Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ether maintains a value of $1,820, yet professional traders express doubts regarding potential future increases.

The price of Ether (ETH) has remained above $1,820 for the last three weeks, despite experiencing a 13.7% decline from April 18 to April 21. However, a broader analysis reveals a more positive outlook, as ETH has increased by 20.8% over the past three months, while the S&P 500 stock market index has remained stagnant. Nevertheless, data from ETH options and futures indicates that these gains have not been sufficient to instill bullish sentiment among professional investors.

Deteriorating macroeconomic conditions have contributed to the positive momentum in cryptocurrencies throughout 2023, including the ongoing banking crisis. Arthur Hayes, the former CEO of the crypto derivatives exchange BitMEX, has stated that if the government does not provide a bailout for First Republic Bank, it could trigger a perilous chain reaction of bankruptcies.

The risk of recession has escalated following a modest 1.1% annualized growth in the U.S. economy during the first quarter, significantly below the anticipated 2%. At the same time, inflation continues to impact the economy, with the personal consumption expenditures price index increasing by 4.2% in the first quarter.

The bearish sentiment among whales and market makers is driven by the declining total value locked (TVL) on the Ethereum network and average transaction fees exceeding $4 since February. Data from DefiLlama shows that Ethereum DApps reached a TVL of 15.3 million ETH on April 24, compared to 22.0 million ETH six months earlier, marking a 30% decrease.

The failure of Ether to surpass the $2,000 mark may also indicate that traders are anticipating another interest rate hike from the Federal Reserve on May 3. Increased interest rates render fixed-income investments more appealing, while businesses and households face higher costs for refinancing their debts, creating a bearish climate for risk assets, including ETH.

Ether futures indicate lack of buying interest

Ether quarterly futures are favored by whales and arbitrage desks. However, these fixed-month contracts generally trade at a slight premium to spot markets, suggesting that sellers are demanding more to postpone settlement.

Consequently, futures contracts in healthy markets should exhibit a 5% to 10% annualized premium — a scenario referred to as contango, which is not exclusive to cryptocurrency markets.

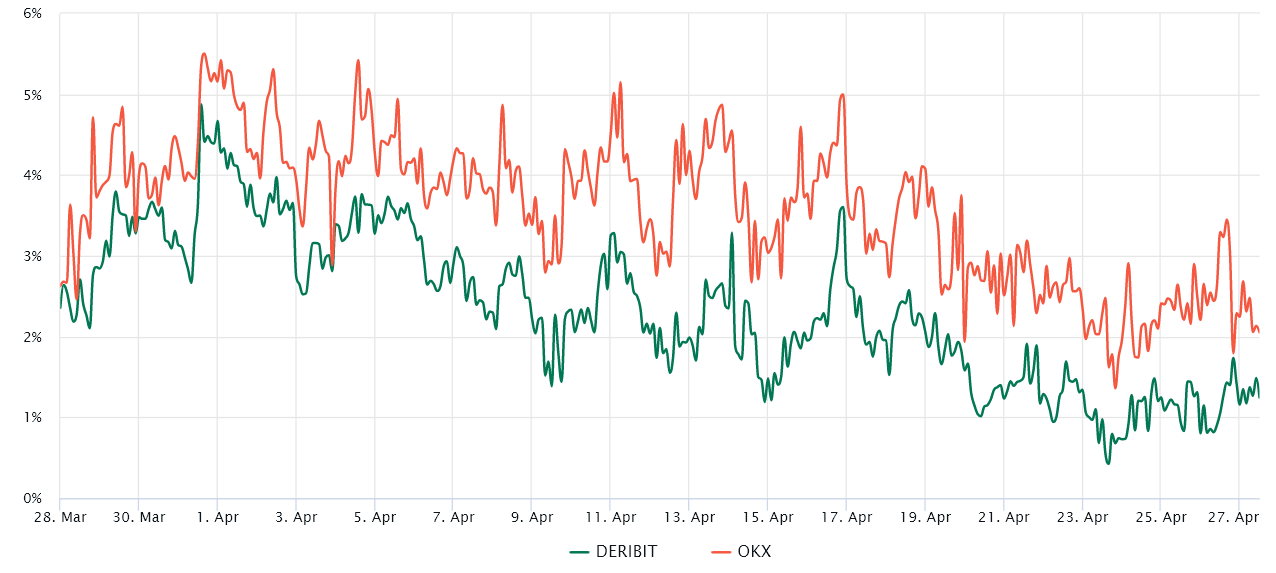

Ether 3-month futures annualized premium. Source: Laevitas.ch

Ether 3-month futures annualized premium. Source: Laevitas.ch

Ether traders have exhibited caution in recent weeks, and despite the recent breakout above $2,100 on April 14, there has been no significant increase in demand for leveraged long positions.

