Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Three essential Ethereum price indicators indicate that ETH may be poised for fluctuations.

The price of Ether (ETH) has been facing significant challenges, and on September 11, it underwent a crucial test when it dropped to the $1,530 support level. In the subsequent days, Ether managed to achieve a notable recovery, rising by 6%. This rebound may indicate a critical juncture, following a month in which ETH experienced a 16% decline.

Despite the relatively quick recovery, Ether’s price movements prompt investors to question whether it can ascend back to $1,850, with ETH derivatives and network activity potentially holding the answers to this inquiry.

Ether/USD price index, 1-day. Source: TradingView

Ether/USD price index, 1-day. Source: TradingView

Macroeconomic elements have significantly influenced investor sentiment, particularly as inflation in the United States rose for the second consecutive month, reaching 3.7% according to the latest CPI report. This data reinforces the expectation that the U.S. government’s debt will continue to increase, prompting the Treasury to offer higher yields.

Scarce assets are likely to gain from the inflationary pressures and expansive monetary policies aimed at addressing the budget deficit. However, the cryptocurrency sector is facing its own array of challenges.

Regulatory uncertainty and high network fees limit investors’ appetite

The potential indictment of the Binance exchange by the U.S. Department of Justice looms large. Additionally, Binance.US is embroiled in legal disputes with the U.S. Securities and Exchange Commission (SEC), resulting in layoffs and the departure of key executives from the firm.

In addition to the regulatory obstacles confronting cryptocurrencies, the Ethereum network has seen a significant drop in its smart contract activity, which is central to its original mission. The network continues to struggle with persistently elevated average fees, remaining above the $3 threshold.

