Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

CertiK reports a $1M rug pull involving Ordinals Finance.

Ordinals Finance, a decentralized finance (DeFi) protocol built on Ethereum that enables users to lend and borrow inscriptions, has been accused of executing an exit scam, commonly referred to as a “rug pull.”

In a press release dated April 24, which was reviewed by Cointelegraph, the blockchain security firm CertiK reported that the protocol’s developer extracted 256 million Ordinals Finance (OFI) tokens from its smart contracts utilizing a “safuToken” function. Additionally, another 13 million OFI tokens were withdrawn via an “ownerRewithdraw” function, resulting in a cumulative total of 269 million tokens withdrawn, according to CertiK.

#CertiKSkynetAlert

We can confirm that the @ordinalsfinance exit scam has led to a loss of $1 million.

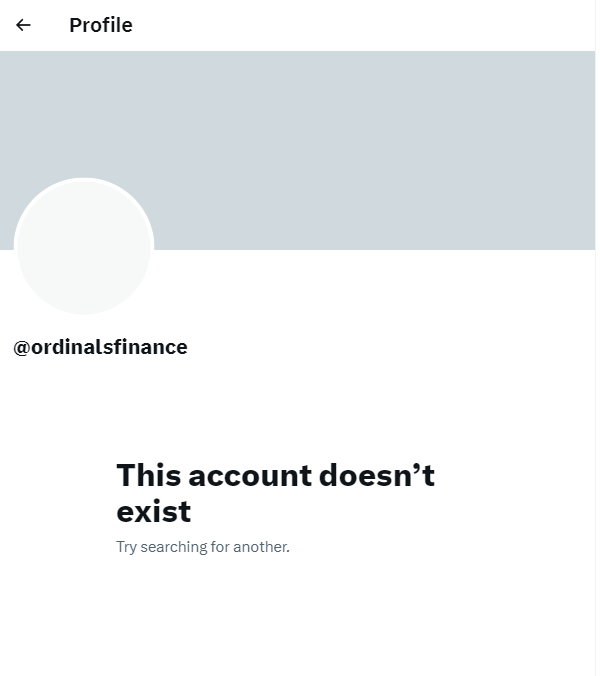

All social media accounts have been removed, along with the project’s website.

Funds have been consolidated into EOA 0x34e…25cCFhttps://t.co/0Pwlt3yibm https://t.co/RA7vSjNajI— CertiK Alert (@CertiKAlert) April 24, 2023

As per the blockchain security firm, the total financial loss for investors amounts to $1 million. Data from Coingecko indicates that the market capitalization of OFI was $2.3 million prior to the alleged exit, but subsequently dropped to just over $143,000. This suggests that losses exceeded $2 million. However, some holders of OFI tokens may have sold their assets following the news, which could explain the reduced figure reported by CertiK.

Blockchain records reveal that the Ordinals deployer account withdrew over 256 million OFI tokens using the safuToken function. Allegedly, these funds were transferred to a different Ethereum account through several transactions. Blockchain data indicates that this address received OFI from multiple sources before depositing the tokens into Tornado Cash.

The project’s Twitter account seems to have been deleted.

This is an evolving story, and additional information will be provided as it becomes accessible.