Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Cryptocurrencies have shifted to the “bottom of the food chain,” according to Binance Research., 2026/02/05 18:07:26

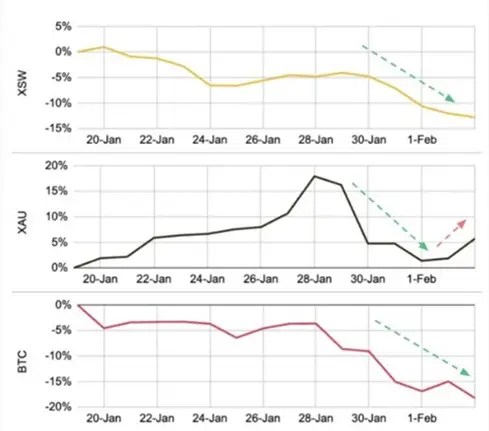

Investors, in an effort to preserve their capital, are currently prioritizing the divestment of major cryptocurrencies, which means that Bitcoin and leading altcoins have found themselves “at the end of the food chain,” according to analysts from Binance Research.

Experts from the world’s largest cryptocurrency exchange have noted signs of overheating in the American stock market. The S&P 500 index has reached a new historical peak, while the debt burden on companies involved in trading and investment activities has significantly increased.

According to exchange specialists, this imbalance raises the risk of a sharp correction in asset prices on traditional markets. In such a scenario, the pressure on cryptocurrencies could intensify further, as digital assets have lost their status as a safe haven.

During periods of market instability, cryptocurrencies are increasingly being utilized as a source of liquidity, meaning they are sold to obtain cash, as explained by cryptocurrency exchange analysts. This trend enhances the correlation between digital assets and stock indices, rendering the crypto market “more sensitive to economic shocks,” the specialists from Binance Research noted.

As long as the global economic situation remains unstable, cryptocurrencies will continue to face significant pressure in the presence of any signs of a systemic crisis. Experts from Binance believe that expecting a recovery in the prices of virtual coins, even in the medium term, is unlikely.

Previously, economist and professor at New York University Nouriel Roubini stated that the cryptocurrency market has become a tool for crime and financial corruption, predicting an impending apocalypse for it.