Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Decentralized asset management platform introduced for Arbitrum and Optimism.

Decentralized asset management platform Valio has officially launched, as announced by the platform’s team. This new protocol enables users to have their assets managed by professional traders without needing to place their trust in these traders as custodians.

The application is initially being rolled out on the Arbitrum and Optimism networks. Valio had previously introduced a whitelisted version on July 24, but the newly released public version on August 7 does not necessitate prior approval for managers.

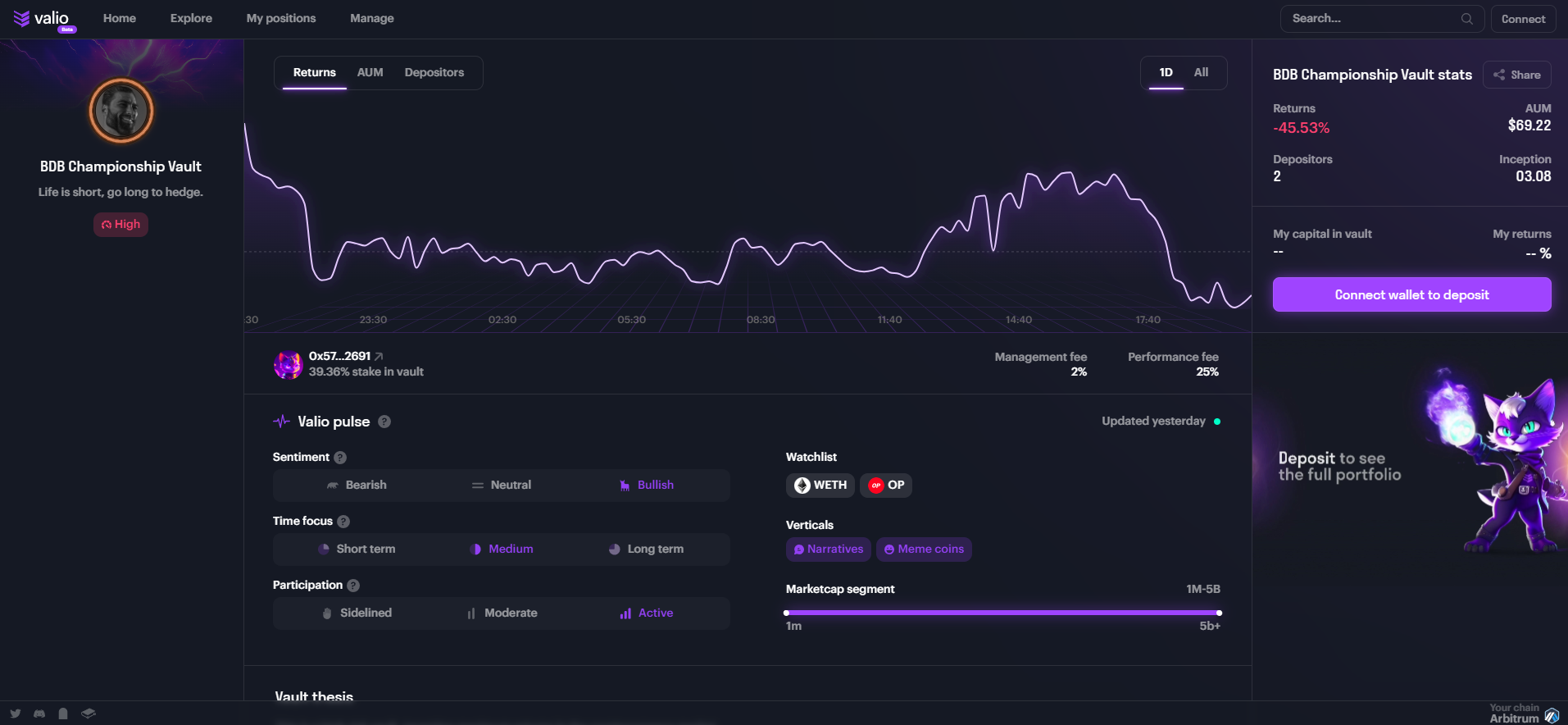

Valio user interface. Source: Valio

Valio user interface. Source: Valio

In an interview with Cointelegraph, Valio founder Karlis provided further insights into the app’s functionality. Investors can explore lists of money managers and examine their statistics via an “explore” page. Should an investor choose to support a specific money manager, they can deposit assets to engage in that manager’s fund.

All assets are secured in smart contracts and cannot be withdrawn by the money manager. Furthermore, the DeFi applications available for investment by a manager are restricted to a predefined list. At launch, Valio is integrated with the perpetual trading platform GMX on Arbitrum and the decentralized exchange protocol 0x on Optimism.

The protocol’s founder noted that it employs a system known as “cumulative price impact tolerance architecture” to restrict the price impact that money managers can exert on individual investments. This mechanism is designed to prevent managers from depleting investors’ funds by investing in illiquid assets while simultaneously betting against their clients. If a dishonest money manager attempted to siphon funds in this manner, he asserted, they would only be able to take 3%-5% of total funds, which would be less than what could be earned through honest practices and fee collection.

Karlis asserted that anyone can become a money manager on Valio. “You no longer need to have been born in the right part of the world or attended the right university and, god forbid, be of the right skin color,” he remarked. “Valio levels the playing field.” Money managers can establish vaults by simply adjusting a few parameters and clicking the “create” button. The app monitors the manager’s returns and offers detailed information about the investments within their vault, enabling investors to support managers based on their performance rather than their real-world credentials.

For users who may not be well-versed in Web3, there is an option to utilize a seedless smart contract wallet for transaction confirmations, allowing them to log into the app using familiar social login methods. According to Karlis, Valio employs Safes (previously known as “Gnosis Safes”) that utilize account abstraction to facilitate this feature.

Karlis contended that applications like Valio signify the future of asset management, as they will draw in the “Wall Street Bets” demographic that seeks “actual success.”

An increasing number of companies are striving to simplify the use of DeFi applications and crypto wallets. Presently, users must understand how to set up a wallet, manage seed phrases, transfer cryptocurrency to the wallet, switch networks, and execute various other tasks that may be unfamiliar to Web2 users. Valio aims to address this challenge by employing new wallet technologies. Other examples include Synquote and Beam wallet.

Magazine: Deposit risk: What do crypto exchanges really do with your money?