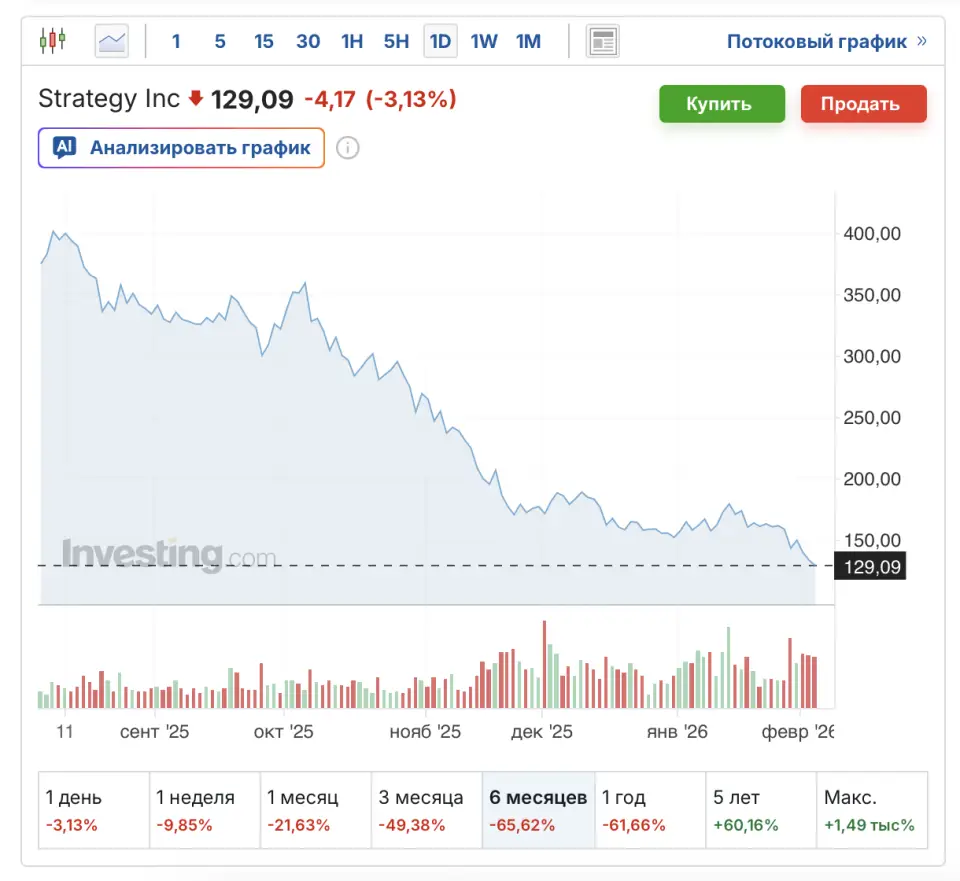

Eleven state pension funds in the U.S. collectively own nearly 1.8 million shares of Strategy, according to analysts at Fintel. Currently, the total value of all Strategy shares is estimated at $240 million, down from $577 million at the time of the initial investments. Over the past six months, the stock has plummeted by 65%.

The New York pension fund suffered the most significant losses, approximately $53 million, which represents around 60% of its investment in Strategy. This fund provides benefits to 1.1 million active employees, retirees, and their dependents. Following closely is the Florida pension system, which incurred losses of $46 million (58% of its investments), having purchased shares of the company only at the end of December. The Wisconsin Investment Board (SWIB) ranks third with losses of about $26 million (approximately 60% of its investments).

Other funds that reported losses include the North Carolina state treasury ($30 million, 58%), the pension system for police and firefighters in New Jersey ($8 million, 59%), and the pension systems of Utah ($5.5 million, 59%), Kentucky ($3 million, 58%), and Maryland ($2.4 million, 57%). The Michigan fund experienced the least impact, with its position in Strategy decreasing by only $100,000 (8%).

On Thursday, February 5, Strategy shares are trading around $129. Over the past month, in light of the bitcoin downturn, the company’s stock has dropped by more than 20%, and it has decreased by 50% since its peak in October.

According to Fidelity’s estimates, the potential of the cryptocurrency market for pension plans is valued at $4.7 trillion. Previously, Bitwise’s investment director, Matt Hougan, encouraged not to hesitate in investing retirees’ funds in cryptocurrencies. He stated that some stocks of traditional companies are subject to even greater fluctuations, making a ban on including bitcoin and bitcoin-related companies in pension plans unreasonable.