Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

CryptoRank analysts indicate a significant bearish signal for Bitcoin., 2026/02/12 11:05:33

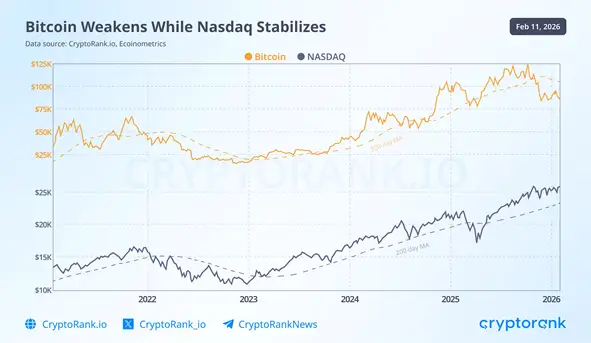

Analysts from the on-chain platform CryptoRank have reported that Bitcoin is exhibiting one of the most significant bearish signals since the beginning of 2022. This pertains to a sharp decline in the 200-day moving average, a crucial indicator of long-term trends.

According to their assessment, such a rapid weakening of momentum has historically occurred during periods of genuine market pressure, rather than during typical corrections.

“Historically, such a collapse in momentum does not take place during healthy corrections, but arises when markets are under real stress,” emphasized CryptoRank.

Nevertheless, the current scenario differs from that of 2022. At that time, the decline was accompanied by a crash in stock indices and a significant withdrawal of investors from risk. Currently, the Nasdaq index is slowing down, but large-scale sell-offs are not observed, and overall risk appetite remains moderate.

Analysts point out that Bitcoin is showing notable weakness against a relatively stable stock market. This creates a complex situation: the asset is losing momentum without a significant external shock.

In their view, the diminishing momentum increases Bitcoin’s vulnerability to sharp movements in either direction. In the short term, the market may face heightened volatility.

Previously, Nobel Prize-winning economist Paul Krugman stated that a “Fimbulvetr” is approaching the Bitcoin market—an apocalyptic winter from Norse mythology that precedes Ragnarok.