Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Julien Bittel called the signals of Bitcoin and the stock market contradictory, 2026/01/16 11:55:20

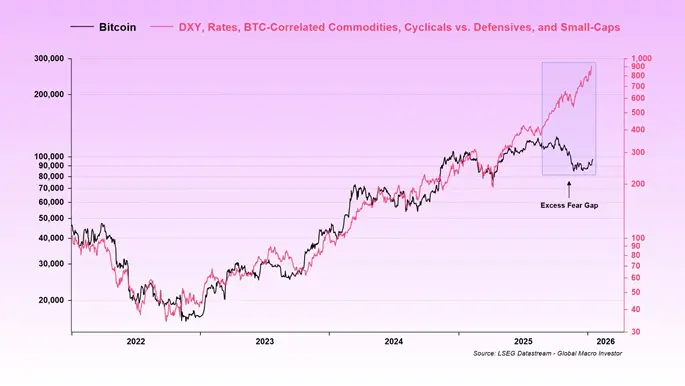

Global Macro Investor’s head of research, Julien Bittel, said there was a disconnect between the flow of money and how different assets responded. If the stock market behaves logically, then Bitcoin literally “fell out” of the overall picture.

The analyst noted that global stock markets are showing growth and updating historical highs, which is fully justified by the increase in the money supply. However, Bitcoin behaves as if the era of “cheap money” is already over. This discrepancy creates a paradox: cryptocurrency includes in its price the scenario of the end of the cycle, while statistics indicate the opposite.

Two opposite signals cannot be true at the same time. Either the stock market is overvalued and will fall soon, or Bitcoin is unreasonably cheap and ignores positive macroeconomic data, Bittel emphasized.

He recalled that the events of October 10, 2025 temporarily disrupted the “price detection” settings of Bitcoin. At the same time, gold, credit markets and stocks continue to move strictly according to the logic of rising capital.

In conclusion, the expert explained: the key debate between the bullish and bearish Bitcoin scenario comes down to one factor – the direction of global liquidity.

Earlier, specialists from the trading company QCP Capital said that the so-called “Goldilocks zone” is forming in the crypto market – a situation that is most suitable for the growth of Bitcoin and other virtual assets.