Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Head of CryptoQuant: Bitcoin rate will be stable for at least several months, 2026/01/08 09:25:58

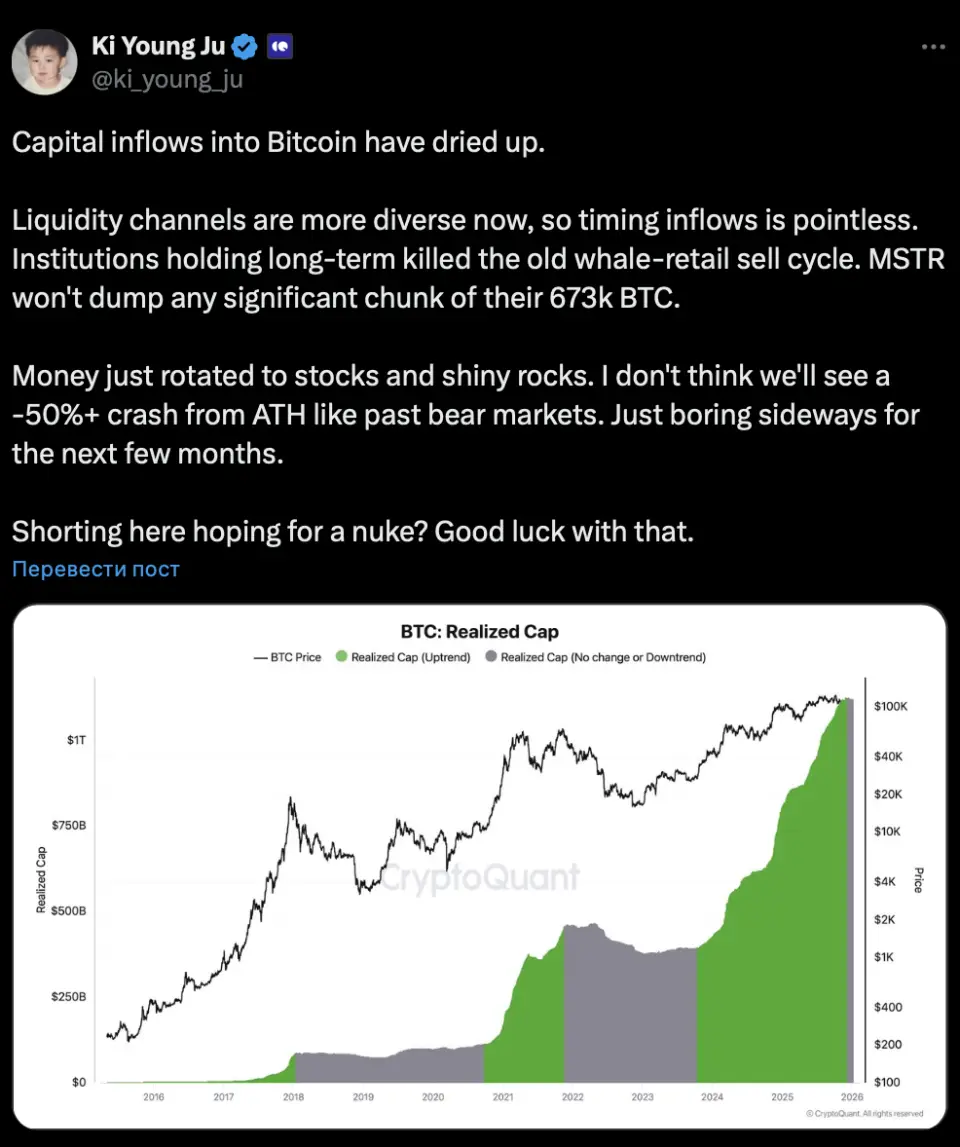

In the first quarter of 2026, the price of Bitcoin will most likely remain at the current level, contrary to historical trends, says Ki Young Ju, CEO of the CryptoQuant analytical platform.

According to him, the influx of capital into Bitcoin has practically stopped, and investor interest has switched to traditional assets: stocks and precious metals. The latest trend is especially noticeable against the backdrop of a sharp rise in prices for gold and silver. However, Ki Yong Joo does not expect a collapse in Bitcoin – he believes that the coming months will pass in “boring sideways movement” mode.

“Money just flowed into stocks and precious metals. I don’t think we will see a collapse of more than 50% from the all-time high as we have seen in past bear cycles. There will just be boring sideways movement for the next few months,” wrote analyst X on social media.

January is usually a relatively quiet month for Bitcoin: according to the CoinGlass platform, the average return during this period has been 3.81% since 2013. But February and March usually show more confident growth – 13.12% and 12.21%, respectively.

On Thursday, January 8, Bitcoin was trading at $91,021. Over the past 24 hours, the asset fell in price by almost 1.5%, retreating from a weekly high of $94,400. Over the month, the cryptocurrency gained slightly (0.39%), and over three months the fall was more than 26%.

The restrained sentiment in the market is also confirmed by the Fear and Greed Index, which reflects the general attitude of investors towards crypto assets. Since the beginning of November, the indicator has fluctuated between the “fear” and “extreme fear” levels. On Thursday, the index settled at 28, which corresponds to the “fear” category.

However, there are some signs of recovery in the market. Thus, according to Farside Investors, spot Bitcoin ETFs raised $925.3 million in the first three trading days of 2026.

Earlier, Santiment analysts reported a bullish signal for Bitcoin. According to their forecasts, if the first cryptocurrency by capitalization can overcome the key resistance level of $95,000, then Bitcoin can reach $100,000 and gain a foothold at this level. Miller Value Partners chief investment officer Bill Miller said Bitcoin could hit a new all-time high this year.