Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ethereum gas fees surged amid memecoin excitement, eliciting varied opinions on network functionality.

The gas fees on the Ethereum network surged to a new multi-month peak amid an escalating memecoin excitement. This increase in transaction costs has significantly boosted Ethereum’s daily revenue compared to Bitcoin (BTC). While supporters of Ethereum hailed the revenue growth, many others quickly highlighted the increasing congestion on the network and the challenges in processing transactions.

An unexpected change occurred in the top 10 gas-consuming altcoins, where instead of ETH (ETH), WETH, and USDT (USDT), memecoins like TROLL, APED, and BOBO emerged among the top 10 spenders.

⛽️ A highly unusual shift in top 10 gas burning #altcoins has emerged today. Instead of $ETH, $WETH, and $USDT being at the top of the fee distribution list, we're seeing new assets like $TROLL, $APED, and $BOBO among them. Read our latest deep dive. https://t.co/7SlmJ59k2m pic.twitter.com/Y2kaLKZTrL

— Santiment (@santimentfeed) April 19, 2023

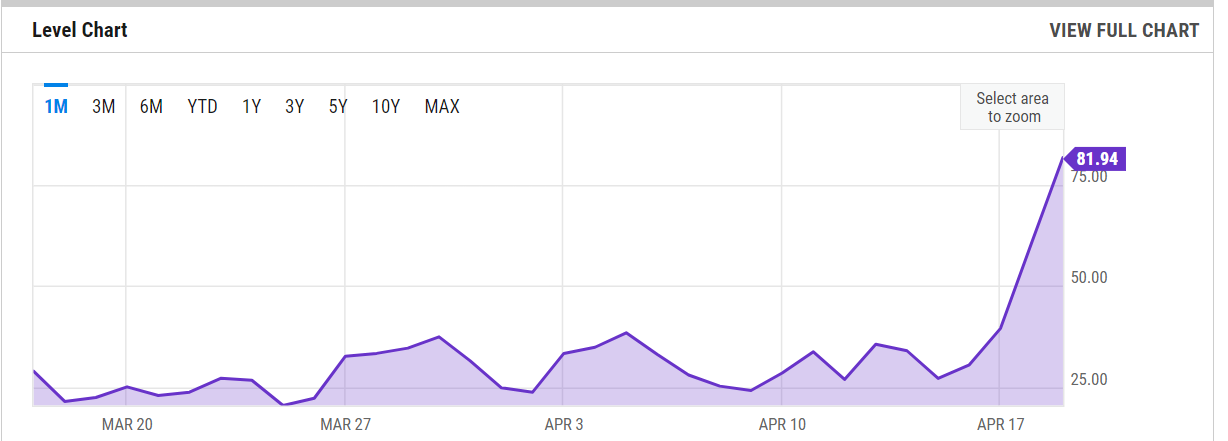

As of April 20, the average gas price for Ethereum transactions was 81.94 gwei, an increase from 60.82 gwei on April 19 and 44.42 gwei the previous year — representing a rise of 34.74% from April 19 and 84.46% from April 20, 2022. Gwei is a unit of Ether, equivalent to one billionth of one ETH.

ETH gas fee increase in last month. Source: Ychart

ETH gas fee increase in last month. Source: Ychart

Independent Ethereum educator Anthony Sassano noted the increase in daily fee revenue for the Ethereum network, stating that the second-largest blockchain generated 28 times the revenue of Bitcoin. He also mentioned Ethereum layer-2 solutions like Arbitrum One that have surpassed the BTC network in daily revenue due to the ongoing memecoin trend.

Daily and weekly revenue of various blockchain. Source: Twitter

Daily and weekly revenue of various blockchain. Source: Twitter

Proponents of Ethereum argue that the elevated gas fees and the resulting higher revenue underscore the network’s increasing usability. However, many users on Crypto Twitter quickly pointed out that the extensive activity they reference involves only a few thousand individuals engaging in memecoin trading.

The extensive usage you’re talking about are a few thousand users gambling meme coins. I thought (and hoped) eth was supposed to be the future of finance

— nap.BasicallyRiskFree (@CryptoPannella) April 20, 2023

Some users reportedly incurred gas fees as high as several hundred dollars, while others expressed frustration over paying a higher gas fee than the actual transaction amount.

try to buy a ~$20 NFT on eth, and the gas is ~$40.

some ppl say the infra operators deserve to be paid. sure, but imaging paying visa $40 fee for buying a $20 digital good.. infra should be affordable. pic.twitter.com/5L4SYjT5af— 0xMQQ (@0xMQQ) April 18, 2023

Another significant factor contributing to the rising gas fees was attributed to a Maximal Extractable Value (MEV) trading bot that is front-running memecoin transactions on a large scale. The bot identified as jaredfromsubway.eth has been the leading gas spender in the past 24 hours, expending 455 ETH ($950,000) and accounting for 7% of the network’s total gas usage.

Related: Tether blacklists validator address that drained MEV bots for $25M

Over the last two months, it has spent over 3,720 ETH ($7 million) in gas fees and conducted more than 180,000 transactions.

bro has used 7% of the total gas on ethereum over the past 24hrs (455 ETH) just feasting away on $pepe

data from the legendary @hildobby_ https://t.co/j3SqtQnkKJ pic.twitter.com/hWavtdO1D5— beetle (@1kbeetlejuice) April 18, 2023

The Subway-themed bot employs the sandwich trading strategy to earn millions while simultaneously congesting the network.

Magazine:‘Account abstraction’ supercharges Ethereum wallets: Dummies guide