Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Is Uptober upon us? Bitcoin and Ethereum surge, eliminating $70M in short positions.

Over $70 million in cryptocurrency short positions were abruptly liquidated following an unexpected rise in the prices of Bitcoin (BTC), Ethereum (ETH), and other digital currencies on October 1.

As per information from TradingView, this sudden surge caused Bitcoin to increase by 3% within a mere 15 minutes, climbing from $27,100 to $28,053 before stabilizing just below the $28,000 threshold at the time of this report.

Happy Uptober to those who celebrate.

Remember 2021? pic.twitter.com/qgHy1ThGOf— The Wolf Of All Streets (@scottmelker) October 2, 2023

In a similar fashion, the price of Ether, the native currency of Ethereum, also experienced a spike, rising as much as 4.7% to $1,755 before settling at $1,727 at the time of this report.

This sudden price movement has left many in the community puzzled. Numerous commentators noted that this shift coincided with the onset of “Uptober.”

Welcome to Uptober.

Welcome to Q4, which is leading towards a great quarter, potentially fueled by ETF approvals and the pre-halving rally.

Potentially #Bitcoin to $40,000 is reasonable.— Michaël van de Poppe (@CryptoMichNL) October 1, 2023

Other members of the community speculated that “someone knows something” that is not widely known.

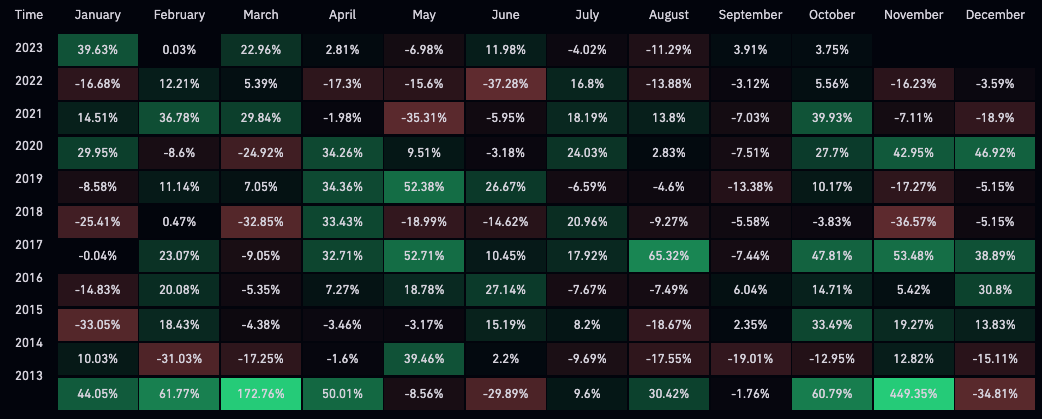

Uptober is a term used in the crypto community to describe October as typically a favorable month for the price movements of Bitcoin and other cryptocurrencies. Data from CoinGlass indicates that October has only yielded negative monthly returns on two occasions since 2013.

Bitcoin monthly returns since 2013. Source: Coinglass.

Bitcoin monthly returns since 2013. Source: Coinglass.

One of the anticipated events that the crypto market is looking forward to is the possible approval of a spot Bitcoin ETF by the United States Securities and Exchange Commission. However, most analysts are predicting January 2024 as the most probable timeframe for such an announcement.

Related: Will Bitcoin ‘Uptober’ bring gains for MKR, AAVE, RUNE and INJ?

Meanwhile, while those with spot and long positions may have rejoiced at the first notable price movement in over a month, short sellers faced the opposite outcome.

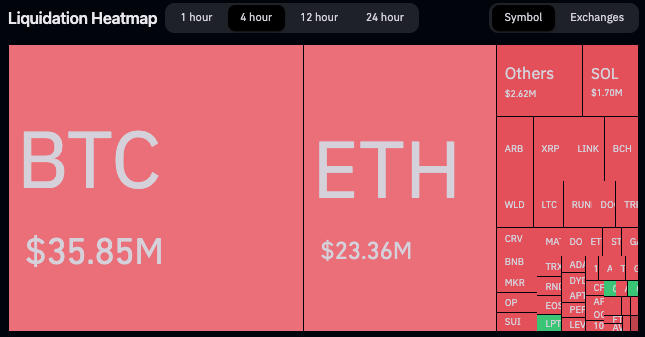

The swift increase resulted in $70 million in short positions being liquidated within just two hours.

More than $70 million worth of shorts were liquidated in the last 2 hours. Source: Coinglass

More than $70 million worth of shorts were liquidated in the last 2 hours. Source: Coinglass

According to data from Coinglass, nearly $36 million in BTC shorts and $23 million in ETH shorts were liquidated due to the sudden price fluctuation.

Magazine: Blockchain detectives — Mt. Gox collapse saw birth of Chainalysis