Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Epstein was linked to investments in Coinbase and various cryptocurrency firms., 2026/02/03 15:57:20

Financial figure and investor Jeffrey Epstein invested $3.25 million in the American cryptocurrency exchange Coinbase through intermediaries, according to recently released documents from the U.S. Department of Justice. The businessman passed away six years ago in prison while under investigation for allegations of sexual offenses against minors, serial rapes, and human trafficking.

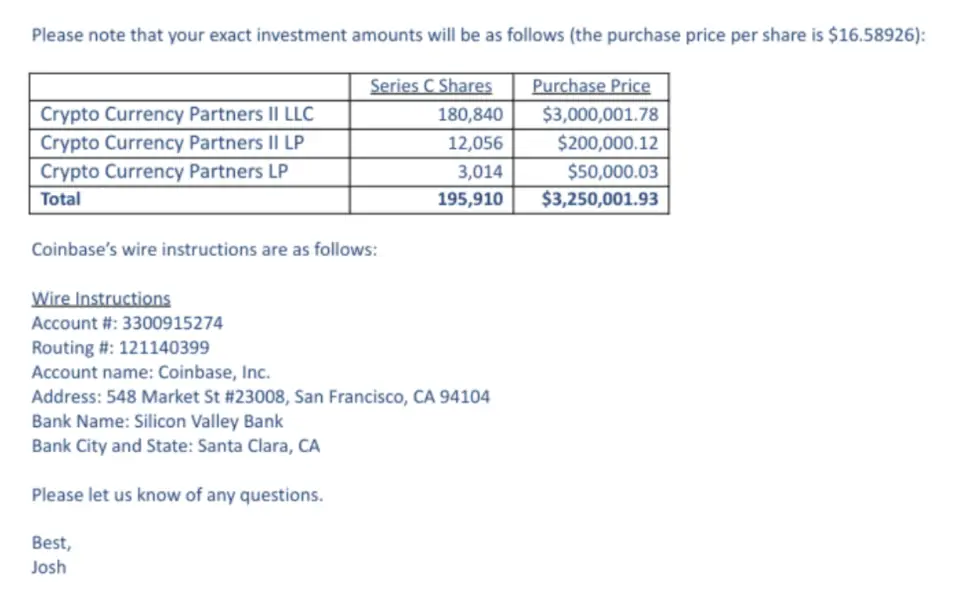

In 2014, a company associated with Epstein acquired 195,910 shares of the cryptocurrency exchange, which was valued at $400 million at that time (the exact size of the acquired stake is not specified). However, the documents do not confirm that Coinbase’s management directly interacted with Epstein or was aware of the ultimate beneficiary of the investments.

It is possible that the investor was attempting to cover his tracks. In correspondence dated December 4, 2014, Blockchain Capital founder and managing partner Bradford Stephens sent instructions to Epstein’s trusted associate Darren Indyke regarding the transfer of funds and the renaming of the company following the completion of the stock purchase deal with Coinbase. Indyke frequently appears in the materials related to Epstein’s case as his financial representative.

In 2018, the founder of Blockchain Capital proposed to buy half of Epstein’s stake in Coinbase. According to the documents, Stephens valued the cryptocurrency exchange at $2 billion and offered $15 million for approximately half of the shares. A month later, on February 22, 2018, Blockchain Capital co-founder Brock Pierce mentioned in another letter that Stephens “transferred $15 million for half of the position in Coinbase.” Subsequently, Pierce repeatedly discussed cryptocurrency investments with Epstein and his attorneys, as indicated in the case materials.

In addition to Coinbase, entities linked to the controversial financier also invested $18 million in Blockstream, a company focused on blockchain technology development. The investments were made through three separate companies collectively known as Crypto Currency Partners.

Millionaire Jeffrey Epstein was arrested in the summer of 2019 on charges of sex trafficking. A few weeks later, he took his own life in his cell before facing trial. Between 2019 and 2024, some materials from Epstein’s case were partially declassified, including witness testimonies, an address book, and a small portion of correspondence. Names of politicians and businessmen appeared, such as former U.S. Presidents Bill Clinton and Donald Trump, British Prince Andrew, and billionaire Elon Musk. Their involvement in any crimes has not yet been proven. In early 2026, under pressure from the American public, the Justice Department released new materials related to the case.

Coinbase found itself at the center of a scandal in the United Kingdom. The local advertising regulator banned a Coinbase advertisement for its “social irresponsibility.” In the harshly satirical ad, potential Coinbase clients among residents of the United Kingdom appeared as individuals facing serious economic issues.