Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ethereum LSDFi sector expanded almost 60 times since January following the Shapella upgrade, according to CoinGecko.

The Ethereum liquid staking derivatives finance (LSDFi) ecosystem has experienced significant growth this year as Ether (ETH) holders opted to stake instead of liquidating their assets.

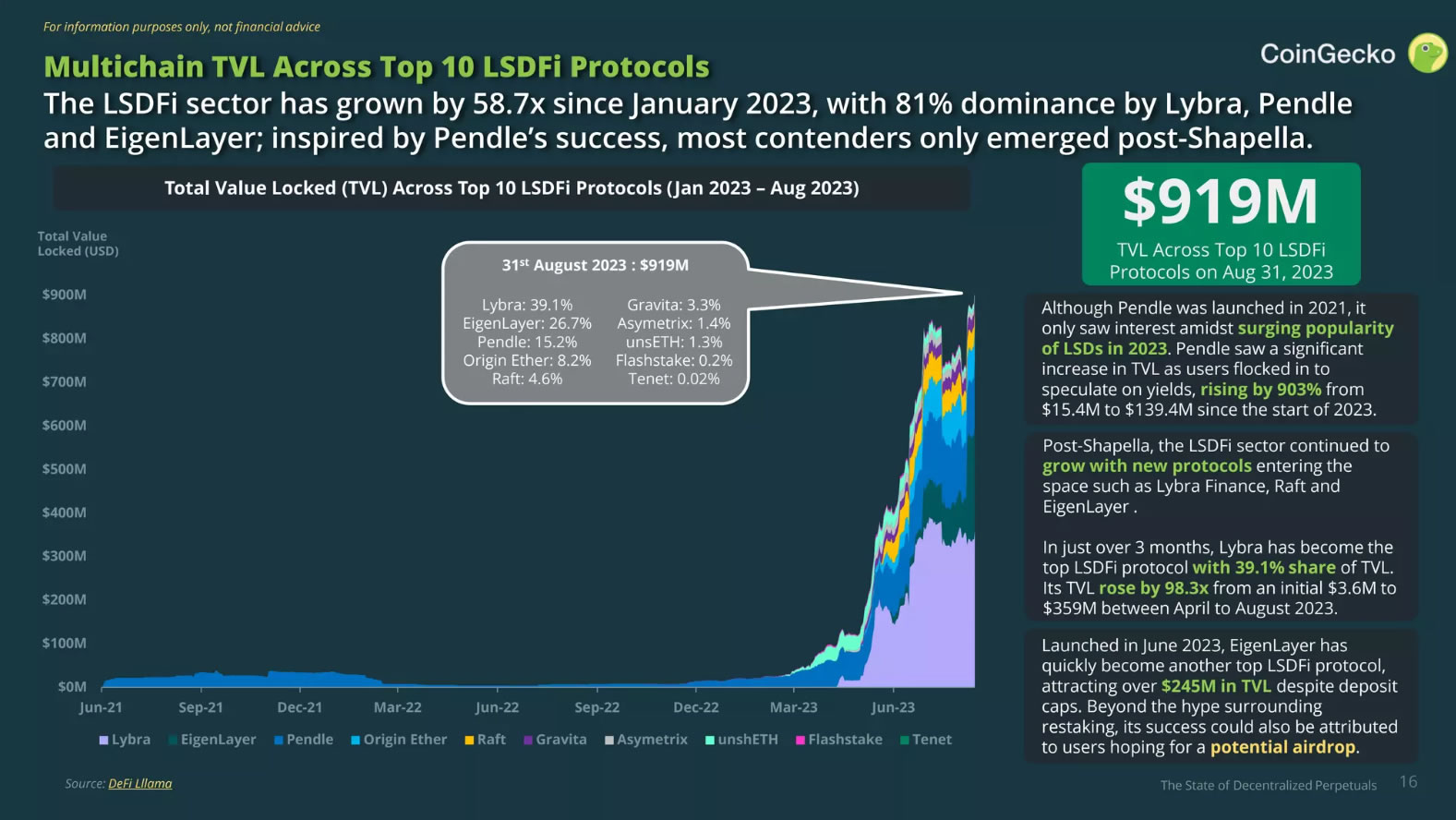

Although ETH withdrawals were permitted following the Ethereum Shapella upgrade in April 2023, an Oct. 16 LSDFi report from crypto data aggregator CoinGecko indicated that the sector has expanded by 58.7 times since January.

By August 2023, LSD protocols represented 43.7% of the total 26.4 million ETH staked, with Lido capturing nearly one-third of the overall staked market.

The growth statistics of the LSDFi sector suggest that ETH holders prefer to re-stake for improved yield opportunities rather than liquidate their holdings after withdrawals.

CoinGecko highlighted that since the enabling of withdrawals, the exit queue has remained at zero for over half of the time (55%) and has stayed below 10 validators for 77% of the duration.

LSDs were created to allow smaller ETH holders to engage in staking and access liquidity following the launch of the Ethereum Beacon Chain in December 2020.

Multichain TVL across top 10 LSDFi protocols. Source: CoinGecko

Multichain TVL across top 10 LSDFi protocols. Source: CoinGecko

Since the start of this year, the total value locked (TVL) across the 10 primary LSDFi protocols, excluding Lido, has increased to over $900 million, as per the report.

TVL in LSDFi protocols has risen by 5,870% since January 2023. In contrast, the total decentralized finance TVL has decreased by approximately 8% during the same timeframe, according to DefiLlama.

The average yield for LSD protocols since January 2022 has been 4.4%, although this figure is expected to decline as the volume of staked ETH grows.

Currently, there are 27.6 million ETH staked, valued at around $43.4 billion, according to Beaconcha.in.

Related: Liquid staking emerges as a game-changer for crypto investors

In the last two weeks, Ethereum supporters have celebrated the ascent of the LSDFi platform Diva, which they claim is executing a “vampire attack” on Lido by attracting users and liquidity from Lido through higher incentives.

The Diva vampire attack on Lido is gaining momentum

Over 11k Steth deposited into making number go down https://t.co/L6uITU3Bdq pic.twitter.com/vtzVXdKypD— Evan Van Ness (@evan_van_ness) October 13, 2023

Diva provides token rewards to stakers who lock their ETH and Lido staked ETH (stETH) for divETH. Since the start of October, Diva’s TVL has skyrocketed by 650% to 15,386 stETH, valued at approximately $24 million, according to Divascan.

Magazine: Blockchain detectives — Mt. Gox collapse saw birth of Chainalysis