Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin and Ethereum ETFs Start the Year with Sharp Inflows, 2026/01/04 08:43:53

On the first trading day of the year, the total net inflow of funds into US exchange-traded funds (ETFs) for bitcoin and ether reached $645.8 million, a record for more than a month and a half.

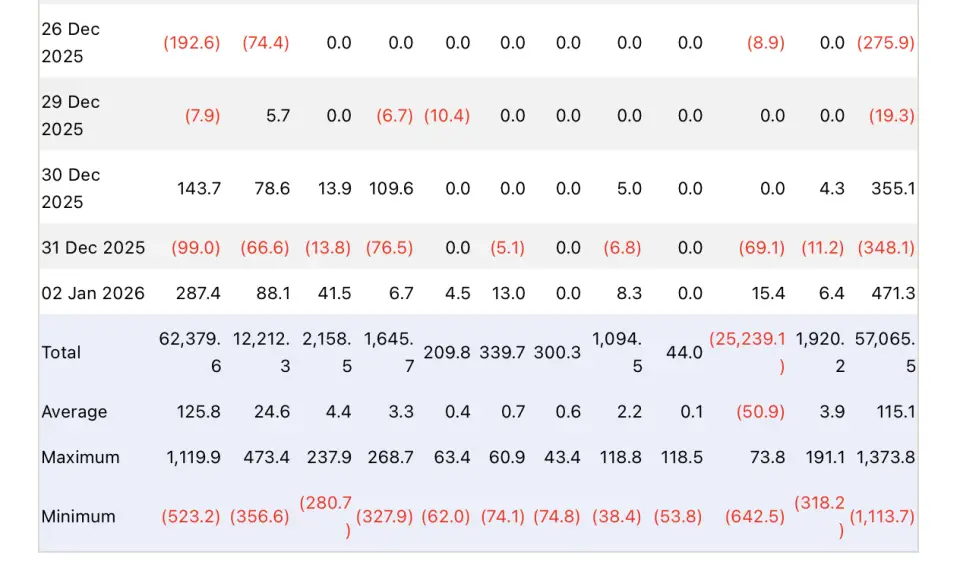

Bitcoin ETFs attracted $471.3 million, and ether funds attracted $174.5 million. For Bitcoin ETFs, this was the largest daily influx in the last 35 trading days, Farside analytics showed. The previous comparable result was recorded on November 11, when 11 American funds raised a total of $524 million in one day.

Ether funds recorded their highest daily inflow of funds over the past 15 trading days. Prior to this, the highest figure was recorded on December 9 – then ETFs raised $177.7 million.

The chief marketer of the crypto market analysis company Tonso AI under the pseudonym Wals wrote on the social network X that many corporate investors sold BTC in the fourth quarter of 2025 in order to record tax losses. According to Wahls, these players are now returning to the market and are actively increasing their positions, and current events are just the beginning of a larger trend.

December turned out to be a difficult month for crypto ETFs. Market prices of underlying assets have shown a decline: over the past 30 days, Bitcoin has fallen in price by 1.56%, and Ethereum – by 1.39%. This trend continued the decline that began shortly after Bitcoin reached an all-time high on October 5. The situation worsened on October 10, when a large-scale market crash occurred with the liquidation of traders’ positions worth $19 billion.

Over the last week of December, investors withdrew $782 million from spot bitcoin exchange-traded funds (ETFs), data from the SoSoValue service shows. The largest one-day outflow during this period was recorded on Friday, December 26, when $276 million was withdrawn from the Bitcoin ETF.

If we consider the results of 2025 as a whole, American investors invested more than $31.77 billion in US crypto ETFs. The bulk of the funds came from Bitcoin-linked ETFs: their net inflow amounted to $21.4 billion. However, this figure was lower than the result of the previous 2024, when the inflow reached $35.2 billion.