Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Michael Saylor identified a crucial price point for Bitcoin concerning Strategy., 2026/02/16 13:00:59

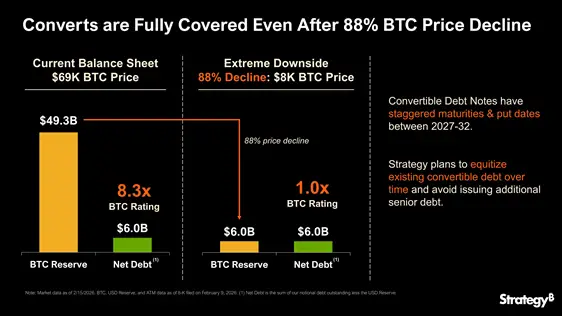

The chairman of the largest corporate Bitcoin holder, Strategy, Michael Saylor, stated that the firm could withstand a decline in BTC to $8,000.

Saylor mentioned that the company aims to convert $6 billion in debt obligations into equity over the next 3-6 years. This will reduce the debt burden and maintain sufficient assets to fully cover its obligations. As a result of this conversion, bondholders will have the opportunity to exchange their bonds for company shares.

The chairman of Strategy emphasized that the management continues to view Bitcoin as a long-term investment and does not intend to sell assets to meet short-term obligations. Current market fluctuations do not affect the company’s strategic approach to accumulating cryptocurrency.

Currently, the firm holds 714,644 BTC, with reserves valued at $49 billion. The average purchase price of Bitcoin for Strategy is nearly $76,000. With the current price of the leading cryptocurrency at $68,800, the company is experiencing a loss of approximately 10% on its investments.

Shares of Strategy (MSTR) closed the previous trading week with an increase of 8.8%, reaching $133.88 after Bitcoin briefly approached $70,000. MSTR is trading 70% below its all-time high of $456, set in mid-July.

Previously, Michael Saylor discussed Strategy’s plans in the event of further declines in Bitcoin, stating that the company intends to refinance its debt rather than sell digital assets.