Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Conflict in Iran and Ethereum Controversy: The Response of the Cryptocurrency Market, 2026/02/20 18:20:22

The decline in cryptocurrency values has come to an end. Most individuals looking to sell have likely already divested their assets. However, it is premature to celebrate. The anticipation of military action by the U.S. against Iran, coupled with a lack of positive developments in the crypto market, could reignite and exacerbate the price drop.

Bitcoin

From February 13 to 20, 2026, the price of Bitcoin fell by 1.4%. Each daily trading session was characterized by relatively low volatility. Only on one occasion, Tuesday, February 17, did the price of the leading cryptocurrency change by more than 2% by the end of the day.

Source: tradingview.com

Compared to the end of January, the decline in Bitcoin’s price has noticeably slowed. However, investor anxiety remains. U.S. President Donald Trump has yet to reach concrete agreements with Iran regarding the cessation of its nuclear program. Several sources, including Axios, agree that military action is quite possible. The likelihood of conflict in the Middle East has significantly increased by mid-February, especially with important Congressional elections approaching for Trump and declining voter support. Given the risks of escalation, crypto investors are opting to refrain from investing in highly volatile assets like Bitcoin.

Activity on the network of the leading cryptocurrency has recently decreased significantly. According to analytics platform Santiment, since 2021, the number of unique addresses conducting transactions has dropped by 42%, while new wallet creations have fallen by 47%. Representatives of the platform are far from pessimistic conclusions that the cryptocurrency is dead or that a bear trend will persist. Santiment believes that the situation in 2025 was much more precarious, as there was a divergence—discrepancy between price and blockchain activity. Nevertheless, weak network metrics do not instill confidence in crypto investors.

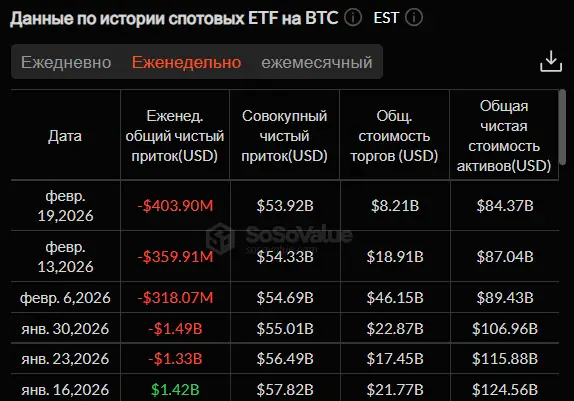

Negative trends are also evident in spot ETFs for BTC. Last week, a cash outflow was again recorded, amounting to $403.9 million. The series of weeks during which investors preferred to withdraw funds from spot ETFs has reached five. The largest outflow of $367.94 million was noted from the BlackRock iShares Bitcoin Trust (IBIT).

Source: sosovalue.com

From a technical analysis perspective, the Bitcoin trend remains bearish. This is supported by the price of BTC being below the 50-day moving average (marked in blue). The MACD histogram provided a bullish signal when it crossed the zero mark from below (red bars turned green). Despite this, there are currently no other confirmations of a trend reversal. The nearest support and resistance levels on the daily chart are $59,930 and $72,174, respectively.

Source: tradingview.com

The fear and greed index has decreased by two points compared to last week. The current value is 7. This still indicates that extreme fear prevails among crypto investors.

Ethereum

Ethereum continued its decline from February 13 to 20, losing an additional 4.64% in value. All seven days of trading occurred within a relatively narrow range between $1,900 and $2,100. If not for a 5.77% drop on Sunday, February 15, the dynamics of ETH would have been nearly flat.

Source: tradingview.com

The main news was the announcement regarding the amount of the second-largest cryptocurrency in staking. The analytics platform Santiment reported that the volume of staked Ether has surpassed 50% of the total supply for the first time. However, this assertion was quickly called into question.

Senior research analyst at investment firm CoinShares, Luke Nolan, noted that Santiment considered information from the Ethereum staking deposit contract. However, relying on this data is somewhat misleading, as the contract indicates how much Ether is locked in staking but does not reflect the amount of ETH withdrawn.

