Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

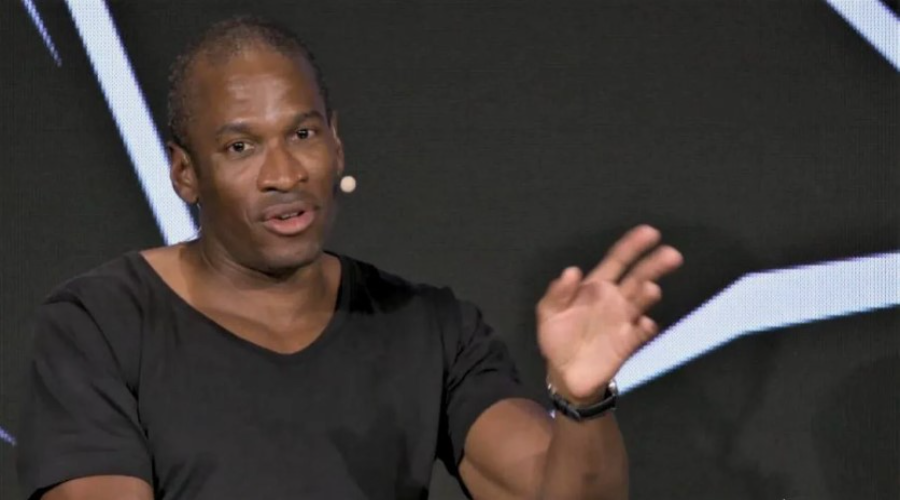

Arthur Hayes: Bitcoin has become a gauge for issues with dollar liquidity., 2026/02/18 10:15:25

Co-founder and former CEO of the cryptocurrency exchange BitMEX, Arthur Hayes, has stated that Bitcoin is assuming a new role as an indicator of liquidity issues and the stability of the fiat financial system.

According to Hayes, the divergence between Bitcoin’s performance and that of technology stocks may signal a potential credit crisis linked to the advancement of artificial intelligence. This scenario could lead to an increase in money supply by central banks.

“Bitcoin serves as a global alarm regarding the liquidity of fiat currencies. It is the most responsive freely traded asset to the supply of fiat credit,” Hayes remarked.

He emphasized that job losses due to AI implementation could impact consumer lending and the mortgage market, as highly skilled workers with significant debt burdens may face challenges in meeting their monthly payments.

A reduction in employment could trigger a new banking crisis. Regional banks may be the first to feel the pressure, which would exacerbate deposit withdrawals and strain credit markets. Ultimately, the U.S. Federal Reserve may resume money printing.

This surge in liquidity injection is expected to initially elevate Bitcoin from its current lows and subsequently drive it toward a new all-time high, according to the entrepreneur.

Previously, Arthur Hayes indicated that Bitcoin is likely to reach a new historical peak this year. The anticipated rally of the leading cryptocurrency is attributed to the expansion of dollar liquidity in the stock markets.