Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin’s fall has made investing in ETFs unprofitable – CryptoQuant, 2026/01/28 19:03:45

Investors in Bitcoin exchange-traded funds now face a choice: endure possible losses or exit positions without profit and obvious losses, CryptoQuant analysts said.

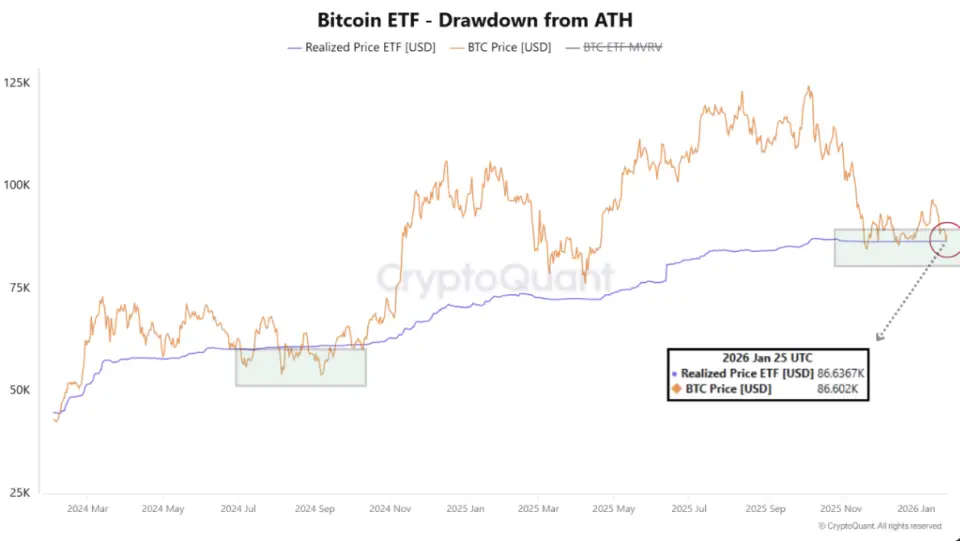

They believe the market has reached a point at which investors are no longer taking profits. Bitcoin’s price of $86,600 serves as a psychological threshold: if the value of the crypto asset remains above the average price of an ETF share, this will strengthen investor confidence and stabilize the flow of funds. A sustained drop in price below this level is fraught with an increase in the risk of mass sales: investors will lose their “profit buffer” and will begin to withdraw capital, CryptoQuant suggested.

“We’re talking about behavioral stress. Right now, Bitcoin is trading at the threshold where investments in ETFs are tested for strength and there is a risk of massive sales,” analysts write.

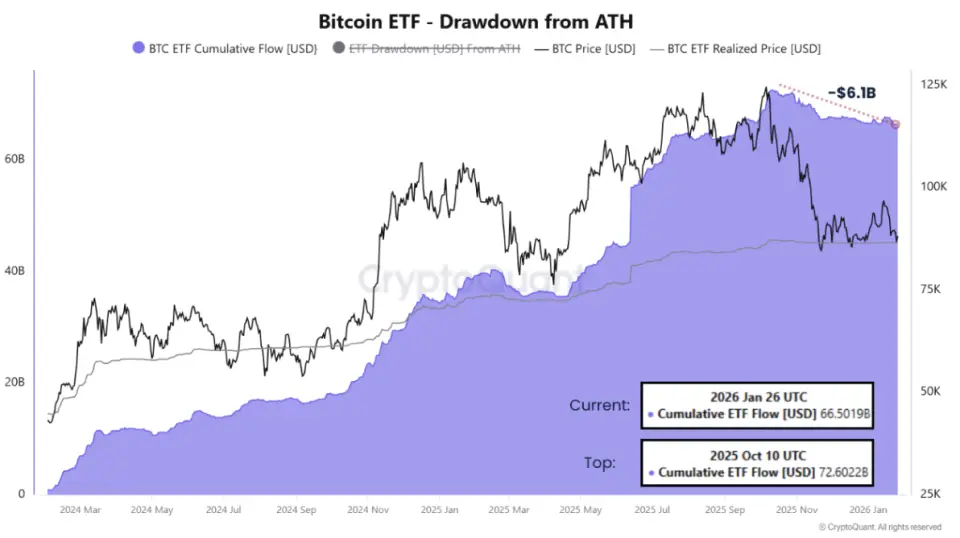

The total volume of investments in Bitcoin ETFs peaked in October at $72.6 billion. However, by January, fund assets decreased by 8.4%, to $66.5 billion. At the same time, the average entry price of investors remains stable and even shows an upward trend, experts say. The outflow of funds indicates the exit of less stable participants – those who invested at the market peak or seek to fix the remaining profits before new losses occur.

According to the British investment company Farside Investors, since January 16, the BTC-ETF has had a predominant net outflow of funds. On just one day of the month there was a modest inflow of $6.8 million, but the ETF still lost capital.

As of 19:00 Moscow time on Wednesday, January 28, Bitcoin is trading around $89 465. Over the past three months, the first cryptocurrency has fallen in price by more than 20%.

It is exchange-traded bitcoin funds, or rather the high demand for them, that can quickly exhaust the available supply of cryptocurrency and, as a result, increase the value of the asset. Moreover, the price increase, although delayed, will be extreme – similar to the recent rally in gold, says Bitwise investment director Matt Hougan.