Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

What’s causing the decline in the crypto market today?

Just when some analysts believed that Bitcoin (BTC) was poised to confirm a new bull market, the cryptocurrency sector experienced a decline amid regulatory apprehension and indications of deteriorating macroeconomic conditions.

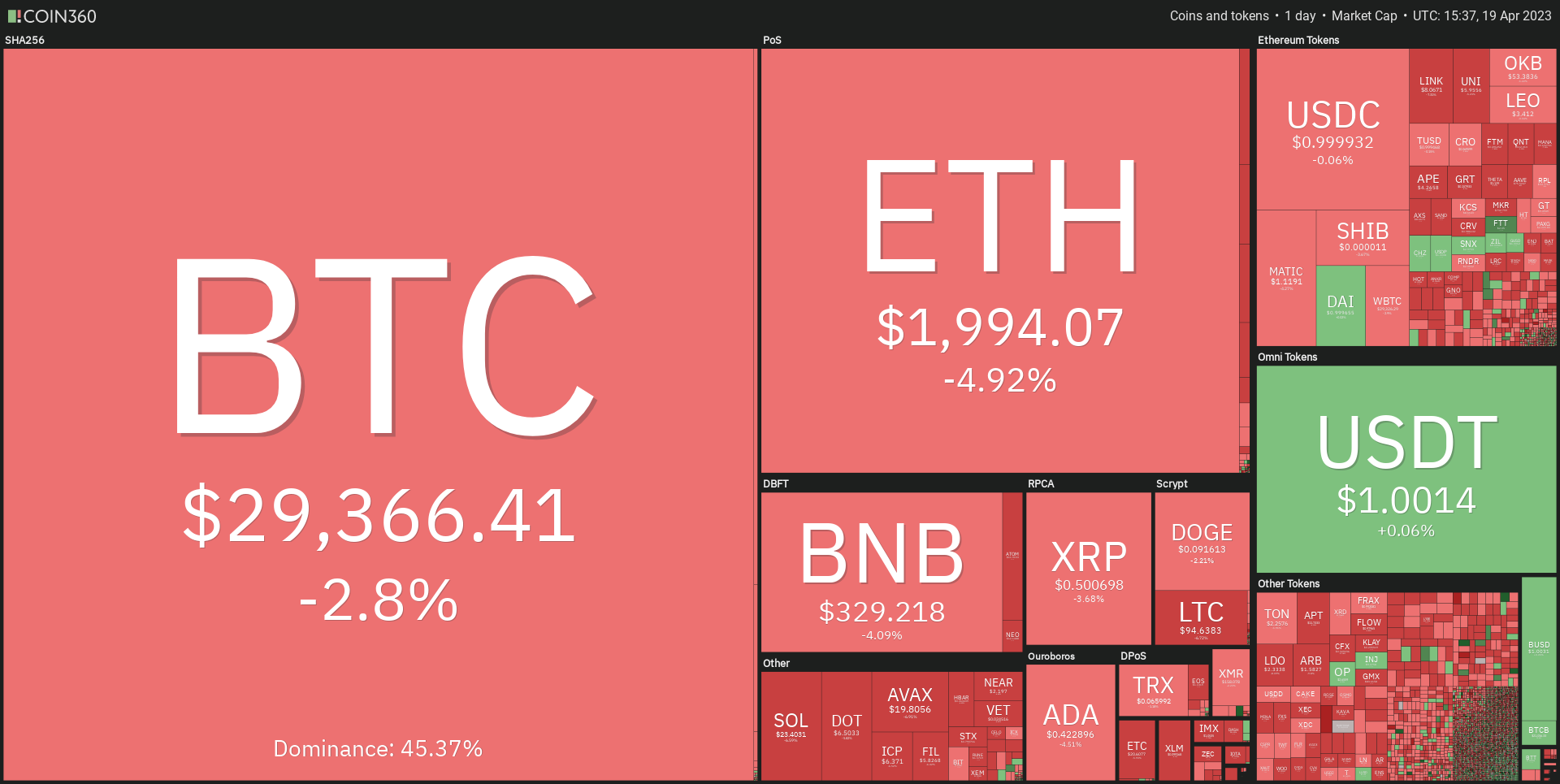

Crypto market down 4%, Bitcoin below $30,000

The price of Bitcoin reached a 7-day low of $29,158 on April 19 after it was unable to hold the crucial $30,000 threshold. Additionally, some traders express concerns that a further correction could bring back the bear market lows.

