Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Crypto experiences outflows for the sixth straight week, with XRP and SOL attracting investor interest.

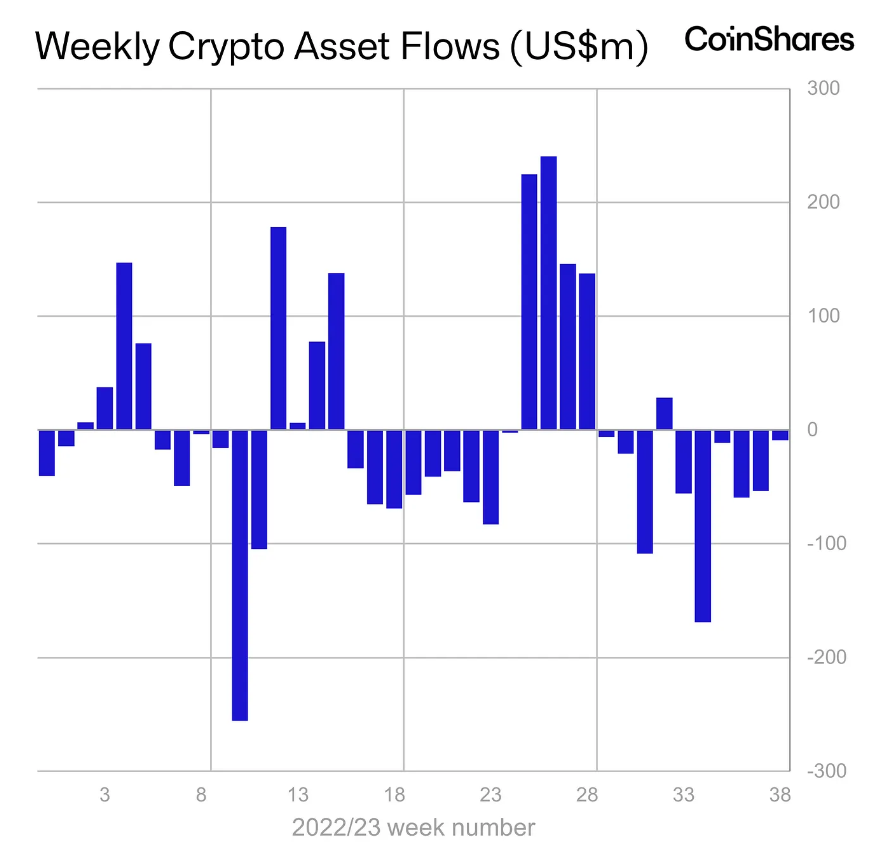

Crypto investment products experienced their sixth consecutive week of outflows for the week ending Sept. 24. Data from CoinShares indicates that digital asset outflows from these investment products totaled $9 million last week.

Weekly crypto asset flows. Source: CoinShares

Weekly crypto asset flows. Source: CoinShares

Bitcoin (BTC) marked its third consecutive week of outflows, amounting to $6 million in the previous week. Short Bitcoin positions recorded outflows of $2.8 million. Ether (ETH) noted its sixth consecutive week of outflows, with $2.2 million leaving over the past week.

Conversely, altcoins like XRP (XRP) and Solana (SOL) experienced inflows of $0.66 million and $0.31 million respectively. The report highlighted that investors are increasingly drawn to the altcoin sector, with ongoing inflows into XRP and SOL.

The report disclosed a split in sentiment among traders in Europe and the United States based on regional activities. European crypto investment products saw inflows of $16 million, while U.S.-based products experienced outflows of $14 million.

This regional disparity was linked to the uncertainty surrounding crypto regulations and the recent actions taken by the U.S. Securities and Exchange Commission (SEC) against crypto firms.

The report also indicated that weekly trading volumes fell below $820 million — significantly lower than the average of $1.16 billion in 2023.

Related: European digital asset manager CoinShares’ revenue up 33% in Q2

The latest digital asset flow market report from CoinShares mirrors the prevailing market sentiment, which is under bearish pressure. The Bitcoin price is currently constrained below the $27,000 key resistance level and has remained largely stagnant since the U.S. Federal Reserve’s recent decision to maintain interest rates for the quarter. Additionally, the delay in payouts to Mt. Gox creditors has also significantly influenced price movements last week, yet BTC has remained relatively unaffected by both major market developments.

Magazine: Recursive inscriptions: Bitcoin ‘supercomputer’ and BTC DeFi coming soon