Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

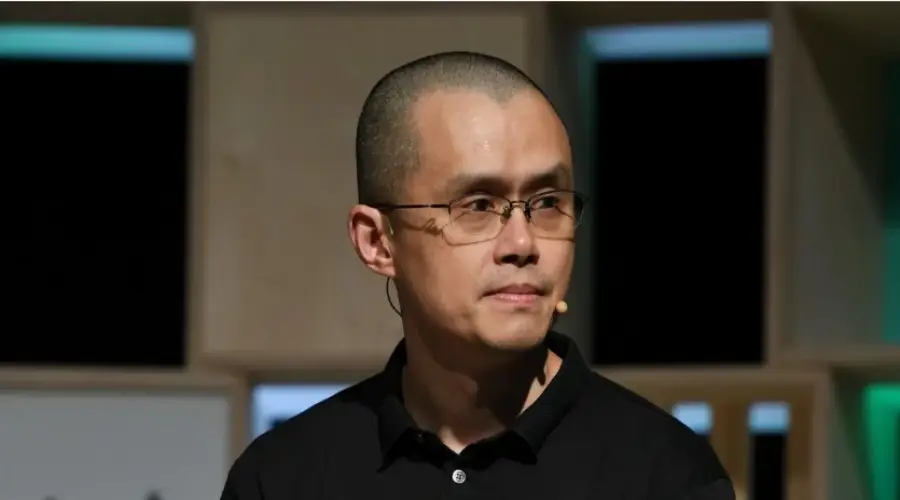

Changpeng Zhao: Up to 10% of the Global Population Owns Cryptocurrencies, 2026/02/14 09:50:03

The majority stakeholder of the largest cryptocurrency exchange by trading volume, Changpeng Zhao, stated that the proportion of cryptocurrency owners globally is approximately 8–10%.

According to Zhao, cryptocurrencies are far less widespread than commonly believed: their share of global wealth is under 1%. This indicates a substantial growth potential for the entire industry over the coming years.

He pointed out that the current bearish cycle is distinct from previous downturns: the market has matured, and institutional involvement has become more pronounced. Zhao also identified a more constructive regulatory approach from the United States towards digital assets as another factor contributing to long-term stability.

He emphasized that short-term forecasts remain speculative: the high volatility of cryptocurrencies persists, thus investment decisions should align with individual risk tolerance.

The entrepreneur also highlighted the differences between centralized and decentralized platforms. He noted that these platforms are not direct competitors, as they cater to different user categories.

Engaging with decentralized protocols necessitates technical expertise and strict adherence to cybersecurity principles: compromising a device or wallet can result in total asset loss.

In contrast, centralized exchanges provide familiar infrastructure—accounts, passwords, customer support—which makes them more accessible to the general public. As users gain experience, some transition to decentralized solutions; however, this shift entails responsibility for asset management.

Discussing the evolution of the crypto industry, Zhao urged teams to focus on product development rather than short-term fluctuations in crypto assets. In the long run, he believes that projects with robust technological frameworks, transparent strategies, and clear economic models will prevail. He identified key success metrics as the security of user funds, low fees, high transaction speeds, and user-friendly interfaces.

Previously, Changpeng Zhao shared that in 2014, he sold his apartment in Shanghai for $900,000 and purchased 1,500 BTC at an average price of $600 per coin, which caused his mother to express discontent.