Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Interest in Bitcoin Searches Increases Amid Cryptocurrency Market Decline, 2026/02/08 15:58:46

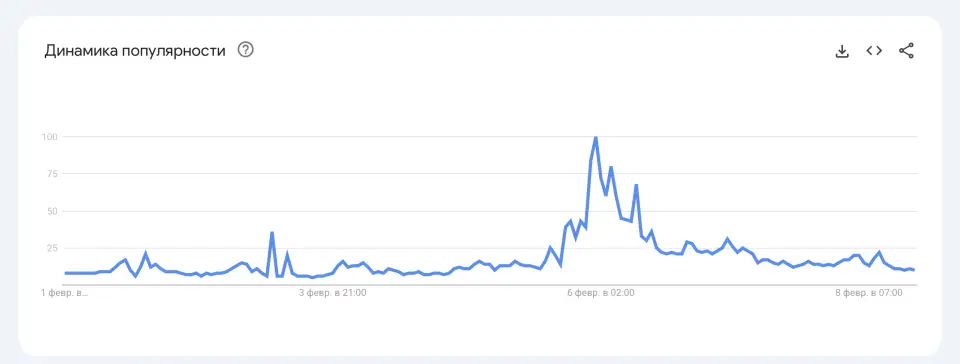

The weekly assessment of Bitcoin-related search queries on Google reached a score of 100 by the weekend—its highest level in the past year, according to an analysis by Google Trends. The previous peak (95 points) was recorded from November 16 to 23, when Bitcoin fell below the psychologically significant threshold of $100,000 for the first time in six months.

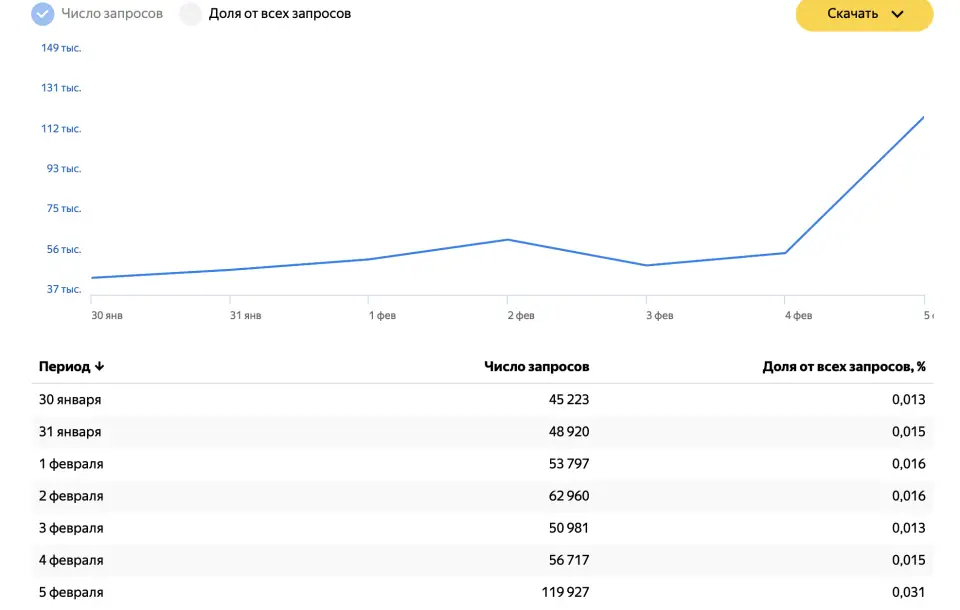

In the Russian segment of the internet, searches for the term “Bitcoin” more than doubled. As per “Yandex Wordstat,” on January 30, the first cryptocurrency was searched slightly over 45,000 times, while on February 5, it surged to 120,000. The majority of queries originated from Moscow, the Irkutsk region, and Ingushetia.

According to André Dragosch, head of Bitwise’s European division, the increase in interest towards Bitcoin may indicate the onset of widespread purchases by small investors.

“Retail investors are coming back,” — he noted on the social media platform X.

American investors began acquiring Bitcoin after its drop to $60,000, highlighted Julio Moreno, head of research at CryptoQuant. He pointed out that the Coinbase premium (the difference between the exchange price and the market index) turned positive for the first time since mid-January.

A surge in search queries typically coincides with sharp rises and falls in asset prices. Within just five days, Bitcoin’s price plummeted to $60,000, before recovering to above $70,000. Over the past week, the asset has lost 15.51% of its value. Meanwhile, the Fear and Greed Index from Alternative.me has dropped to 6 points (“Extreme Fear”)—a level close to the lows of June 2022.

In just a few days, the total losses in the crypto market since the peak at the beginning of October reached $2 trillion. Over the last month, the market has contracted by approximately $800 billion, according to CoinGecko. For comparison, in October, the market capitalization was $4.379 trillion.