Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ethereum whale count declines following Shapella — Is a decrease in ETH value imminent?

The proportion of Ethereum (ETH) owned by so-called whale addresses has decreased since the Shapella upgrade in mid-April, indicating that significant investors may be adopting a bearish stance in the near term.

ETH whale numbers decline after Shapella

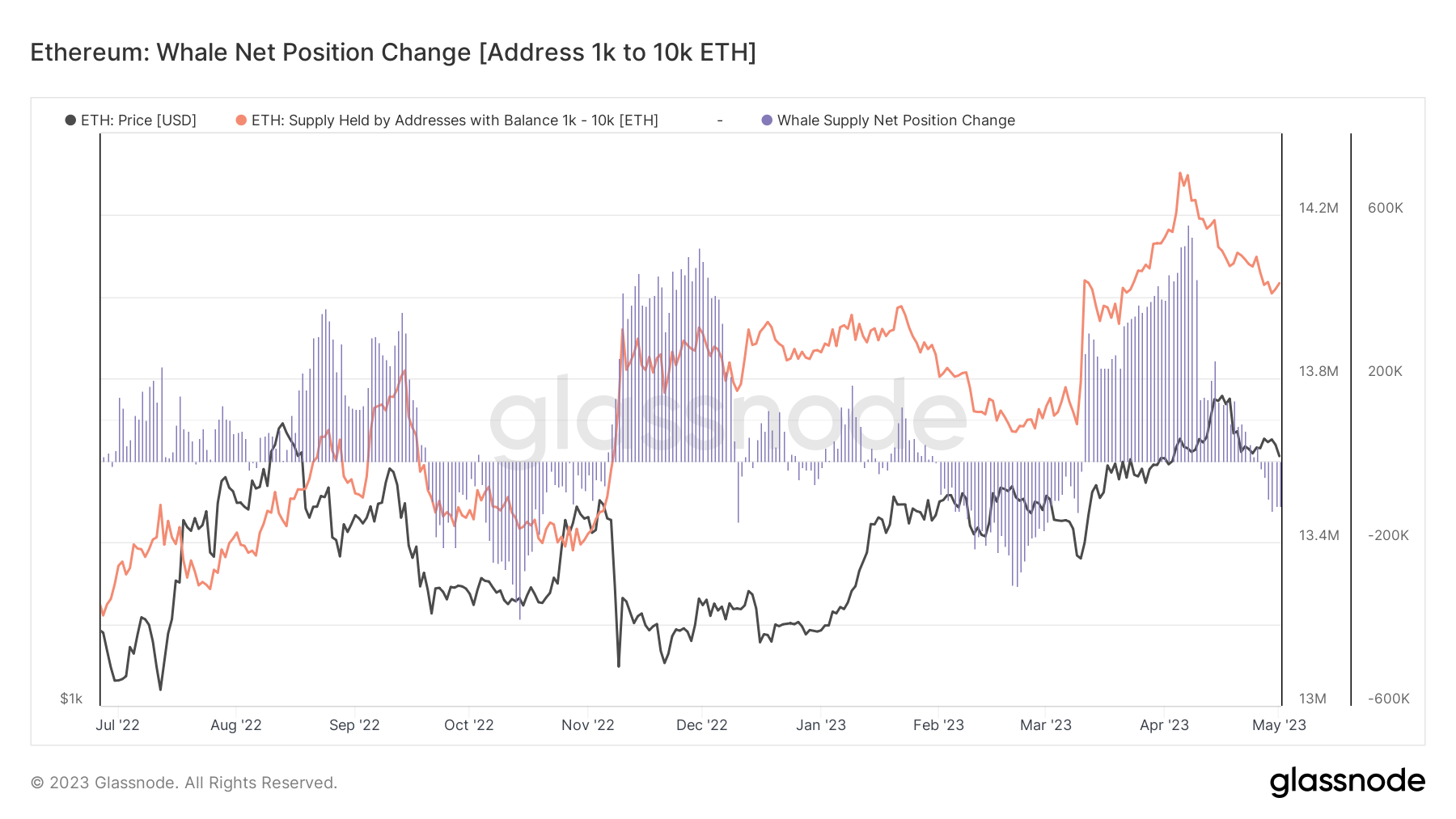

The quantity of Ether possessed by addresses holding 1,000-10,000 ETH, referred to as “whales,” was over 14.033 million ETH on May 1, based on data from Glassnode. In contrast, the figure stood at 14.167 million ETH on April 12, the day Shapella was implemented on Ethereum.

Ethereum whale net position change. Source: Glassnode

Ethereum whale net position change. Source: Glassnode

Notably, a week prior to the Shapella upgrade, the Ethereum whale group held 14.303 million ETH, marking the peak amount for 2023.

"Shrimps" are the only buyers of ETH since Shapella

The price of Ether has fallen by over 3.5% since the Shapella upgrade—implying that several whales may have indeed "sold the news."

Interestingly, other address categories also experienced a decline, including sharks (100-1,000 ETH), fishes (10-100 ETH), crabs (1-10 ETH), and even mega-whales (10,000+ ETH).

