Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Crypto lender BlockFi receives court approval to reimburse clients.

Customers of the insolvent cryptocurrency lending service BlockFi are nearing the possibility of receiving payouts following the approval of its liquidation strategy by a United States Bankruptcy Court in New Jersey.

During a court session on September 26, Bankruptcy Judge Michael A. Kaplan sanctioned BlockFi’s third revised Chapter 11 plan, as indicated by a filing from that same day.

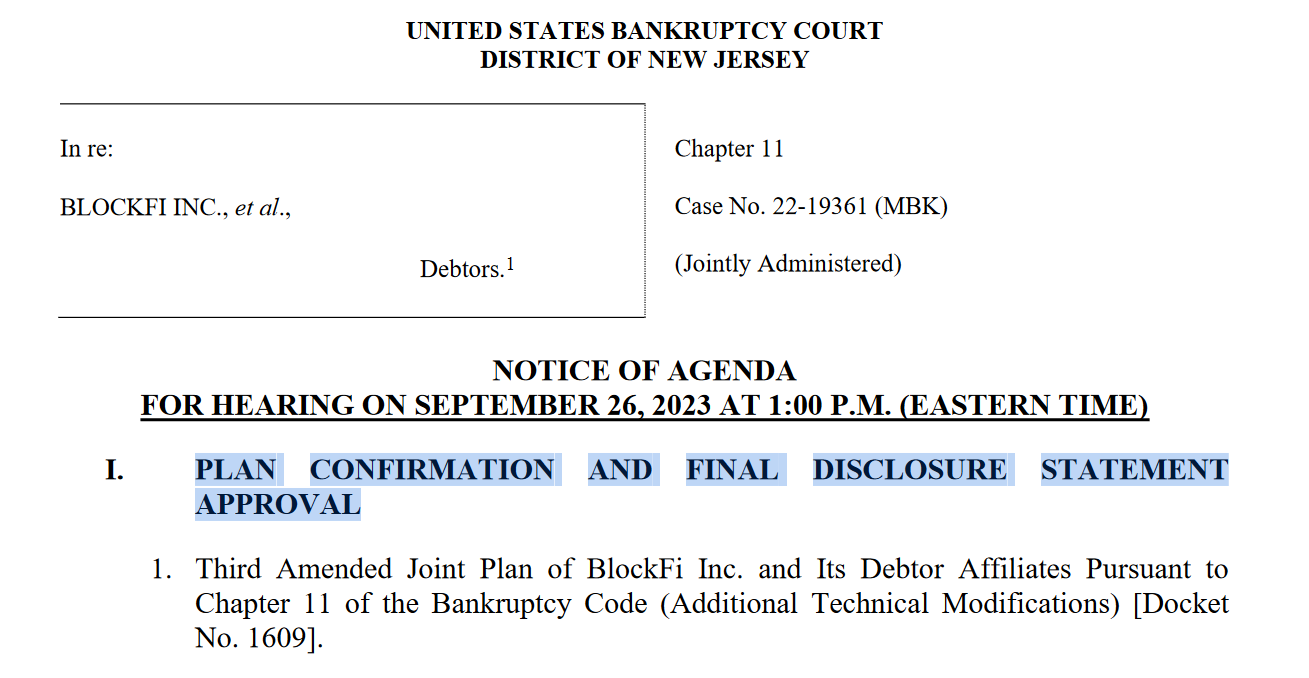

Sept. 26 court filing in the bankruptcy case of BlockFi. Source: Kroll

Sept. 26 court filing in the bankruptcy case of BlockFi. Source: Kroll

The repayment amount that BlockFi’s unsecured creditors will receive will primarily hinge on the outcome of BlockFi’s legal proceedings against FTX and other insolvent cryptocurrency companies.

BlockFi initially submitted its liquidation proposal to the bankruptcy court on November 28 but was subsequently required to present a first, second, and third amended plan on May 12, June 28, and July 31, respectively, according to court documents.

The approval of BlockFi’s liquidation plan followed the resolution of a protracted dispute with the creditors committee regarding the company’s senior management.

A court filing dated September 25 reveals that the BlockFi creditors committee recognized that the settlement likely minimized further administrative costs and expenses that could have impacted recoveries.

The now-defunct lending platform attributed its downfall to the collapse of FTX, even though the creditors committee raised concerns regarding BlockFi’s association with FTX and its former CEO Sam Bankman-Fried.

Related: BlockFi requests court approval to convert trade-only assets into stablecoins

Estimates indicate that BlockFi owes as much as $10 billion to over 100,000 creditors, which includes $1 billion to its three largest creditors and $220 million to the bankrupt crypto hedge fund Three Arrows Capital.

BlockFi is being represented by the law firms Kirkland & Ellis LLP and Haynes and Boone LLP.

Magazine: What do crypto exchanges really do with your money?