Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bypassing sanctions using cryptocurrencies has increased by 400%, 2026/01/29 11:08:10

Activity related to circumventing international sanctions has grown on the crypto market over the year by more than 400% in dollar terms, analysts at TRM Labs calculated. Separately, experts highlighted the A7A5 stablecoin pegged to the ruble.

Last year, more than $72 billion passed through A7A5, and wallets associated with this token processed another $39 billion. In 34% of transfers, the value of A7A5 was inflated through “wash-trading,” that is, an artificial increase in trading activity due to resale of the coin by the same person, TRM representatives assure Labs.

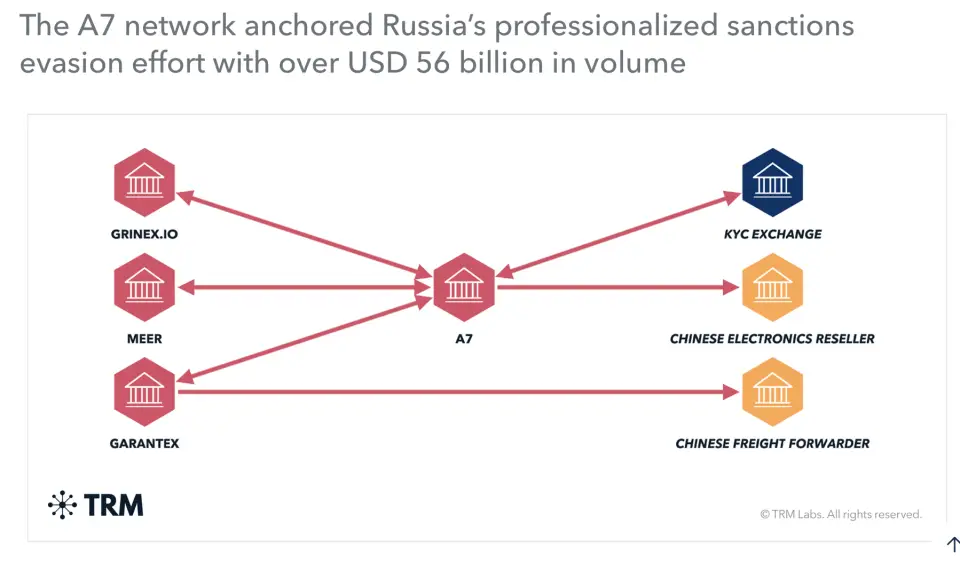

The increase in the number of crypto-transactions associated with circumventing sanctions was extremely concentrated: the vast majority of transfers were made to structures affiliated with Russia, including the Garantex and Greenex exchanges and the A7 wallet, according to TRM Labs materials. Analysts associated the sharp increase in the number of transactions and amounts with several reasons: the tightening of the sanctions regime, the more active use of cryptocurrencies by government agencies and the improvement of technologies for tracking transfers on the blockchain.

TRM Labs estimates that at least $56 billion passed through A7. In addition, some of the money went through intermediary wallets that experts called “A7 wrappers” or foreign trading partners in China, Southeast Asia and South Africa – with the most money going to China and Hong Kong.

“The numbers reflect a coordinated financial infrastructure created to circumvent sanctions. It centered around the A7 platform, associated with the ruble stablecoin. The wallet works as a node connecting Russian structures with counterparties in China, Southeast Asia and networks associated with Iran. This reflects a conscious shift towards state-supported cryptoinfrastructure,” TRM Labs is confident.

TRM Labs described schemes to circumvent restrictions through crypto intermediaries in Hong Kong. They were involved in processing payments from companies in mainland China, where the use of cryptocurrencies is limited. These structures most often received USDT stablecoins through the Tron network from the A7 wallet and associated addresses. One Chinese freight forwarding company sent navigation components for missiles to Russia, receiving $1.31 million from the Garantex crypto exchange, and additional money from their Kyrgyz crypto platform, representatives of TRM Labs are convinced. Addresses linked to A7 transferred more than $37 million to an unnamed large Chinese electronics distributor, analysts said.

TRM Labs data correlates with the calculations of Elliptic company analysts. According to these experts, $100 billion passed through the A7A5 stablecoin in 250,000 transactions over the past year.