Cryptocurrency market performance, daily timeframe: Coin360

Cryptocurrency market performance, daily timeframe: Coin360

Similar concerns are present for Ether (ETH), which fell below the $2,100 mark after the Shapella upgrade and reached an 11-month peak, followed by a 7-day low of $1,972 on April 19, despite ETH staking deposits exceeding withdrawals the previous day.

U.S. regulatory crackdown fears

On April 18, Gary Gensler, the SEC Chair, testified before the United States House Financial Services Committee during an oversight hearing, which likely unsettled crypto traders.

Related: Crypto regulation: Does SEC Chair Gary Gensler have the final say?

Throughout the hearing, Gensler declined to provide a clear answer regarding whether Ethereum is classified as a commodity or a security, despite numerous requests from committee members.

Gary Gensler and Representative McHenry debating whether $ETH is a commodity or a security, with Gensler unable to respond to the question pic.twitter.com/DTMtazYmuS

— Cointelegraph (@Cointelegraph) April 19, 2023

On April 17, the SEC initiated a lawsuit against the cryptocurrency exchange Bittrex. The lawsuit claims that Bittrex was functioning as an unregistered national securities exchange, broker, and clearing agency.

Gensler issued the following caution,

“If this field is to have any chance of survival and success, it must adhere to time-tested rules and regulations to protect the investing public. Do not exploit your customers, using their funds for your own platform.”

Hawkish Fed, weaker economy weigh on risk-assets

Despite fears surrounding a banking crisis and hopes for a dovish pivot, Federal Reserve Chair Jerome Powell appears determined to combat inflation through additional rate hikes.

Powell and the Fed continue to emphasize the objective of reducing inflation to 2%. In a press conference on March 28, Powell reiterated,

“We remain committed to bringing inflation back down to our 2 percent target and to maintaining well-anchored long-term inflation expectations. Lowering inflation is likely to require a period of below-trend growth and some softening of labor market conditions. Restoring price stability is crucial for achieving maximum employment and stable prices in the long run.”

