Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

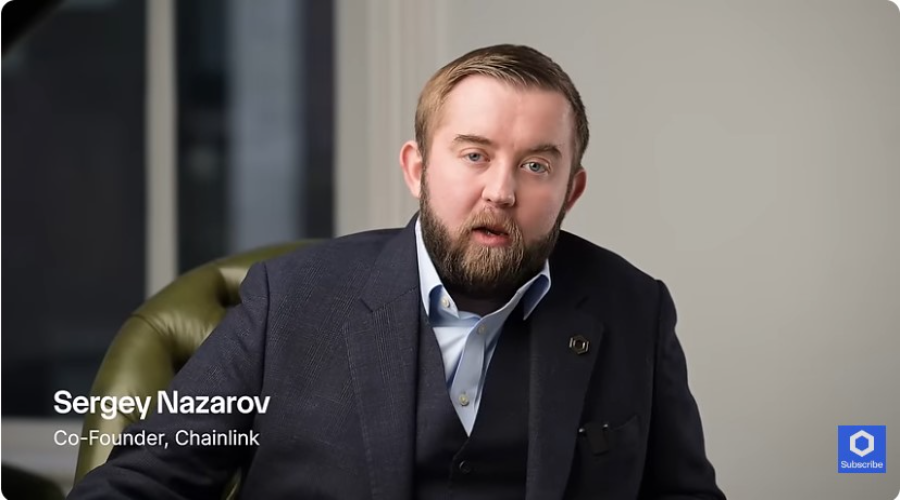

Co-founder of Chainlink Sergey Nazarov: This bear market is different from previous ones., 2026/02/10 11:38:28

Co-founder of the major oracle provider Chainlink, Sergey Nazarov, stated that the current bear market is distinguished from earlier ones by two factors: the absence of significant institutional failures and the active development of real-world assets (RWA).

According to him, in previous cycles, market pressure intensified due to systemic errors in risk management. Among the notable failures in risk management, Nazarov highlighted the collapse of the FTX cryptocurrency exchange and the downturn of the crypto lending market in 2022. Currently, such disruptions are not evident, indicating a more mature and resilient industry infrastructure.

The second key factor Nazarov identified is the vigorous advancement of real-world assets, as well as perpetual contracts on the blockchain for traditional goods. These areas continue to expand regardless of cryptocurrency price movements, affirming the value of the technology. The presence of RWA on the blockchain is not tied to the valuations of other crypto assets and can evolve independently.

Nazarov also pointed out several trends that could reshape the future of the industry. Tokenization and asset protection on the blockchain provide access to markets and enable real-time data utilization. This fundamental utility, he believes, will drive further institutional adoption.

The demand for more advanced blockchain infrastructure is expected to grow. If these trends persist, the Chainlink co-founder suggests that the total value of RWA could eventually surpass the market capitalization of cryptocurrencies, leading to a profound transformation of the industry itself.

Earlier, analysts from Binance Research indicated that investors are currently prioritizing capital preservation by divesting from major cryptocurrencies—meaning that Bitcoin and leading altcoins have found themselves “at the end of the food chain.”