Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Metaplanet reported a loss of $664 million due to the decline in Bitcoin value., 2026/02/16 14:29:57

The Japanese firm Metaplanet, one of the largest corporate holders of Bitcoin, reported an annual unrealized loss of 102.2 billion yen (approximately $664 million). This result is slightly better than the company’s own forecast. The losses stem from the reevaluation of its Bitcoin holdings.

The operational results of the Japanese company demonstrated explosive growth: revenue surged by 738% to 8.9 billion yen ($57.9 million), while net profit increased by 1694% to 6.3 billion yen ($40.9 million). The primary driver of revenue growth was income from Bitcoin options trading, as noted in the financial report.

The company, which follows a “Bitcoin treasury” model (holding cryptocurrency as a long-term asset), aims to engage in active trading of Bitcoin derivatives. By 2026, Metaplanet anticipates generating revenue of $103 million and an operating profit of approximately $73 million.

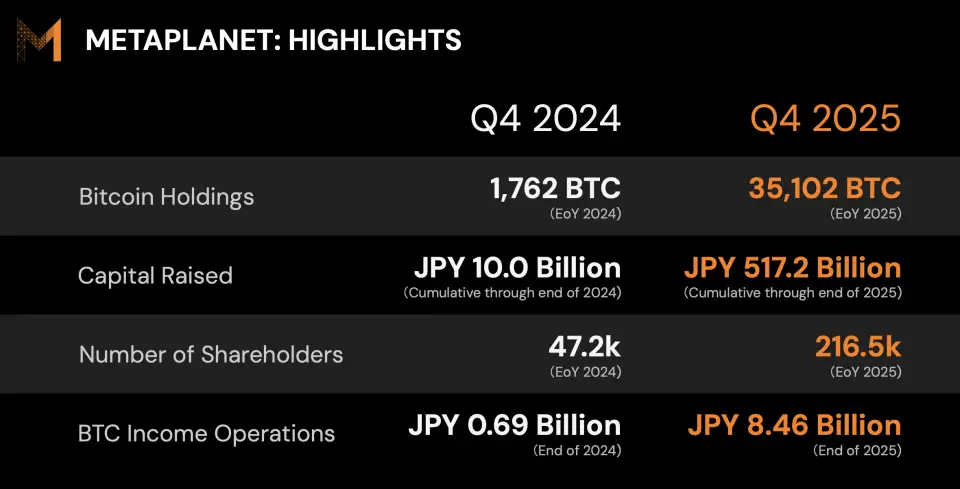

By the beginning of 2026, the company’s portfolio included 35,102 BTC, which is more than 19 times higher than the previous year (1,762 BTC). In terms of cryptocurrency reserves, Metaplanet ranks fourth among publicly traded companies worldwide. The total investment capital of Metaplanet in Bitcoin reached 527.2 billion yen ($3.43 billion).

The leader among publicly traded corporate entities in Bitcoin reserves is the American company Strategy. Currently, it holds 714,644 BTC, with reserves valued at $49 billion.

In mid-2025, Metaplanet’s CEO Simon Gerovich stated that his company aims to accumulate as much Bitcoin as possible to later acquire profitable companies with those funds.

Previously, the American cryptocurrency exchange Coinbase reported a net loss of $667 million for the last quarter of the previous year. Amid the downturn in the cryptocurrency market, the losses ended an eight-quarter streak of profitable reporting periods: the last time the company recorded losses was in the third quarter of 2023.