Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

FTX submits request for Galaxy Digital to oversee retrieved cryptocurrency assets.

Mike Novogratz’s cryptocurrency asset management firm Galaxy Digital appears poised to oversee the remaining digital currency assets of the insolvent cryptocurrency exchange FTX.

On August 24, the firm submitted a motion to the United States District Court for the District of Delaware, requesting authorization and approval of guidelines for the liquidation of digital assets retrieved during the ongoing bankruptcy process.

The submission details FTX’s intentions and strategies to transfer approximately $7 billion worth of recovered cryptocurrency tokens under the management of Galaxy Digital following the exchange’s downfall in 2022.

Related: FTX unveils restructuring plan, suggests a revived offshore exchange

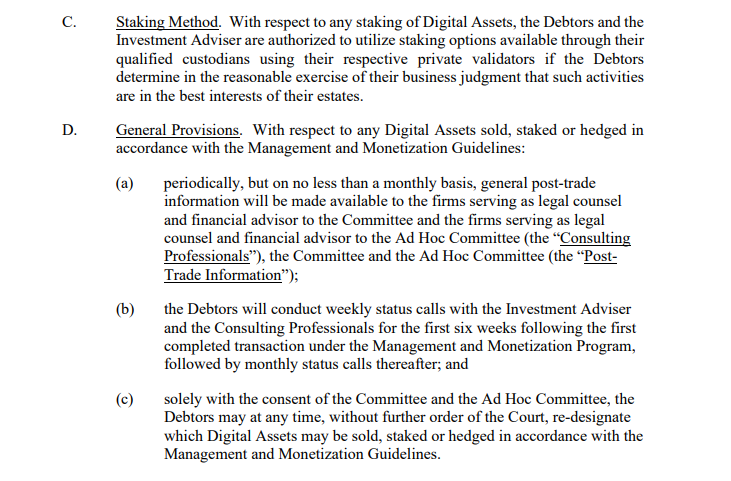

FTX plans to prepare for the possible sale of its cryptocurrency assets and stake tokens through Galaxy Digital, as indicated in its initial statement. The filing highlights a “comprehensive management and monetization plan” for its cryptocurrency assets aimed at minimizing exposure to volatility and potential fiat repayments to creditors.

FTX aims to engage Galaxy Digital as a registered investment adviser, leveraging its “specialized knowledge” of digital asset markets to help the company optimize the value of its token portfolio.

The firm identified several potential advantages of this collaboration, including the ability to discreetly sell its assets in the markets and reduce the risk of market manipulation.

“Similarly, the Debtors anticipate that the Investment Adviser’s expertise will be vital in evaluating the timing, trading venues, and counterparties for potential transactions.”

FTX indicates that the general investment guidelines will allow Galaxy Digital to sell various digital assets owned by FTX in the future, as well as manage the hedging of Bitcoin (BTC) and Ether (ETH) prior to any potential sales.

FTX plans to convert its cryptocurrency holdings into fiat to lessen exposure to market volatility while utilizing liquid hedging markets for Bitcoin and Ether to mitigate the risk of unexpected price changes before their sale.

FTX’s filing outlines intentions to stake and liquidate some of its cryptocurrency assets through Galaxy Digital. Source: SEC filing.

FTX’s filing outlines intentions to stake and liquidate some of its cryptocurrency assets through Galaxy Digital. Source: SEC filing.

Decentralized Finance is also acknowledged in the filing, with FTX stating that it plans to stake certain cryptocurrencies to generate passive yield income under the supervision of Galaxy Digital:

“The debtors assert that staking specific digital assets according to the staking method will benefit the estate – and, ultimately, creditors – by producing low-risk returns on their otherwise dormant digital assets.”

As bankruptcy proceedings progress, FTX recently submitted a proposed restructuring plan that suggests the establishment of a revived offshore exchange. This could provide creditors with the option to recover a portion of their lost funds or choose a share of equity, tokens, and other interests in an FTX revival.

Magazine: Can you trust crypto exchanges after the collapse of FTX?