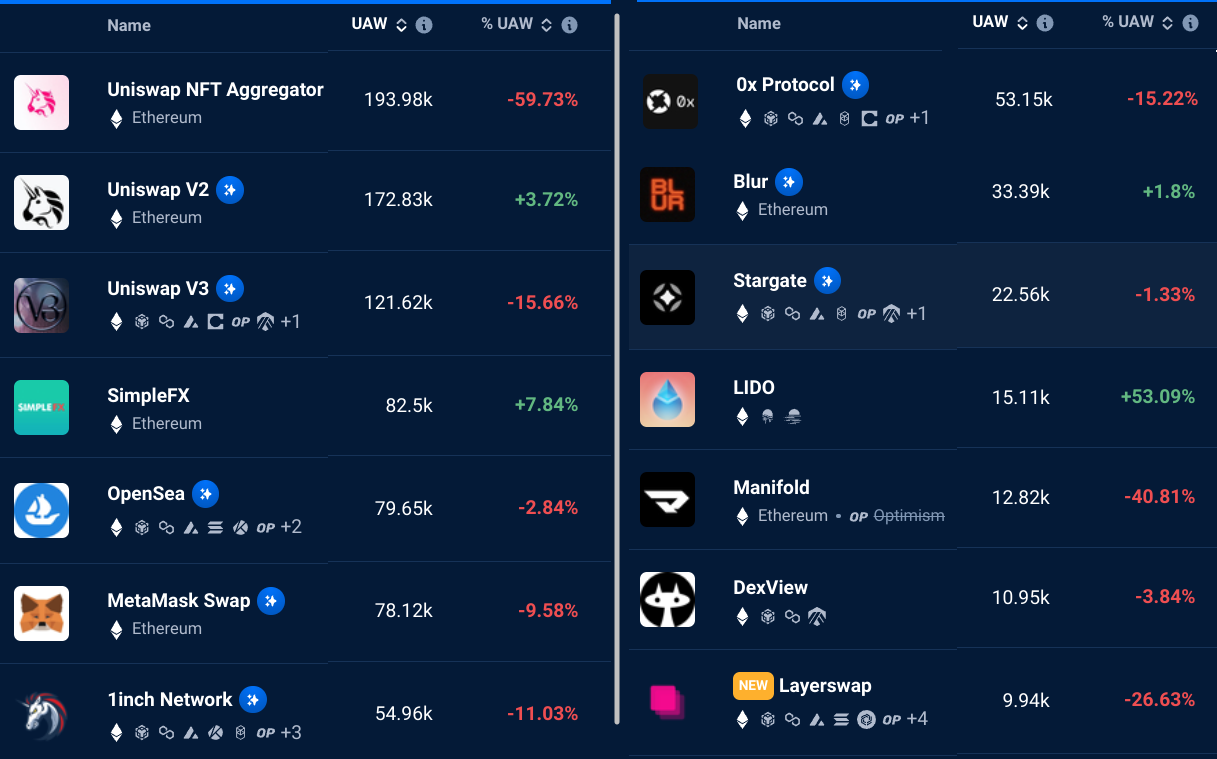

Ethereum network dApps rank by active addresses. Source: DappRadar

Ethereum network dApps rank by active addresses. Source: DappRadar

Over the past month, the leading Ethereum dApps have experienced an average decline of 26% in the number of active addresses. An exception to this trend is the Lido (LDO) liquid staking project, which recorded a 7% increase in its total value locked (TVL) in ETH terms during the same timeframe. It is noteworthy that Lido’s success has faced criticism due to its dominance, representing a significant 72% of all staked ETH.

Vitalik Buterin, co-founder of Ethereum, has recognized the necessity for Ethereum to become more accessible for everyday users to operate nodes to ensure long-term decentralization. However, he does not foresee a feasible solution to this issue within the next decade. As a result, investors harbor valid concerns regarding centralization, particularly regarding the influence of services like Lido.

ETH futures and options show reduced interest from leverage longs

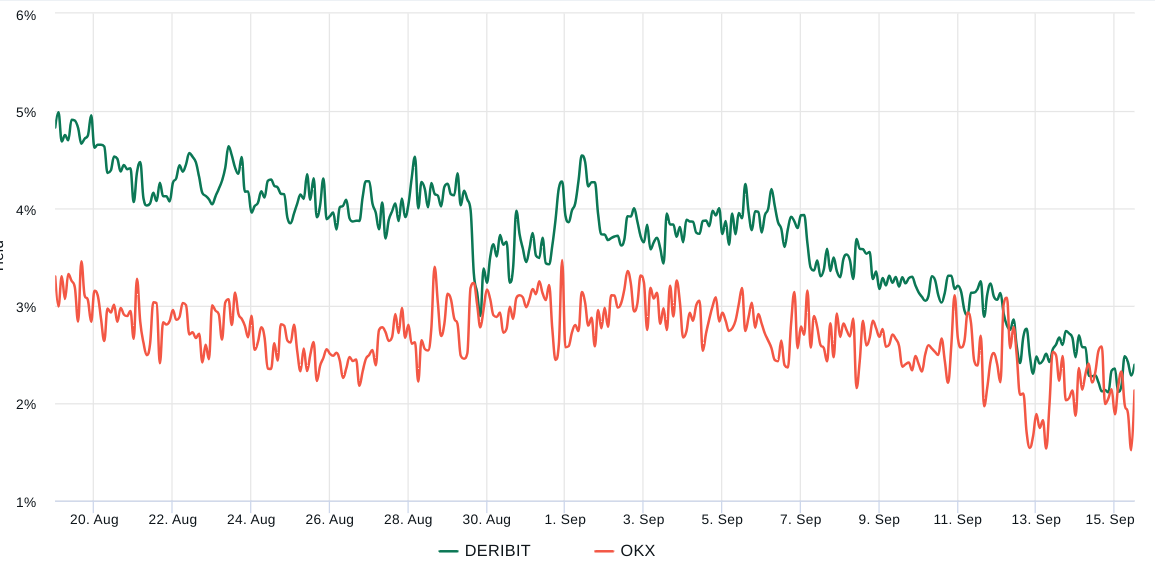

An examination of derivatives metrics will provide further insight into how Ether’s professional traders are positioned under the current market conditions. Ether monthly futures typically trade at a 5 to 10% annualized premium — a scenario known as contango, which is not exclusive to cryptocurrency markets.