Moreover, the Ether futures premium has declined from a recent high of 4.7% on April 1 to its current level of 1.8%. This indicates that buyers are shying away from leveraged long positions and there is moderate interest in short (bear) positions through futures contracts.

Ether option traders show signs of bearishness

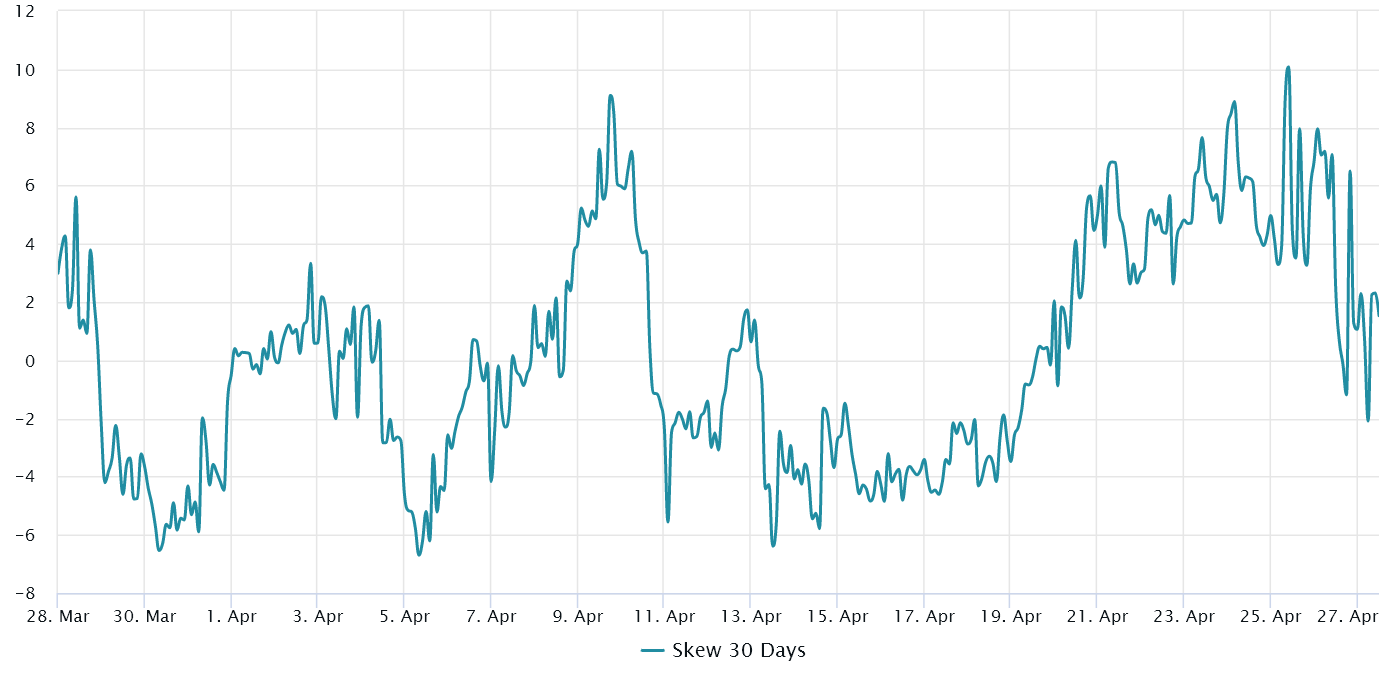

It is also essential for traders to examine options markets to determine whether the recent correction has led to increased optimism among investors. The 25% delta skew serves as a significant indicator when arbitrage desks and market makers charge a premium for upside or downside protection.

In summary, if traders expect a decline in Ether’s price, the skew metric will rise above 7%, while periods of enthusiasm typically exhibit a negative 7% skew.

Related: 11 industry leaders discuss effective ways to ensure compliant staking

Ether 30-day options 25% delta skew: Source: Laevitas

Ether 30-day options 25% delta skew: Source: Laevitas

At present, the options delta 25% skew is neutral between protective puts and neutral-to-bullish call options. However, from April 24 to April 26, the indicator briefly exceeded 7% as traders anticipated a significant price correction as the most probable outcome.

This shift suggests a slight uptick in confidence, but over the past four weeks, moderate fear has been the dominant sentiment according to the 25% options skew.

Essentially, the Ether options and futures markets indicate that professional traders are less confident compared to a week ago, but not excessively pessimistic. Therefore, if the ETH price surpasses $2,000, it would be unexpected for many, yet the indicators do not reflect any signs of distress.

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making a choice.