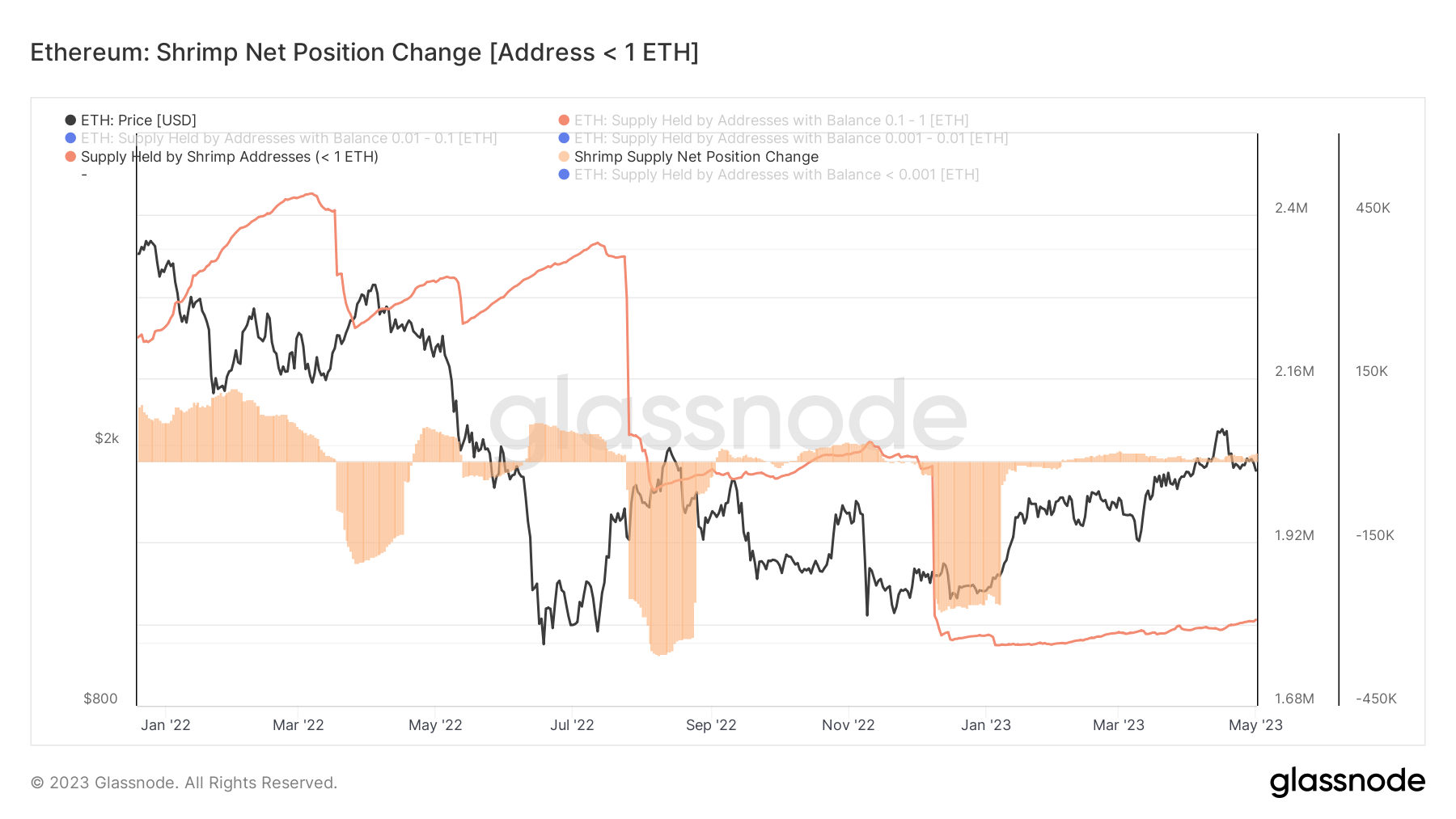

Only shrimps (<1 ETH) increased their holdings during this timeframe, with their net position rising slightly from 1.79 million ETH on April 12 to 1.80 million ETH on May 1.

Ethereum shrimp net position change. Source: TradingView

Ethereum shrimp net position change. Source: TradingView

Shapella allowed investors to withdraw ETH that had been locked through staking, which some analysts suggested could heighten selling pressure.

Since the Shapella upgrade, investors have withdrawn more than 1.97 million ETH valued at approximately $3.6 billion, according to Beaconcha.in. However, no significant changes in the ETH balances of cryptocurrency exchanges have been observed thus far.

Ethereum whales versus shrimps

Historically, a decrease in Ethereum whales generally indicates an increased downside risk for ETH prices.

Whale activity often serves as a leading market indicator. Therefore, wealthy investors accumulating typically precedes a price increase, and vice versa.

