Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ethereum price forecast declines, yet ETH derivatives indicate $1.6K is improbable.

The price of Ether (ETH) has exhibited signs of weakness after it was unable to surpass the $1,950 resistance level on April 26. The subsequent decline brought ETH down to $1,810 on May 1, approaching its lowest point in four weeks. Interestingly, this movement coincided with the seizure of First Republic Bank (FRB) by the California Department of Financial Protection and Innovation.

The Federal Deposit Insurance Corporation (FDIC) entered into a purchase and assumption agreement with JPMorgan to safeguard FRB depositors, projecting a loss of $13 billion.

Regarding the recent significant bank failure in the U.S., UBS analyst Erika Najarian remarked:

“This deal does not change the rates, recession and regulatory headwinds that regional banks are facing.“

ETH price disregards banking crisis

Notably, the VIX indicator, which gauges how traders are pricing the risks of extreme price fluctuations for the S&P 500 index, reached its lowest point in 18 months at 15.6% on May 1.

It is important to highlight that overconfidence is a primary factor behind unexpected movements and significant liquidations in derivatives markets, suggesting that low volatility does not necessarily precede stable price periods.

The economic landscape has deteriorated considerably after the U.S. reported a first-quarter gross domestic product (GDP) growth of 1.1%, falling short of the 2% market consensus. Meanwhile, inflation in Germany remained notably high at 7.6% year-over-year in April. Investors are now factoring in increased probabilities of a global recession as the U.S. Federal Reserve is anticipated to raise interest rates above 5% on May 3.

According to macro analyst Lyn Alden, the U.S. Treasury is now aiming for $1.4 trillion in new net borrowing between April and September 2023 due to tax receipts falling below expectations.

The U.S. Treasury updated their borrowing estimates.

They target over $1.4 trillion in net new borrowing during the two quarters from April through September 2023, with an ending cash balance target of $600 billion.

Tax receipts have been coming in below their expectations. pic.twitter.com/qnA6QFqx4m— Lyn Alden (@LynAldenContact) May 1, 2023

If the U.S. debt level continues to rise while interest rates remain elevated, the government will be compelled to increase debt payments, further straining its fragile fiscal situation. Such a scenario should favor scarce assets, but what insights can Ethereum derivatives metrics provide regarding professional traders’ risk appetite? Let’s examine.

Ethereum derivatives reflect moderate confidence

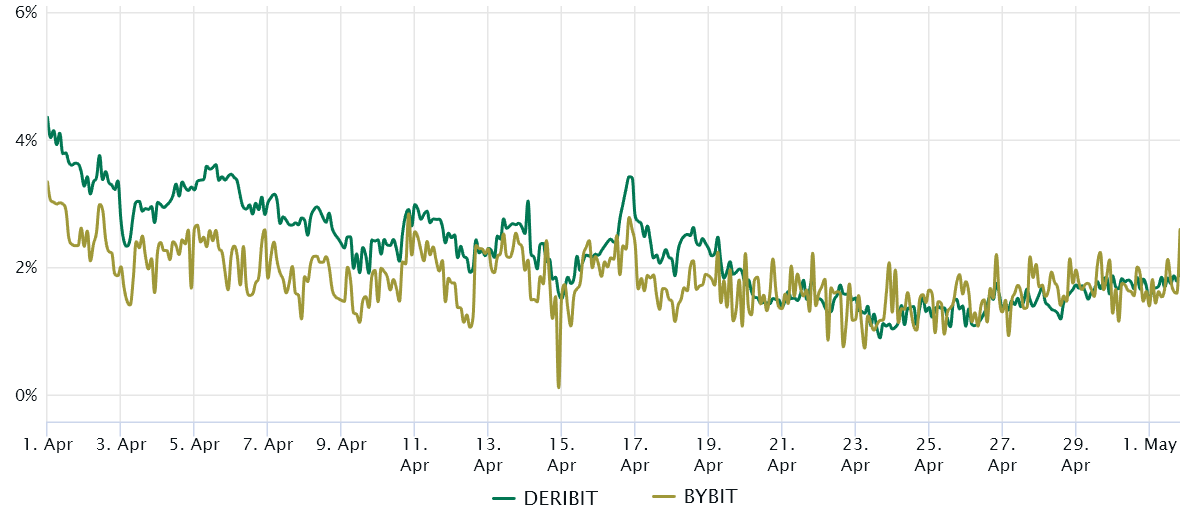

Ether quarterly futures are favored by whales and arbitrage desks, typically trading at a slight premium to spot markets, indicating that sellers are demanding more funds to postpone settlement for an extended period.

Consequently, futures contracts in healthy markets should trade at a 5% to 10% annualized premium — a condition referred to as contango — which is not exclusive to crypto markets.

Ether three-month futures annualized premium. Source: Laevitas

Ether three-month futures annualized premium. Source: Laevitas

Since April 19, the Ether futures premium has remained around 2%, indicating that professional traders are hesitant to shift from a neutral stance despite ETH’s price testing the $1,950 resistance on April 26.

The lack of demand for leveraged long positions does not necessarily indicate a price drop. Therefore, traders should analyze Ether’s options markets to understand how whales and market makers assess the likelihood of future price movements.

Related: Venmo will enable fiat-to-crypto payments in May

The 25% delta skew reveals when market makers and arbitrage desks charge a premium for upside or downside protection.

In bearish markets, options traders heighten their expectations of a price decline, leading the skew indicator to rise above 8%. Conversely, bullish markets tend to push the skew metric below 8%, suggesting that bearish put options are less sought after.

Ether 60-day options 25% delta skew: Source: Laevitas

Ether 60-day options 25% delta skew: Source: Laevitas

The 25% skew ratio currently stands at 1 as protective put options are trading in alignment with the neutral-to-bullish calls. This is a bullish signal given the six-day 7.8% correction since ETH’s price was unable to breach the $1,950 resistance.

Up to this point, Ether’s price has not demonstrated strength, while the banking sector has created a significant opportunity for decentralized financial systems to exhibit their transparency and resilience compared to traditional markets. On the other hand, derivatives metrics show no indication of extreme fear or leveraged bearish positions, suggesting low chances of revisiting the $1,600 support in the near future.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.