Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Three factors that may hinder Ethereum’s price at the $1,900 mark

Since May 12, Ether’s value has been struggling to maintain its $1,800 support level, as investors contend with challenges stemming from a deteriorating regulatory landscape for cryptocurrencies and elevated gas fees on the Ethereum network. Additionally, three indicators are adversely affecting Ether’s (ETH) price, indicating a decline in demand for its decentralized applications (DApps) and a lack of leveraged buying interest from professional traders.

Regulators indicate plans to further restrict crypto intermediaries

As per court documents submitted on May 15, the United States Securities and Exchange Commission (SEC) has provided a formal response in court regarding Coinbase’s request for clearer regulations in the crypto space. The SEC indicated that any rulemaking process may take years, and enforcement actions will persist in the interim.

On May 16, the Economic and Financial Affairs Council of the European Union, which consists of finance ministers from all member states, approved the much-anticipated Markets in Crypto-Assets (MiCA) regulation, set to take effect by mid-2024.

Some believe that MiCA promotes business development in the region, while others emphasize the privacy risks associated with personal user data and the challenges posed to non-custodial solutions, including decentralized finance applications.

The decline in DApp deposits raises concerns

The Ethereum network is facing issues due to rising gas fees—the costs linked to transactions, including those executed by smart contracts. Over the past four weeks, the average transaction fee has remained above $9, significantly restricting the demand for DApp usage.

Total deposits on the Ethereum network in Ether terms have dropped to their lowest levels since August 2020. This analysis does not account for the effects of native Ethereum staking, which has recently begun allowing withdrawals.

Ethereum network applications' total deposits in ETH. Source: DefiLlama

Ethereum network applications' total deposits in ETH. Source: DefiLlama

Data from DefiLlama indicates that Ethereum DApps reached a total value locked (TVL) of 14.9 million ETH on May 16. This is a decrease from 16.5 million ETH two months earlier, representing a 10% drop. In comparison, TVL on BNB Smart Chain in BNB (BNB) terms remained relatively stable during the same timeframe, while deposits on the Polygon network increased by 29%.

BNB Smart Chain seeks to lead in DEX volume

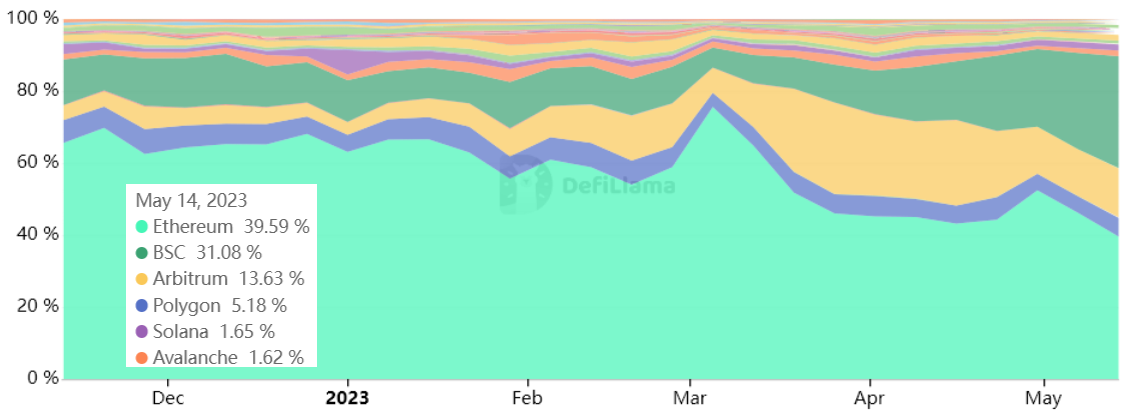

While Ethereum has historically been the dominant player in decentralized exchange (DEX) volume since its launch, this dominance is now being challenged. Ethereum’s market share by volume on DEXs reached a peak of 75% in the week ending March 5 but has steadily declined to a record low of 39.6% in the week ending May 14.

Weekly DEX volume by chain. Source: DefiLlama

Weekly DEX volume by chain. Source: DefiLlama

Since March 5, the DEX trading volume has seen gains from Arbitrum, rising to 14% from 7%, and BNB Smart Chain, which increased to 31% from 5.6%. While one might suggest that the success of Ethereum’s scaling solutions reflects positively on Ether’s price, the correlation is not straightforward.