In other words, Santiment’s figures represent the volume of deposited coins rather than the actual balance. According to CoinShares data, the amount of ETH in staking is just under 37 million coins, equivalent to 30.8%, not 50%. If Santiment’s data initially generated optimism among crypto investors, analysts quickly dampened that sentiment.

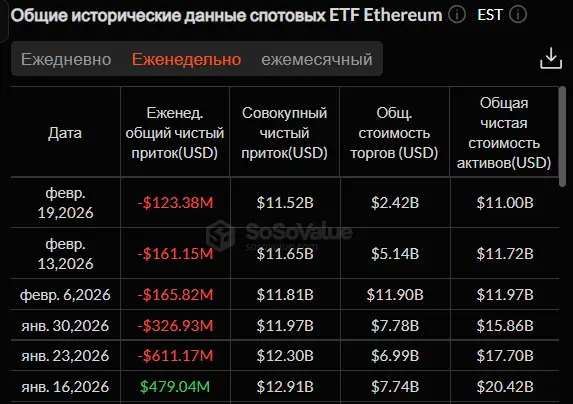

Spot ETFs for Ethereum continue to experience cash outflows. For five consecutive weeks, investors have preferred to withdraw funds from exchange-traded crypto funds. This time, the outflow amounted to $123.38 million, with the majority, $103.84 million, coming from the BlackRock iShares Ethereum Trust (ETHA).

Source: sosovalue.com

Additionally, the non-profit organization Ethereum Foundation, which supports the blockchain and its ecosystem, released a roadmap for 2026. The priority areas include enhancing the scalability of the first layer and blobs, improving user experience, which involves further wallet abstraction and optimizing interactions with second-layer networks (L2), strengthening Ethereum itself through security upgrades, censorship resistance, and testing updates.

By the end of 2026, the Ethereum Foundation plans two significant hard forks: Glamsterdam in the first half and Hegota in the second. This news is relatively positive for Ethereum, as it provides clear information about the development path of the second-largest cryptocurrency in the medium term.

From a technical analysis standpoint, the ETH trend remains bearish. This is indicated by the price being below the 50-day moving average (marked in blue). The RSI, although it has exited the oversold zone, still remains below 50, which also favors sellers (bears). The nearest resistance and support levels on the daily chart are $2,149.9 and $1,741.8, respectively.

Source: tradingview.com

Dogecoin

Dogecoin increased by 2.62% from February 13 to 20. Although most of the week for the largest meme coin was marked by declines, the overall seven-day trend was positive, primarily due to a 14.82% surge on Saturday, February 14.

Source: tradingview.com

One reason for Dogecoin’s significant rise at the beginning of the week was increased trading volumes. On South Korean exchanges, the largest meme coin by market capitalization ranked fifth with $122 million, surpassing larger assets like BNB, Solana, USDC, and Tron. Additionally, from February 13 to 15, there was a notable increase in open interest, reaching nearly 30% over two days. However, it later declined.

On a positive note, the largest U.S. cryptocurrency exchange, Coinbase, has allowed Dogecoin to be used as collateral for loans issued to clients through the DeFi protocol Morpho. Users in the U.S., except for those in New York, can borrow up to 100,000 USDC without selling DOGE. In addition to the largest meme coin, Coinbase has also permitted XRP, Cardano, and Litecoin to be used as collateral under the same conditions.

Spot ETFs for Dogecoin have shown no movement for the second consecutive week. The total net cash inflow since the launch of these products has remained unchanged at $6.67 million.

Source: sosovalue.com

According to technical analysis, the Dogecoin trend remains bearish. This is confirmed by the price being below the 50-day moving average (marked in blue). The stochastic indicator has also declined below 50, supporting the sellers. The nearest support and resistance levels on the daily chart are $0.088 and $0.116, respectively.

Source: tradingview.com

Conclusion

The decline of major cryptocurrencies has slowed. Some, like Dogecoin, have managed to show slight gains. However, investors remain tense due to Trump’s international policies. A shift from a bearish to a bullish trend is not yet visible.

This material and the information contained herein do not constitute individual or any other investment advice. The opinions of the editorial team may not align with those of analytical portals and experts.