Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

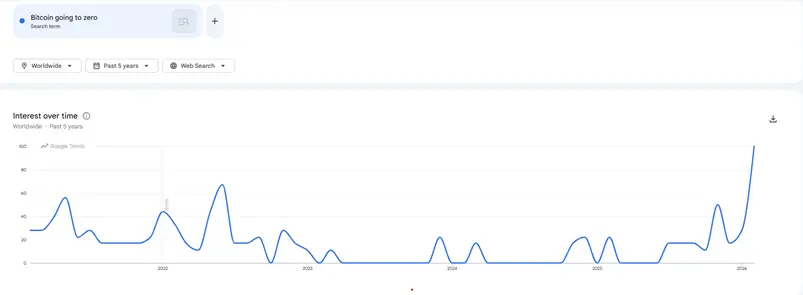

Google Trends: Interest in Bitcoin’s decline to zero has peaked., 2026/02/20 11:41:16

The Google Trends service has recorded a significant increase in search queries for the phrase “Bitcoin will drop to zero.” This metric has reached a score of 100 points, indicating the highest level of user interest.

A comparable surge was observed in November 2022, when the cryptocurrency exchange FTX halted withdrawals, and Bitcoin’s price fell to around $15,000.

Fernando Nikolic, the founder of Perception, noted that the nature of fear in the crypto market has evolved. While in 2022, panic was driven by internal industry crises, including the bankruptcies of centralized lenders and the collapse of FTX, current anxiety is fueled by macroeconomic risks and exacerbated by pessimistic forecasts.

According to him, one of the most prominent proponents of a bearish scenario remains Bloomberg analyst Mike McGlone, who suggests that Bitcoin could fall “to zero or nearly zero.” The high citation of such forecasts in the media may influence the increase in search queries.

Meanwhile, alternative viewpoints are less visible. While retail investors are actively seeking information about a potential crash, institutional players continue to accumulate assets. Nikolic cited sovereign funds, including the Abu Dhabi fund, increasing their investments in spot Bitcoin ETFs, as well as companies like Strategy that are continuing to build their BTC reserves.

An additional source of anxiety stems from concerns related to the advancement of quantum technologies. However, Nikolic stated that such fears tend to intensify during price declines and do not act as an independent driver.

The expert believes that the rise in search queries reflects a combination of concerns regarding price drops, macroeconomic risks, and technological threats.

Previously, economist and president of Euro Pacific Capital Peter Schiff stated that if the US dollar weakens, Bitcoin may lose its value before other assets.