Related: Updated European tax directive requires reporting on all crypto asset transfers

Data indicates professional traders are turning bearish

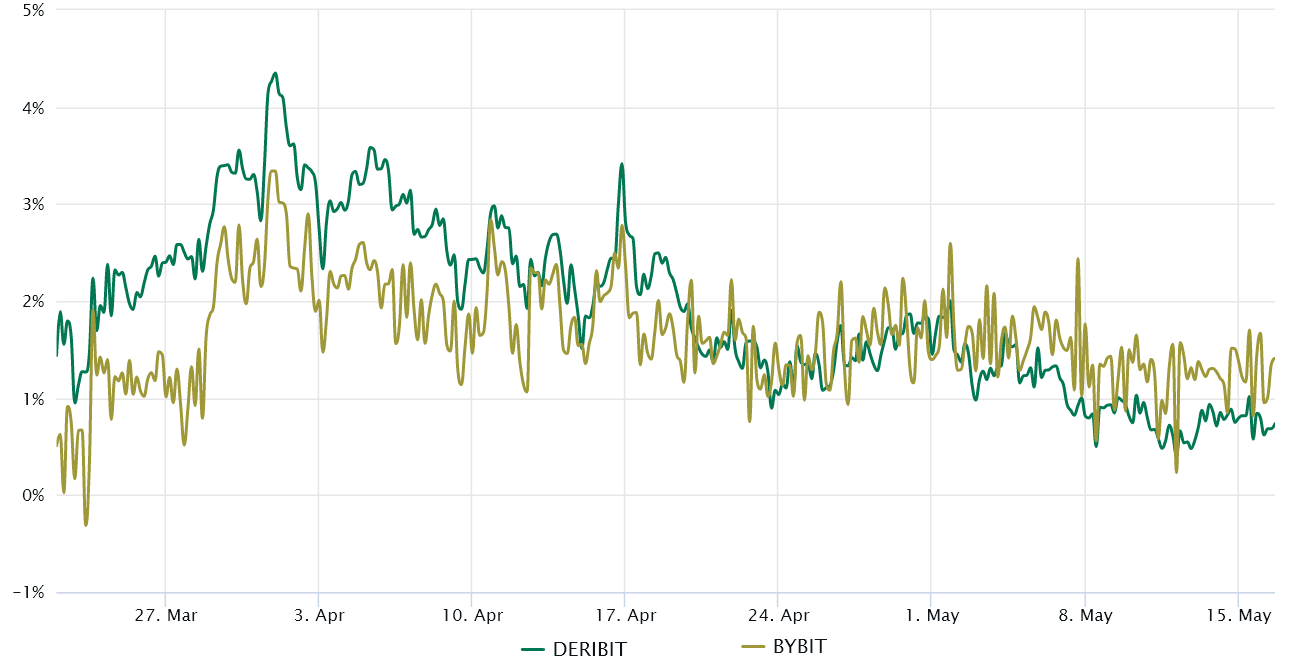

Ether quarterly futures are favored by whales and arbitrage desks. However, these fixed-month contracts usually trade at a slight premium to spot markets, suggesting that sellers are demanding more to postpone settlement.

Consequently, ETH futures contracts in healthy markets should trade at an annualized premium of 5 to 10%—a condition known as contango, which is not exclusive to crypto markets.

Ether 3-month futures annualized premium. Source: Laevitas

Ether 3-month futures annualized premium. Source: Laevitas

Professional traders in Ether have steered clear of leveraged long positions (bullish bets) since early April. Furthermore, the current 1% ETH futures premium is on the verge of turning negative, a situation referred to as backwardation—if confirmed, this would be a concerning indicator, as bearish sentiment prevails.

In summary, these three indicators—namely, the declining TVL, unprecedented low DEX market share, and absence of leveraged buying interest—suggest that breaking through the $1,900 resistance will be challenging in the near term. At present, Ether bears appear to be in control, increasing the likelihood of a price correction.

This article is for informational purposes only and is not intended to be construed as legal or investment advice. The views, thoughts, and opinions expressed herein are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making any decisions.