Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

FTX wallet transfers $10 million in cryptocurrency, raising concerns over potential token sell-offs.

A wallet associated with the insolvent cryptocurrency exchange FTX has transferred $10 million in digital assets from the Solana (SOL) network to Ethereum, raising concerns that this may signal the onset of a series of token sell-offs during the exchange’s bankruptcy process.

Data from blockchain analytics service Arkham Intelligence indicates that since August 31, the FTX wallet has moved $6.23 million in Ether (ETH) and over $4 million in various altcoins.

Among these transfers were $1.2 million of FTX Token (FTT), $1.8 million in Uniswap (UNI), $1.3 million of HXRO (HXRO), $550,000 in SushiSwap (SUSHI), and $260,000 in Frontier Token (FRONT), all sent to another FTX wallet via the Wormhole Bridge.

FTX wallets on the move

Over $1.5B worth of $SOL, SPL tokens, and Wrapped #Bitcoin in FTX's Solana addresses are shifting‼️

Looks like they're gearing up for potential sell-offs.

Keep an eye on this, especially the ~$200M in #Solana Wrapped $BTC.#crypto #bitcoin … pic.twitter.com/sRDI6hvTJD— Pump House (@pumphouz) September 3, 2023

On August 24, FTX put forth a proposal to appoint Mike Novogratz’s Galaxy Digital Capital Management as the investment manager responsible for overseeing the sale and management of its recovered cryptocurrency assets.

The proposal stipulates that the FTX estate would be allowed to sell $100 million worth of tokens weekly, although this cap could be increased to $200 million for individual tokens. These restrictions aim to mitigate the effects of token sales while enabling FTX to satisfy its creditors.

In addition to this proposal, the exchange has also submitted a separate motion to hedge its larger Bitcoin (BTC) and Ether holdings.

While the proposals outlined in the filings are not yet legally enforceable, the matter of FTX token sales is anticipated to be addressed by the Delaware Bankruptcy Court on September 13.

Related: FTX court filing reveals former Alameda CEO’s $2.5M yacht purchase

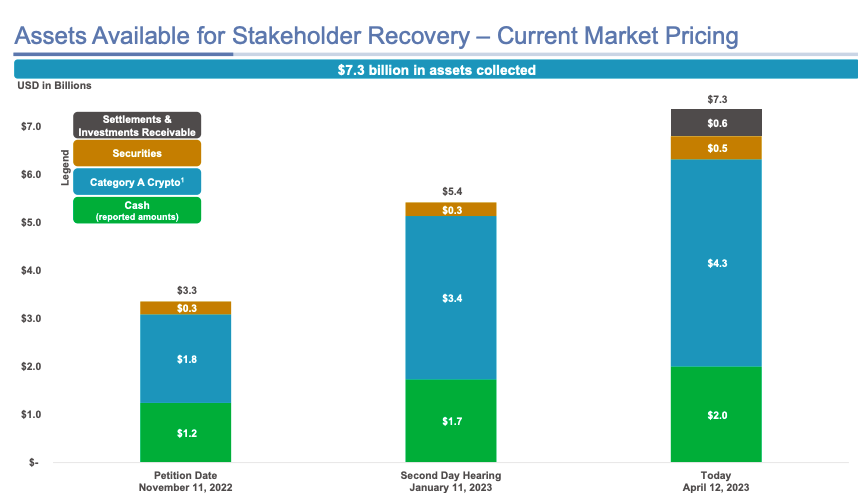

During an April 12 hearing, FTX revealed that it had recovered approximately $7.3 billion in liquid assets, with $4.8 billion of that total being assets retrieved as of November 2022.

Documents presented during the hearing indicated that FTX possessed a total of $4.3 billion in crypto assets available for stakeholder recovery at market values as of April 12.

FTX assets available for stakeholder recovery as of April 12. Source: Sullivan and Cromwell

FTX assets available for stakeholder recovery as of April 12. Source: Sullivan and Cromwell

The current reorganization strategy for FTX includes a possible revival of the cryptocurrency exchange, with FTX CEO John Ray III stating that the company has “initiated the process of soliciting interested parties for the reboot of the FTX.com exchange.”

According to FTX attorneys, the launch of the new exchange is projected to be finalized sometime in the second quarter of 2024.

Magazine: How to protect your crypto in a volatile market — Bitcoin OGs and experts weigh in