Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

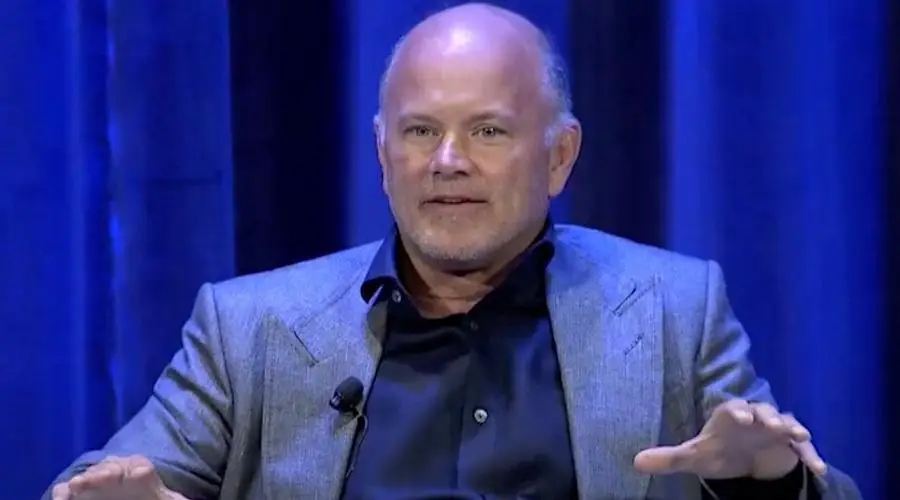

Mike Novogratz: The Corporate Crypto Reserve Model is on the Verge of Collapse, 2026/01/11 15:25:36

Galaxy Digital CEO Mike Novogratz said that the strategy of “treasury companies” creating reserves of Bitcoin and Ethereum has reached a critical point. According to him, such organizations face a choice: transform or gradually go bankrupt.

Novogratz believes that storing crypto assets can no longer be considered a sustainable business model. With the exception of individual players like the largest crypto asset holders, Strategy and BitMine, most need to turn into businesses with real products and services, the top executive said.

“Merely owning the underlying asset does not create value for shareholders. Management must turn these structures into real companies,” Novogratz said.

The CEO of Galaxy Digital provided data: about 40% of Bitcoin treasury companies are trading below the net value (NAV) of their crypto assets. More than 60% of such organizations purchased Bitcoin at prices significantly higher than current market quotes.

Purchases of ether by large companies have practically ceased. The only major organization that continues to make regular acquisitions is BitMine. Her assets are estimated at $21 billion.

Novogratz admitted that he himself had succumbed to the hype in the past. “We have all been carried away by speculative trading at some point,” he declared.

Strategy, the largest public corporate holder of Bitcoin, launched in August 2020 and led to a tenfold increase in the company’s share price. However, Novogratz called this case “almost unique”: out of 50 companies with similar investment tactics, only three managed to successfully implement a similar model. And Strategy’s shares have fallen by more than 50% over the past six months.

Novogratz advised the management of the “treasury companies” to take two steps. First, buy back discounted shares to reduce the gap between NAV and the stock price. Secondly, develop a new business model based on existing human resources and assets.

“If you have Bitcoin, Ethereum or Solana, you can use that capital to launch a neobank or create a real product. The simple story of “crypto storage” no longer sells,” concluded Novogratz. Earlier, the head of Galaxy Digital named two cryptocurrencies that, in his opinion, “are on the edge of the abyss” – XRP and ADA. Novogratz is confident that their value may soon fall to a minimum.