Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

The Ethereum Foundation has liquidated $30 million in Ether — Will the price of ETH decline this time?

On May 6, the Ethereum Foundation moved nearly $30 million in Ether (ETH) to the Kraken cryptocurrency exchange, leading to concerns in the market regarding a possible selloff.

The price of ETH dropped by 4.8% to $1,900 on that day; however, this decrease has been minimal thus far within a broader recovery trend.

ETH price maintaining crucial support

On May 7, Ether’s price saw a slight recovery to $1,920 after it tested its 50-day exponential moving average (50-day EMA; the red wave) around $1,850 as support the previous day.

Additionally, price volatility on Kraken decreased during this time, as indicated by the contracting Bollinger Bands Width in the chart below. This further illustrates traders’ composure following the Ethereum Foundation’s transfer.

Importantly, the 50-day EMA has limited Ether’s downward movements so far in 2023, except for the early March selloff that briefly pushed the price below the red wave. Meanwhile, testing this level as support has encouraged the ETH price to aim for a breakout above $2,000.

Consequently, ETH bulls may seek to push the price above $2,000 once more.

On the other hand, a decline below the 50-day EMA could lead traders to focus on a support confluence that includes a multi-month ascending trendline and the 200-day EMA (the blue wave) near $1,700, representing a potential downside target approximately 13% lower than current price levels.

Even with a significant drop, ETH would still be upholding its overall recovery trend when assessed from its June 2022 low of $880.

Ethereum exchange reserves versus Kraken reserves

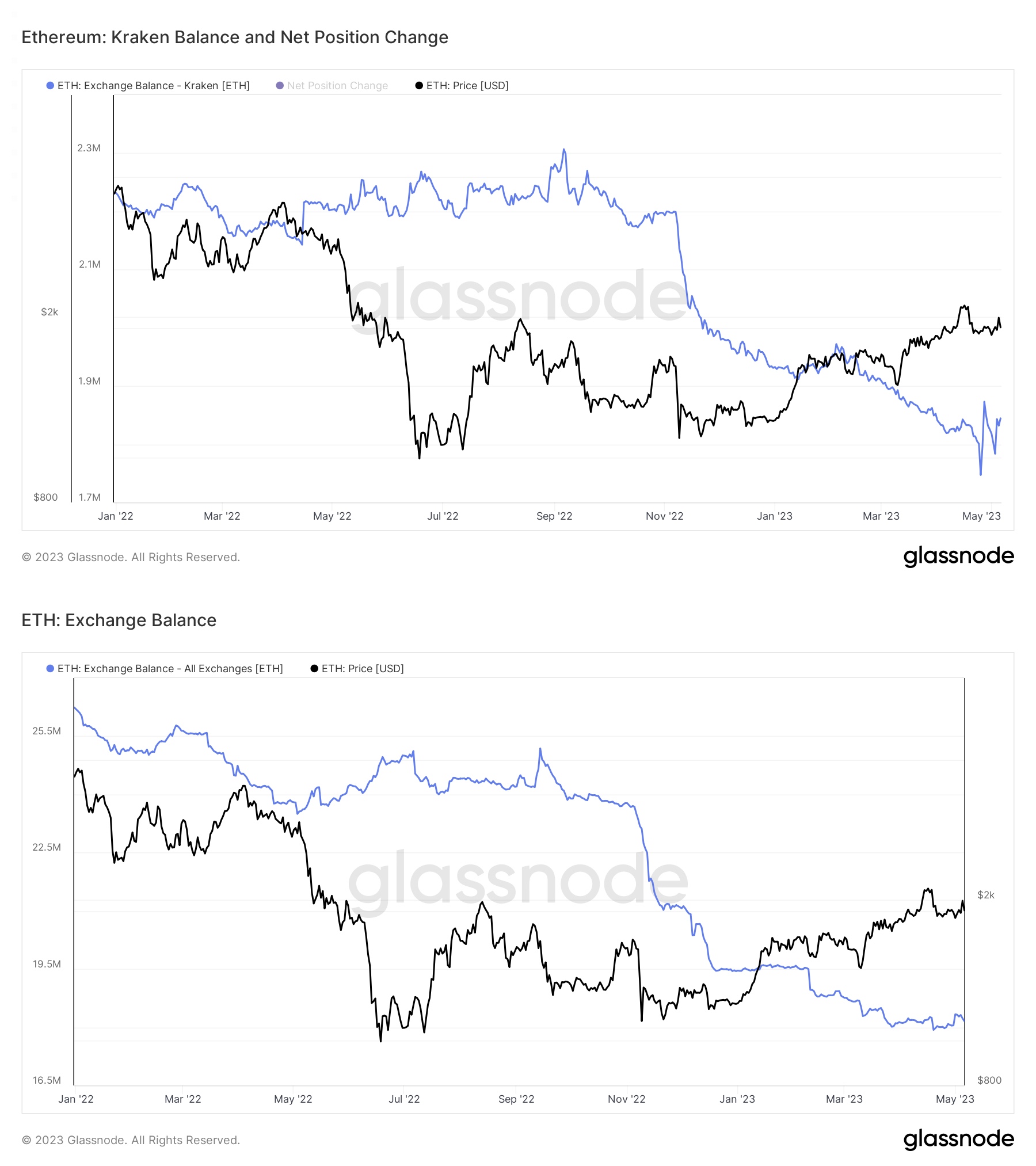

An increasing exchange balance indicates potential selling pressure rising, and vice versa. In the case of Ethereum, the balance remained lower across all exchanges despite the Ethereum Foundation’s transfer of $30 million to Kraken.

For example, Kraken’s Ether balance rose to 1.84 million ETH on May 6 from 1.83 million the day prior.

Ether Kraken balance vs. exchange balance. Source: Glassnode

Ether Kraken balance vs. exchange balance. Source: Glassnode

Nonetheless, the total balance across all exchanges actually decreased to 18.15 million ETH from 18.22 million ETH on that day, suggesting that any potential selling pressure from the Ethereum Foundation can be easily absorbed.

Not necessarily an ETH market peak

The last significant transfer by the Ethereum Foundation was 20,000 ETH in November 2021, when the price peaked around $4,850, followed by an 80% decline. Similarly, the foundation sold 35,053 ETH at the local market peak of approximately $3,500 in May 2021.

Related: Ethereum up 20% in April while Markets Pro sees 379% gain in one day

Many analysts viewed these patterns as indicative of another potential market peak formation near $2,000, suggesting that the price may decrease in the upcoming sessions.

Ethereum Foundation sold another 20,000 Ethereum at the recent local top.

Every time the ETH foundation / Vitalik / Consensys dumps a massive presale bag it marks the top.

What’s the difference between Ripple dumping hundreds of millions on retail vs ETH founders doing it? https://t.co/pw8ukMiR8v— Brad Mills ⚡️ (@bradmillscan) January 28, 2022

However, broader data indicates otherwise. For instance, the Ethereum Foundation’s substantial ETH sales also occurred during the 2020-2021 bull cycle, driven by increasing demand for risk-on assets in a low interest rate macro environment.

Ethereum Foundation large ETH transfers to exchanges in recent period. Source: Wu Blockchain

Ethereum Foundation large ETH transfers to exchanges in recent period. Source: Wu Blockchain

In summary, there is little evidence to suggest that the Ethereum Foundation’s sales have any significant effect on Ethereum’s price trend. Instead, the cryptocurrency market is currently responding to the U.S. banking crisis and whether this will compel the Federal Reserve to halt interest rate hikes and implement cuts.

This article does not contain investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research when making choices.