Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Investors withdrew $3.74 billion from cryptocurrency funds., 2026/02/16 13:39:07

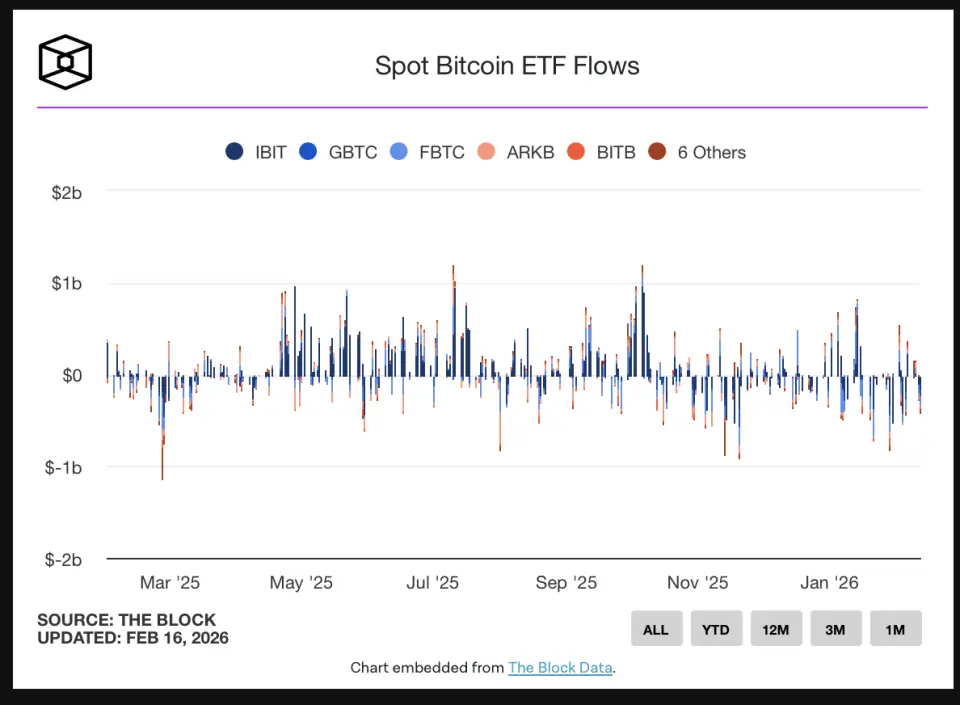

Cryptocurrency exchange-traded funds have recorded a net outflow of funds for the fourth consecutive week. Over the past week, investors withdrew $173 million, bringing total losses over the four-week period to $3.74 billion, as calculated by the management firm CoinShares.

Currently, the scale of outflows from the funds has decreased compared to peak levels. In early February, a record outflow of $1.7 billion was noted for a single week, while the current losses have reduced to $187 million. Although selling pressure has lessened, it has not ceased: the market is undergoing a prolonged correction, CoinShares analysts explained.

American investors collectively withdrew $403 million over the week. In contrast, analysts observed a total inflow of funds in other regions of the world, amounting to $230 million. The highest interest was shown by investors from Germany ($115 million), Canada ($46.3 million), and Switzerland ($36.8 million). This indicates a redistribution of demand, as noted by CoinShares: investors outside the U.S. continue to show interest in crypto funds, while Americans are actively reducing their positions amid a declining crypto market.

Among specific assets, the largest outflow was recorded for financial products linked to Bitcoin, with $133 million withdrawn. Ethereum funds saw an outflow of $85.1 million. CoinShares experts highlighted a notable trend: the outflow from short products (where the bet is on a price decline) surged to $15.4 million over two weeks. Such investor behavior is often observed near market lows, analysts stated.

Certain altcoins managed to attract capital amid the overall caution of investors. XRP funds recorded an inflow of $33.4 million, Solana saw $31 million, and Chainlink attracted $1.1 million.

Investor and co-founder of Morgan Creek Digital, Anthony Pompliano, believes that a bullish trend in the cryptocurrency market will arrive later than anticipated. He promised increased volatility for Bitcoin, but did not specify when it would begin or how long it would last.