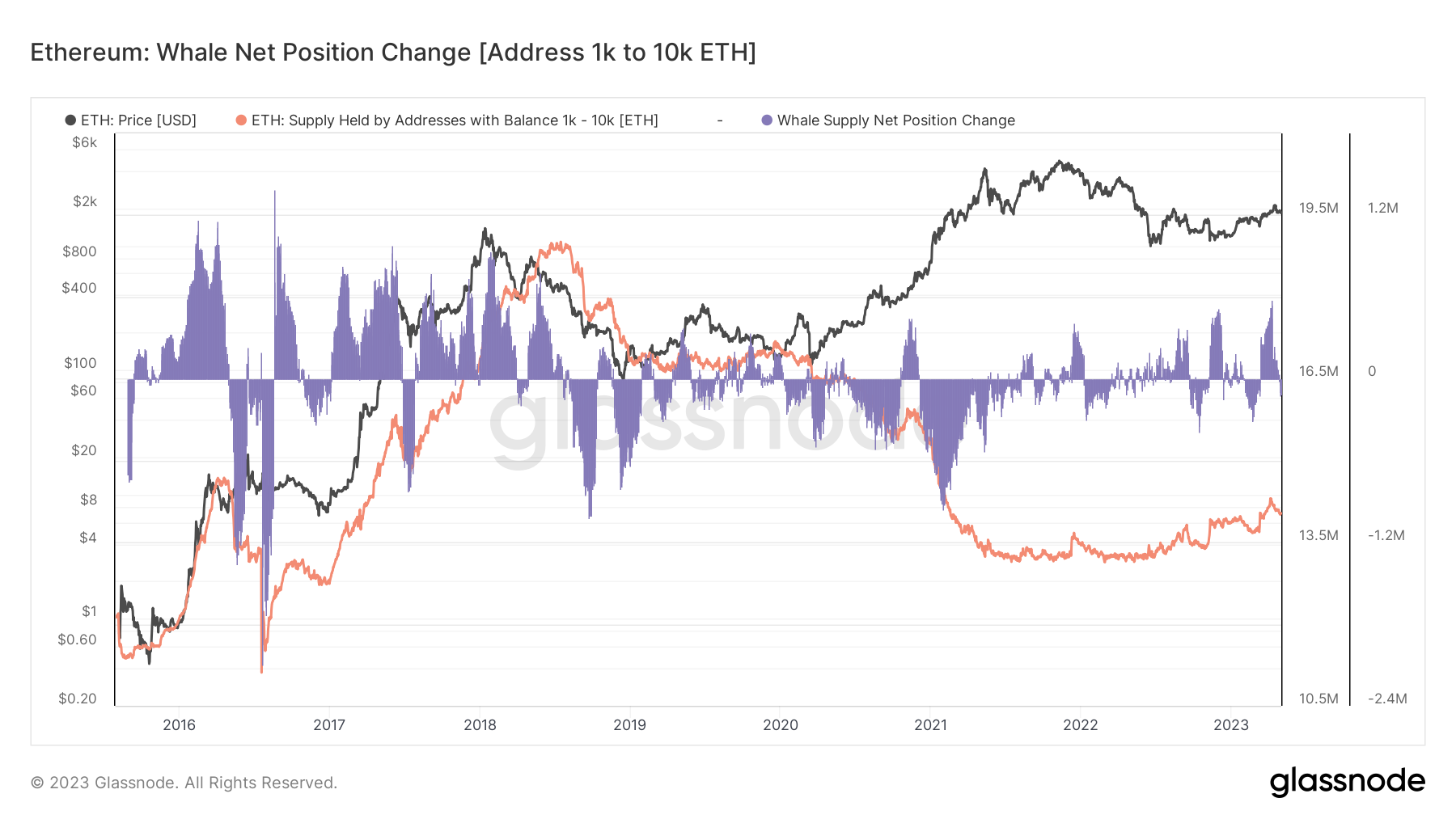

The positive correlation between price and whale activity existed until March 2020, as illustrated in the chart below. Following that, retail enthusiasm surged alongside the Federal Reserve’s quantitative easing, disrupting the correlation.

Ethereum whale net position change. Source: Glassnode

Ethereum whale net position change. Source: Glassnode

Significantly, the price of ETH rose from $110 in March 2020 to over $4,950 in November 2021 despite the decline in whale numbers. The inverse correlation persisted throughout the price downturn to around $850 in June 2022.

Since then, whale holdings have increased by nearly 1 million ETH. Meanwhile, ETH’s price has more than doubled to approximately $1,850, suggesting a potential return of the price-whale correlation, which could be a bullish indicator for Ethereum.

What are the potential next movements for ETH price?

The $2,000 mark represents a significant psychological resistance level for ETH/USD that bulls have struggled to surpass in multiple attempts throughout 2023.

Related: Ethereum price outlook weakens, but ETH derivatives suggest $1.6K is unlikely

On the daily chart, ETH/USD remains above the short-term support provided by its 50-day exponential moving average (50-day EMA; the red wave), near $1,840. A successful rebound from this level could open up the $2,000-$2,125 range as the next target for Q2.

ETH/USD daily price chart. Source: TradingView

ETH/USD daily price chart. Source: TradingView

Conversely, a drop below the 50-day EMA could push ETH toward its 200-day EMA (the blue wave) near $1,670, representing a decline of about 10% from current price levels.

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making any decisions.