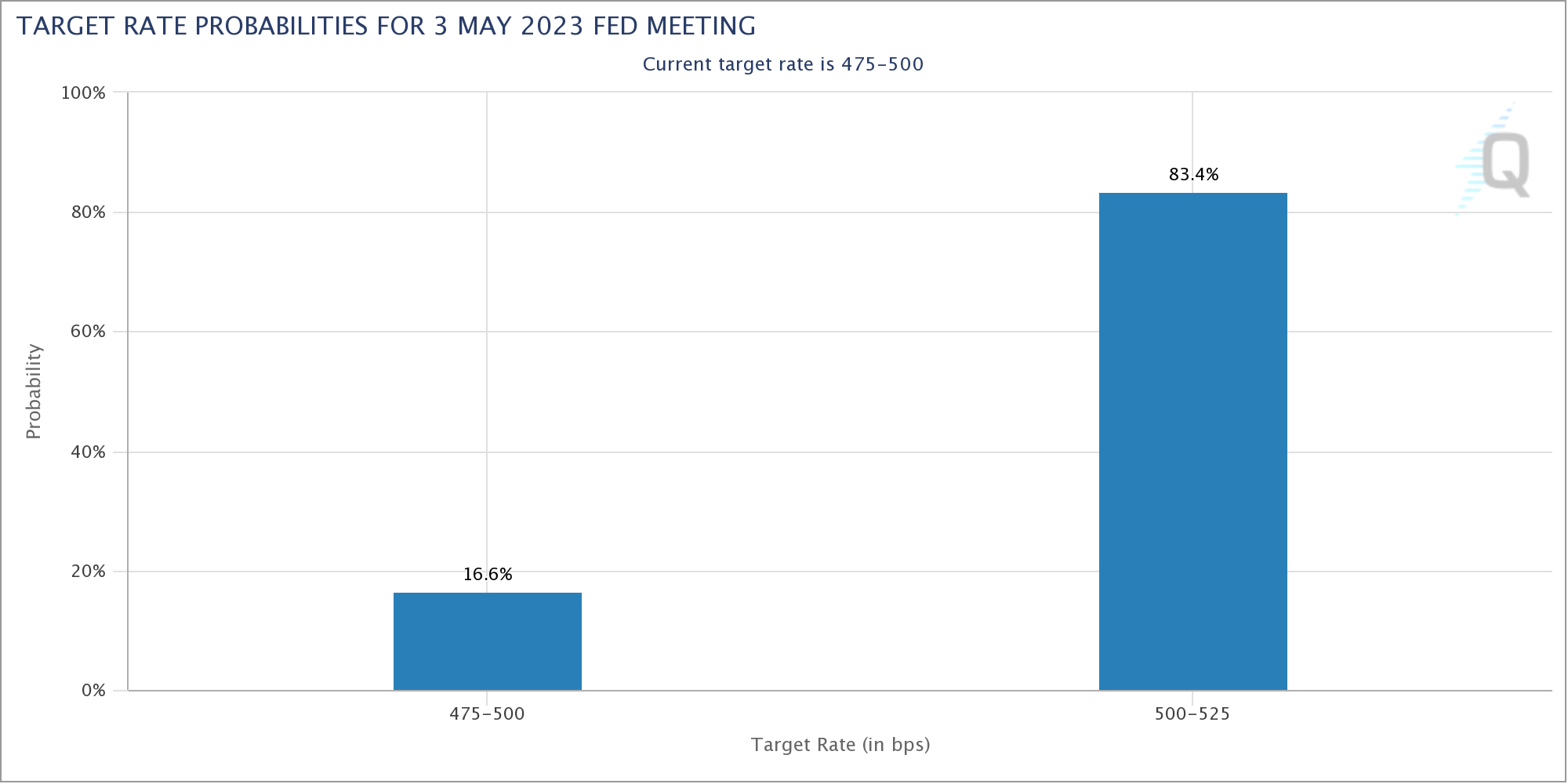

The market seems to anticipate that interest rates will keep rising, with the next Federal Open Markets Committee (FOMC) meeting slated for May 3, 2023.

This date will be significant for cryptocurrency investors as the sector remains closely linked with the Dow and S&P 500.

Target interest rate probabilities. Source: CME Group

Target interest rate probabilities. Source: CME Group

Meanwhile, the Fed faces its own challenges as major banks continue to predict that the U.S. will experience a sharp recession at some point in 2023, which is likely to depress risk-on asset prices, including cryptocurrencies.

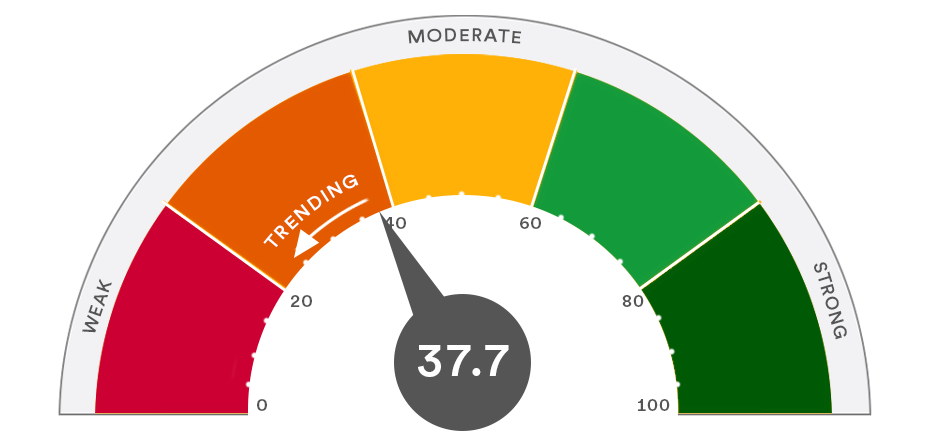

According to an analysis by U.S. Bank, investor sentiment regarding the current economic landscape remains low and is trending downward.

Global economic health. Source: U.S. Bank

Global economic health. Source: U.S. Bank

As per U.S. Bank,

“Inflation, interest rates, and earnings continue to be pivotal to equity returns. Persistent inflation, rising interest rates, and uncertainty regarding the pace of earnings growth in 2023 remain obstacles to advancing equity prices.”

This article does not provide investment advice or recommendations. Every investment and trading decision carries risks, and readers should conduct their own research before making a choice.