Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

CryptoQuant: Bitcoin market experiences one of its largest capitulations., 2026/02/13 12:07:57

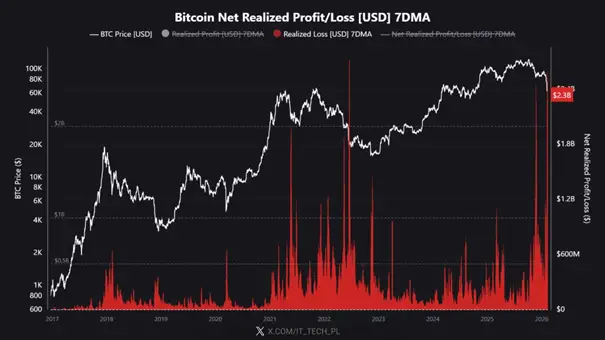

Losses incurred by short-term Bitcoin holders over the past week have reached $2.3 billion, marking one of the largest capitulation events since the crash of 2021, according to analysts at CryptoQuant.

Their analysis indicates that sharp spikes in realized losses have historically been accompanied by short-term price rebounds, while simultaneously signaling a shift in the market towards a deeper correction phase. Such rallies often occur within a bearish trend and do not necessarily indicate the establishment of a definitive bottom.

“In previous cycles, a stable market foundation was established following a period of consolidation below the realized price — the average acquisition cost of coins held by current holders. Currently, this metric is approximately at $55,000,” CryptoQuant explained.

Analysts note that the current capitulation reflects panic among traders and forced position closures amid economic pressures, which may lead to a transition into a more prolonged bearish phase for the market.

Experts believe that a sustainable recovery will require time and confirmation from other indicators — primarily stable purchases from large investors and an improvement in the financial situation of miners.

CryptoQuant emphasized the importance of monitoring the activities of large holders and institutional investors, as their actions can signal potential bottom points and influence short-term market volatility.

Previously, analysts from investment firm QCP Capital stated that the dynamics of Bitcoin and other major cryptocurrencies are increasingly dependent on the state of the global economy.