Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Crypto sector experiences $486M decline in July, marking the largest drop since 2022: Report

Update 14:00 Aug 3: De.Fi has revised their report with the following announcement:

Disclaimer: The details provided in this report are based on data available as of 8/03/2023. Initially, we reported losses totaling $486 million in stolen cryptocurrency. However, further updates from on-chain analysis have revealed that the actual losses are now estimated at $390 million.

The cryptocurrency market is experiencing its most challenging month of 2023, as indicated by a report from Web3 outlet De.Fi shared with Cointelegraph.

Losses for July reached $486 million, exceeding six times the total from the same timeframe in 2022:

Cryptocurrency losses comparing July 2022 and July 2023. Source: De.Fi

Cryptocurrency losses comparing July 2022 and July 2023. Source: De.Fi

This report follows a series of notable hacks and exploits during July, alongside a surge of legislative activity regarding cryptocurrency and digital assets.

With a currently reported recovery total of merely $6.15 million, nearly 99% of all cryptocurrency and digital assets stolen in July remain unrecovered.

According to a document shared with Cointelegraph, the researchers at De.Fi contend that insufficient measures are being taken to swiftly recover lost funds:

“Unfortunately, the recovery efforts in July 2023 were severely lacking, with only $6,796,915 reclaimed from the substantial $486.35 million lost.”

The researchers further characterized the cryptocurrency sector’s capacity to recover stolen or lost funds as “a crucial factor in mitigating the effects of these unfortunate events.”

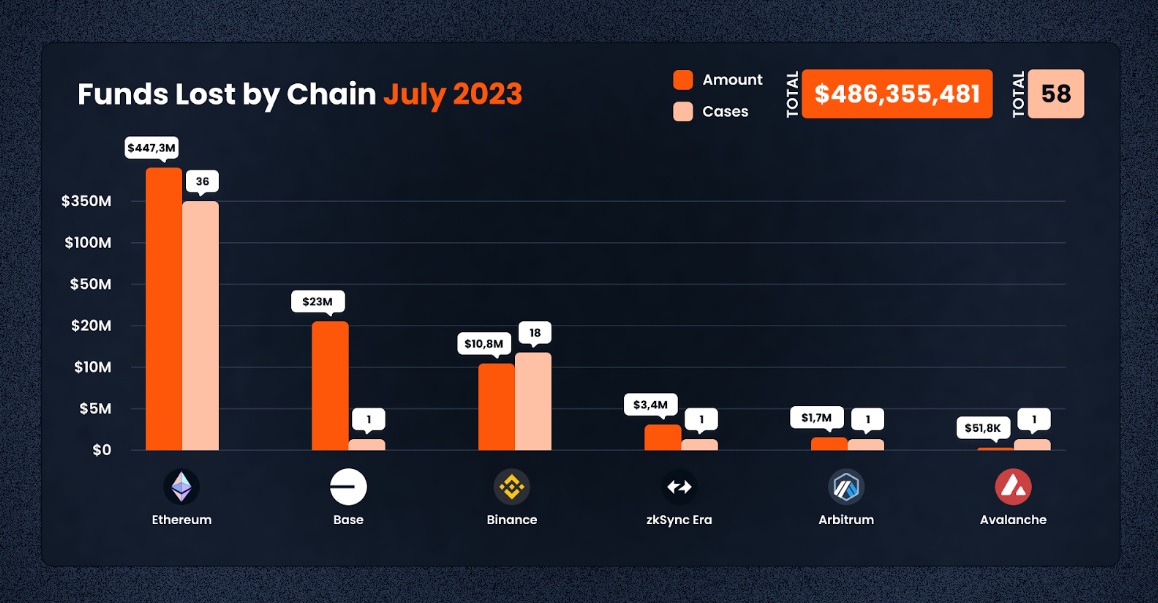

As per the report, the overwhelming majority of losses occurred on the Ethereum network, with $447 million lost across 36 incidents — including the Multichain hack, which involved $231 million, and the Alphapo exploit, which resulted in approximately $100 million in losses.

Losses by chain in July 2023. Source: De.Fi

Losses by chain in July 2023. Source: De.Fi

The next closest network was Base, which experienced $23 million lost in a single incident. Binance ranked third with a reported loss of nearly $11 million across 18 cases.

Related: Memecoin mania hits Base: Obscure tokens skyrocket amid rug pulls and FOMO

“Access control issues” were responsible for the majority of the funds lost in July, totaling $364 million. Rug pulls, with over 38 reported cases, accounted for losses of about $36 million, while reentrancy attacks led to approximately $78 million in losses.