Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin has not yet hit its ultimate low, according to CryptoQuant., 2026/02/15 12:14:22

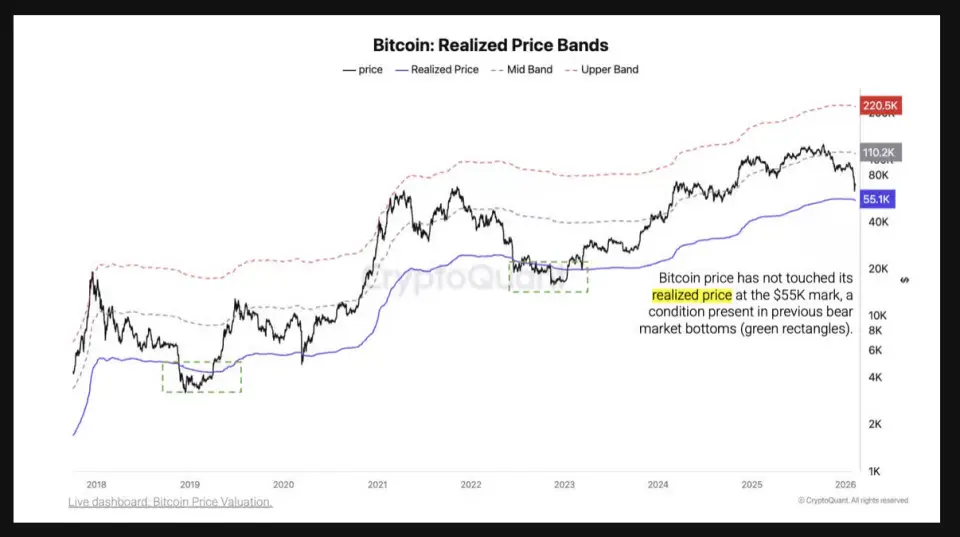

Experts from CryptoQuant suggest that the absolute bottom of the bearish trend for Bitcoin may be around the price of $55,000 per coin. They indicated that only from such a low point could a rebound and increase in the value of the leading cryptocurrency occur.

As a reference point, analysts are using the realized price of Bitcoin — a price level that has historically served as a support zone during previous bearish cycles. Currently, Bitcoin is trading approximately 25% above this level. For comparison, after the collapse of the FTX exchange, the price fell 24% below the realized price, while in the 2018 cycle, it dropped 30% below. Following such levels, Bitcoin typically takes four to six months to establish a base for growth.

Despite the extent of losses in early February, CryptoQuant analysts assert that the bottom price for the leading cryptocurrency is still far off:

Firstly, the accumulated monthly losses (0.3 million BTC) are significantly lower than levels typical for the bottom of a bearish cycle — at the end of 2022, this figure reached 1.1 million BTC.

Secondly, the MVRV ratio, which reflects the relationship between market and realized value, has not yet entered the zone of extreme undervaluation, which usually signals the attainment of a bottom.

Another crucial indicator, the NUPL (Net Unrealized Profit and Loss, the ratio between unrealized profits and unrealized losses of holders), has also not reached the 20% level of unrealized losses, characteristic of the lows in previous cycles.

Additionally, experts note the behavior of long-term holders: they are currently selling the asset at approximately the purchase price. In previous instances at the bottom, they experienced losses in the range of 30–40%. Currently, 55% of Bitcoin’s supply remains profitable. This figure exceeds the 45–50% typically observed at market cycle lows, experts point out.

The CryptoQuant phase indicator remains in the “Bear” phase, rather than in the extreme “Extreme Bear” phase. Analysts assert that the extreme phase typically lasts several months, reinforcing the notion of a prolonged bottom formation process.

On February 5, Bitcoin holders recorded $5.4 billion in losses amid a 14% drop in the price of the leading cryptocurrency to $62,000. This marks the largest daily loss since March 2023, when it reached $5.8 billion. The figure also surpassed the $4.3 billion losses recorded a few days after the FTX collapse in November 2022. The losses for short-term Bitcoin holders over the past week reached $2.3 billion, marking one of the largest capitulation events since the 2021 crash, according to CryptoQuant.