Ether 2-month futures annualized premium. Source: Laevitas.ch

Ether 2-month futures annualized premium. Source: Laevitas.ch

The premium for Ether futures reached its lowest level in three weeks, at 2.2%, indicating a lack of demand for leveraged long positions. Notably, even the 6% increase following the retest of the $1,530 support level on September 11 did not push ETH futures into the 5% neutral threshold.

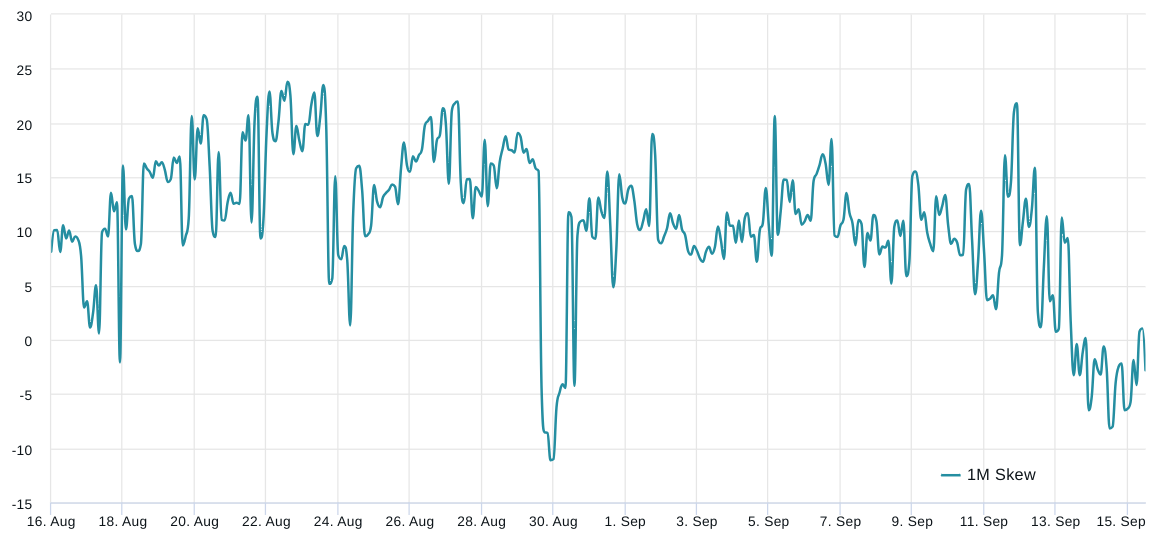

To better assess market sentiment, one should analyze the options markets, as the 25% delta skew can indicate whether professional traders are leaning bearish. In summary, if traders anticipate a decline in Bitcoin’s price, the skew metric will rise above 7%, while periods of optimism typically exhibit a -7% skew.

Ether 30-day options 25% delta skew. Source: Laevitas.ch

Ether 30-day options 25% delta skew. Source: Laevitas.ch

On September 14, the Ether 25% delta skew indicator briefly shifted to a bullish position. This change was driven by put (sell) options trading at an 8% discount compared to similar call (buy) options. However, this sentiment diminished on September 15, with both call and put options now trading at a comparable premium. Essentially, Ether derivatives traders are showing diminished interest in leveraged long positions, despite the successful defense of the $1,530 price level.

On one hand, Ether has potential catalysts, including requests for a spot ETH exchange-traded fund (ETF) and macroeconomic factors influenced by inflationary pressures. However, the declining use of dApps and ongoing regulatory uncertainties create a conducive environment for fear, uncertainty, and doubt (FUD). This is likely to continue applying downward pressure on Ether’s price, making a rally to $1,850 in the short to medium term seem improbable.

This article is for informational purposes only and is not intended to be and should not be construed as legal or investment advice. The views, thoughts, and opinions expressed herein are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.