Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

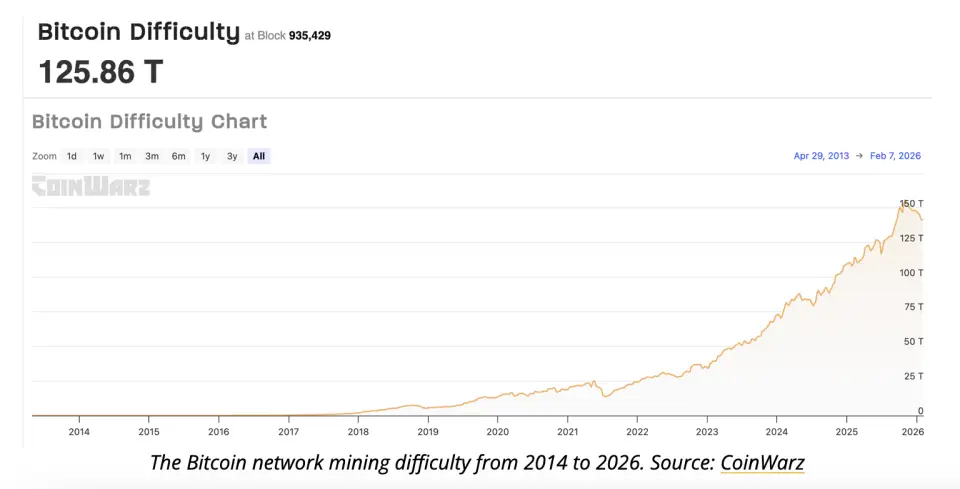

Bitcoin mining difficulty experiences a five-year low., 2026/02/08 11:41:34

The mining difficulty within the Bitcoin network has decreased by 11.16% over the past 24 hours. This decline marks the steepest daily drop since May 2021.

At the time of the adjustment (block 935,429), the difficulty level was recorded at 125.86 TH (a unit representing trillions of operations). The average time to discover a new block reached 9.47 minutes, slightly below the target of 10 minutes. The next adjustment, scheduled for February 20, could see an increase in difficulty of 5.63%, bringing it to 132.96 TH, according to data from CoinWarz.

This decrease in difficulty is comparable to figures from May 2021, when China announced a ban on cryptocurrency mining and initiated strict crackdowns on digital asset holders. Consequently, from May to July five years ago, mining difficulty experienced several reductions, ranging from 12.6% to 27.9%.

Currently, this significant drop coincides with an overall downturn in the cryptocurrency market: the price of Bitcoin has plummeted by more than 50% from its peak in October, falling to $60,000. By the morning of Saturday, February 7, the price of the leading cryptocurrency rebounded to $71,000.

Another contributing factor is the January cyclone “Fern,” which affected 34 states in the U.S. over an area of 2,000 square miles. Heavy snowfall and extreme cold led to power outages, causing American miners to reduce electricity consumption and halt operations. This resulted in a decline of the overall network hash rate to four-month lows. The largest mining pool by hash rate, Foundry USA, was particularly impacted, temporarily losing around 60% of its computational power.

In January, the average costs for mining companies to extract one Bitcoin reached $74,300, as calculated by analysts from the crypto asset management hedge fund Capriole Investments.