Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

K33’s Chief Analyst: Bitcoin Market Experiences a Déjà Vu Effect, 2026/02/19 10:45:07

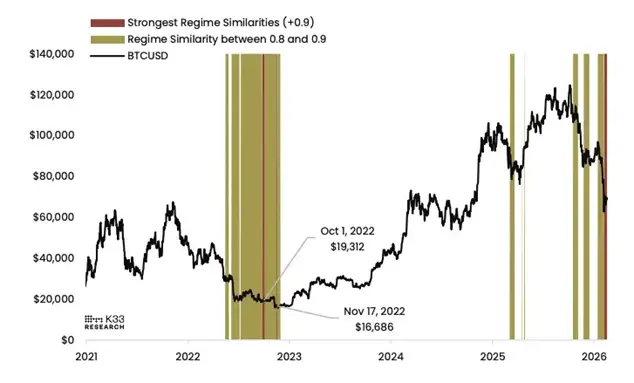

The head of the research division at brokerage firm K33 Research, Vetle Lunde, indicated that the current state of the bitcoin market resembles the final phase of the bearish cycle from 2022.

Lunde referenced data from a market regime indicator that takes into account open interest in bitcoin, macroeconomic signals in the United States, and fund flows in exchange-traded funds (ETFs).

“The market situation bears a striking resemblance to what was observed in September and November 2022. At that time, the market was near a global bottom,” Lunde explained.

According to him, historically, such a regime has not signified a sharp trend reversal but rather the establishment of a local minimum, followed by an extended period of low volatility and subdued price movement for the leading cryptocurrency.

It is likely that bitcoin will remain within the range of $60,000 to $75,000 for several months. This price level may be appealing to major players, as it allows them to accumulate more BTC.

However, for retail traders and investors, prolonged consolidation may pose a challenge: limited volatility reduces the potential for quick profits, while extended sideways movement increases the risk of emotional decision-making and short-term losses, Lunde noted.

Previously, Axel Adler Jr., an analyst at the on-chain platform CryptoQuant, stated that the bearish cycle for bitcoin that began in October is unlikely to conclude before 2027.