Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ethereum’s decline against Bitcoin extends to 15 months — Is a turnaround for ETH price possible?

The value of Ethereum’s native token, Ether (ETH), is currently trading at a 15-month low against Bitcoin (BTC), marking the lowest point since Ethereum transitioned to proof-of-stake (PoS).

Will this trend of decline persist throughout the remainder of 2023? Let’s examine the charts more closely.

Ethereum price falls below key support against Bitcoin

The ETH/BTC pair fell to a low of 0.056 BTC earlier this week. In this movement, the pair breached its 200-week exponential moving average (200-week EMA; the blue wave) around 0.058 BTC, increasing downside risks further into 2023.

The 200-week EMA has historically acted as a dependable support level for ETH/BTC bulls. For example, the pair saw a 75% rebound three months after testing the wave support in July 2022. In contrast, it declined over 25% after losing the same support in October 2020.

ETH/BTC weekly price chart. Source: TradingView

ETH/BTC weekly price chart. Source: TradingView

ETH/BTC faces similar selloff risks in 2023 after failing to maintain its 200-week EMA as support. In this scenario, the next downside target appears to be around the 0.5 Fib line near 0.051 BTC in 2023, representing a decline of approximately 9.5% from current price levels.

On the other hand, the ETH price could rebound towards its 50-week EMA (the red wave) near 0.065 BTC if it manages to reclaim the 200-week EMA as support.

Bitcoin bullish outlook overshadows Ethereum

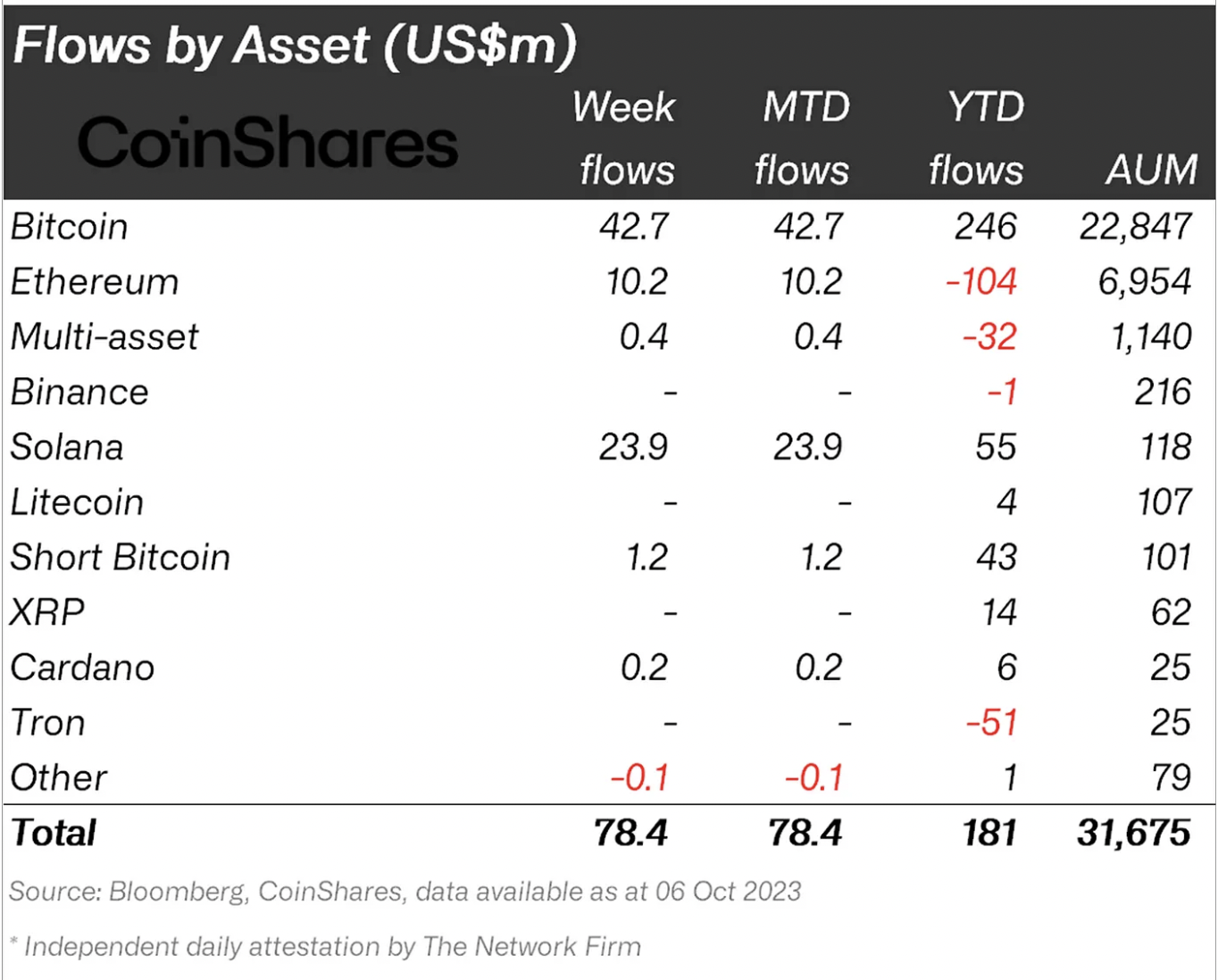

The ongoing weakness of Ethereum against Bitcoin is evident in institutional capital flow data.

As of Oct. 6, Bitcoin-focused investment funds had garnered $246 million year-to-date (YTD), according to CoinShares. Conversely, Ethereum funds have experienced capital outflows totaling $104 million during the same timeframe.

Net flows into crypto funds (by asset). Source: CoinShares

Net flows into crypto funds (by asset). Source: CoinShares

This disparity is likely attributed to the increasing speculation surrounding a potential approval of a spot Bitcoin exchange-traded product (ETF) in the U.S.

Market analysts suggest that the launch of a spot Bitcoin ETF could attract $600 billion. Additionally, Bitcoin’s upcoming fourth halving on April 24, 2024, is also providing support against the altcoin market.

Related: Bitcoin price gets new $25K target as SEC decision day boosts GBTC

The halving will decrease the Bitcoin miners’ block reward from 6.25 BTC to 3.125 BTC, creating a bullish scenario based on historical trends that halve new supply.

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making any decisions.