Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Looking for a trend in the crypto market: how to use the volatility index correctly, 2026/01/22 03:14:41

There are a lot of trend indicators. Some show the strength of an asset’s movement, others focus on direction. And there are those who are dedicated to determining the presence of a trend. These include the variability index.

What is the volatility index in crypto trading

The volatility index is a technical analysis tool that is used in crypto trading to see periods of time when a particular digital asset is trending and when it is flat. The author of the index is Australian commodity trader William “Bill” Dreiss. The index was first described in its book The Trader’s Edge: Cashing in on the Winning Strategies of Floor Traders, Commercial and Market Traders. In his work, Dries tried to describe a new indicator for determining a trend, which would get rid of the shortcomings of existing analytical tools, for example, the lag index. What is needed to calculate the variability index?

How to calculate the variability index

In general, the variability index is calculated using the formula

Choppiness Index = 100*LOG10 ((SUM (ATR (1), n)/((MaxHigh (n) – MinLow (n))).LOG10 (n)

where:

- Choppiness Index – variability index;

- n — selected number of periods;

- LOG10 — decimal logarithm;

- SUM (ATR (1), n) — sum of ATR for n periods;

- MaxHigh (n) — maximum maximum for n periods;

- MinLow (n) — minimum minimum for n periods;

- LOG10 (n) — decimal logarithm of n periods.

The most commonly used period length (n) is 14 days. However, traders can adjust the parameter to suit their specific trading strategies. There is no need to manually calculate anything, as most modern platforms do this automatically. The only thing traders need to do is to set the length parameter.

Calculating the variability index is half the task. It must be interpreted correctly.

Interpretation of the variability index

The volatility index value ranges from 0 to 100. If the indicator exceeds 61.8, there are very large fluctuations in the market. There is no pronounced trend as such, and a particular digital asset is sideways.

Oddly enough, for traders, on the contrary, small, less than 38.2, values of the volatility index are of greater interest. It is in this case that a particular cryptocurrency exhibits a clear trend. The interval between 38.2 and 61.8 is a transition phase. Cryptocurrencies can suddenly move from sideways to trending. It is at such moments that traders need to be extremely careful not to lose money.

Why do the indicator use non-integer numbers as target limits?

Volatility and Fibonacci index

The volatility index is based on Fibonacci levels. An Italian mathematician once noticed that in the sequence from one to infinity, where each subsequent number is equal to the sum of the previous two, the quotient of dividing two neighboring ones will tend to 0.618. If you divide through one number, the coefficient will tend to 0.382. So unusual numbers are not taken for nothing, but are based on mathematics.

How are cryptocurrencies faring according to the volatility index in mid-January 2026?

Volatility and Cryptocurrency Index

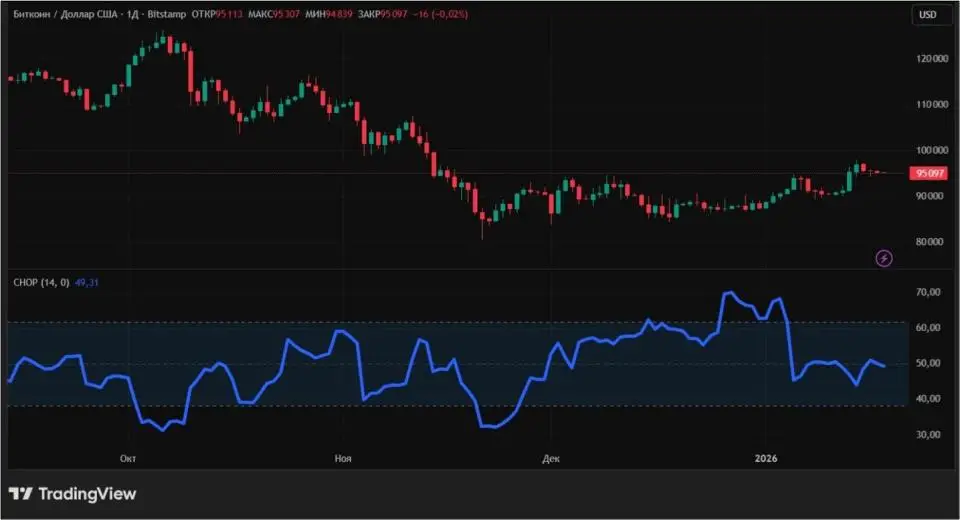

First of all, let’s analyze the trend using the indicator on the daily Bitcoin chart. The current value of the variability index is 49.31. This suggests that Bitcoin is in a transition phase, sometimes showing signs of trending movement, sometimes sideways. This can be clearly seen on the graph, where the variability index is indicated by a broken blue line:

Source: tradingview.com

But not all digital assets are in a transition phase. For example, Monero has a trend movement, based on the variability index. The indicator is 29.74 – below 38.2.

Source: tradingview.com

An example of a cryptocurrency that is currently flat, according to the volatility index, is Avalanche. This is supported by the indicator value – 63.35. It exceeds 61.8.

Source: tradingview.com

What are the disadvantages of the variability index?

Disadvantages of the variability index

Probably the main disadvantage of the indicator is that it shows the presence/absence of a trend, but does not give an idea of the direction, like the same moving averages, or about the strength, like ADX. Another disadvantage is the use of the volatility index primarily for short-term trading. It is less suitable for long-term use.

Some traders interpret the indicator readings as a mandatory transition from the trend phase to the sideways phase and back. This is not always true. Quite often, cryptocurrencies are in the intermediate zone between 38.2 and 61.8.

And, of course, it is better to use the volatility index not alone, but together with other indicators of technical analysis. If you manage to receive confirmation from several instruments at once, then the chance of making money and not losing will be higher.

Output

The volatility index is a technical analysis indicator designed to identify a trend or consolidation zone in a specific crypto asset. The index is based on Fibonacci levels. Like other indicators, the volatility index is best used in combination with other analytical tools.

This material and the information contained herein do not constitute individual or other investment advice. The editors’ opinions may not coincide with the opinions of analytical portals and experts.